New Drug Approvals in 2020: Which Drugs Made the Mark?

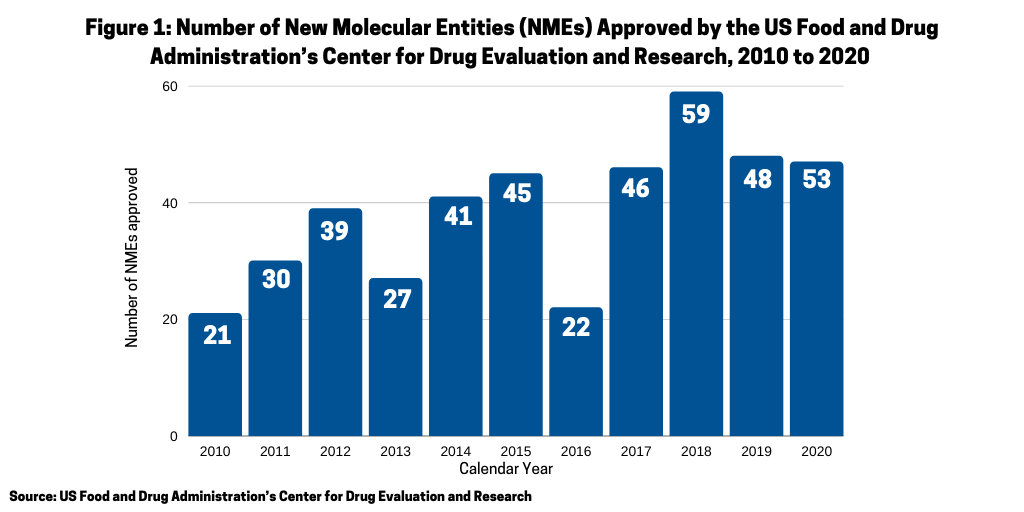

In 2020, the FDA approved 53 new molecular entities (NMEs), the second highest level of NMEs approved in a given year in the past decade and over the 48 approvals in 2019. What drugs were approved, and what was the mix between small molecules and biologics and between large pharma companies and small companies?

New drugs approvals up in 2020

One of the questions arising in 2020 was whether the COVID-19 pandemic would have a negative impact on new drug approvals stemming from either companies’ postponing late-stage trials and/or regulatory agencies scaling back drug reviews. In looking at the number of new molecular entities (NMEs) approved in 2020 by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER), the answer seems to be no. In 2020, the FDA’s CDER approved 53 NMEs, which surpassed the 48 NMEs approved in 2019 and was the second highest level of NMEs approved in the past decade, except for 2018 when 59 NMEs were approved (see Figure 1). Only one NME approved in 2020 was COVID-related: Gilead Sciences’ Verlurky (remdesivir).Table 1 at end of article outlines the 53 NMEs approved in 2020.

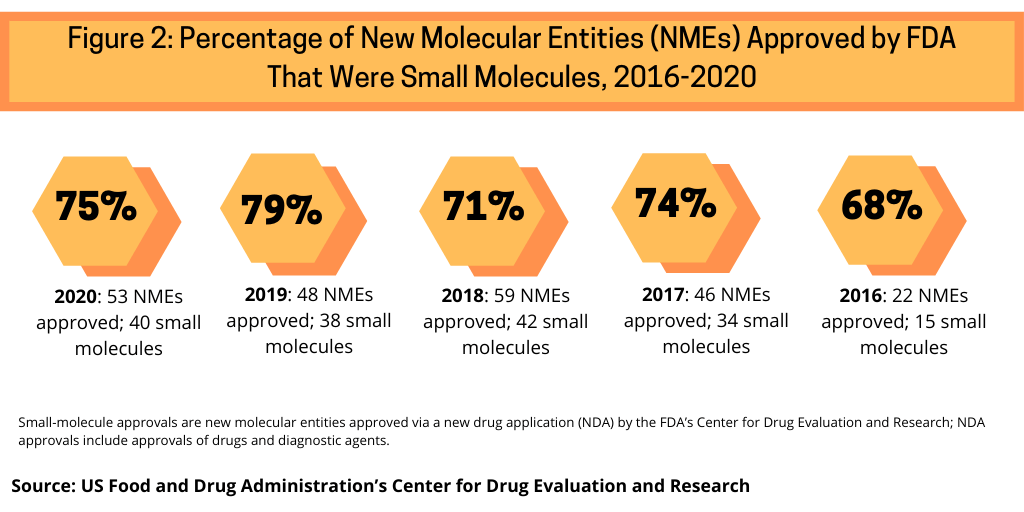

Small molecules versus biologics

Continuing a trend, small-molecule drugs dominated NME approvals in 2020. In 2020, 75% or 40 of the 53 NMEs approved in 2020 were small molecules (see Figure 2). This continues a recent trend of having approximately three-fourths of NME approvals be small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71% and 74% in 2017.Table 1 at end of article identifies small molecules approved in 2020 (approved as new drug applications) and biologics (approved as biologics license applications).

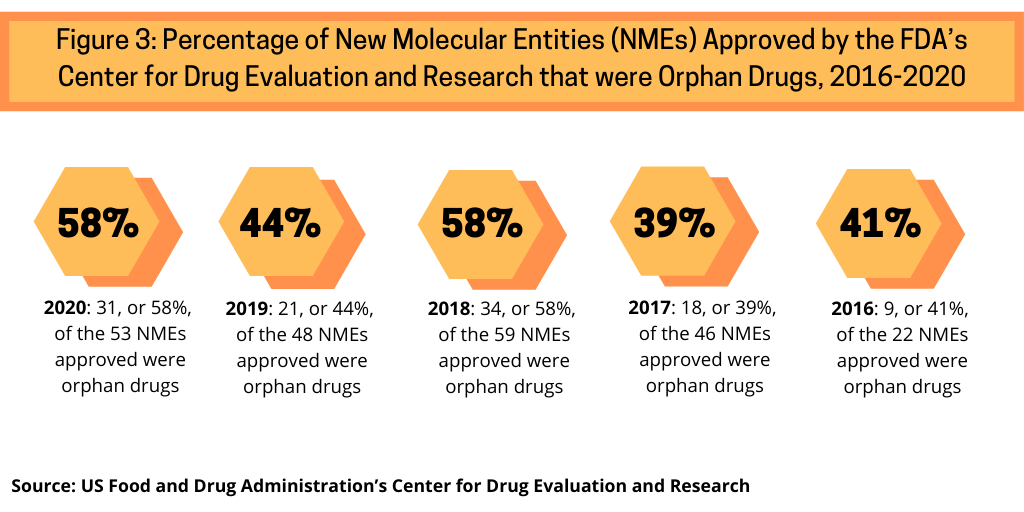

Orphan drugs’ share of NME approvals

Another trend continuing in 2020 was the high share of orphan drugs in new drug approvals. Orphan drugs are defined as prescription medicines developed for rare diseases and conditions, which, in the US, affect fewer than 200,000 people.

Examining approvals of NMEs by the FDA’s CDER from 2016 to 2020 shows the increasing share of orphan drug approvals in recent NME approvals (see Figure 3). In 2020, 58%, or 31, of the 53 NME approvals in 2020 were orphan drugs. Between 2016 and 2020, orphan drug approvals accounted for between 39% and 58% of NME approvals. The 58% of NME approvals in 2020 matched a recent high in the share of orphan drugs in NME approvals; in 2018, 58%, or 34, of the 59 NMEs approved were orphan drugs (see Figure 3).

Innovation: Big Pharma versus mid-to-small size companies

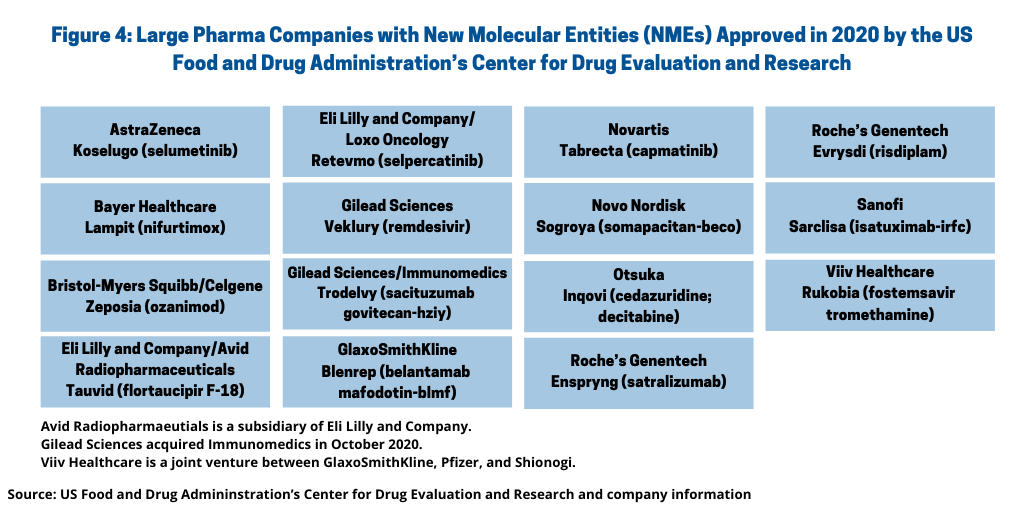

NME approvals are one measure of innovation and new product development in the pharma industry. So how did the innovation bar fare between the large pharmaceutical companies and small and mid-size companies in 2020? Figure 4 outlines NME approvals by the large pharmaceutical companies, defined as those companies among the top 26 companies based on 2019 pharmaceutical revenues (1). Using that as a criterion, the large pharmaceutical companies accounted for 15, or 28%, of the NME approvals in 2020 (see Figure 4). See Table I at the end of the article for a complete listing of all NME approvals in 2020.

Eli Lilly and Company, Gilead Sciences, GlaxoSmithKline, and Roche led companies, each with two NME approvals in 2020. Lilly received approval for the rare disease drug, Retevmo (selpercatinib), a drug to treat certain lung and thyroid cancers, and for Tauvid (flortaucipir F-18), a diagnostic agent for Alzheimer’s disease, through its subsidiary, Avid Radiopharmaceuticals. Retevmo was approved for treating non-small cell lung cancer, medullary thyroid cancer, and other types of thyroid cancers in people whose tumors have an alteration in a specific gene. Gilead also had two NME approvals: Veklury (remdesivir), a drug for treating COVID-19, and Trodelvy (sacituzumab govitecan-hziy), an antibody drug conjugate (ADC) for treating metastatic triple-negative breast cancer in adult patients who received at least two prior therapies for metastatic disease. Gilead gained Trodelvy through its $21-billion acquisition of Immunomedics, a Morris Plains, New Jersey-based biopharmaceutical company, which was completed in October 2020.

GlaxoSmithKline (GSK) received approval for Blenrep (belantamab mafodotin-blmf), an ADC and rare disease drug for treating multiple myeloma in patients receiving certain prior treatments, and for Rukobia (fostemsavir) for treating HIVthrough through Viiv Healthcare, a joint venture between GSK, Pfizer, and Shionogi. Blenrep was approved as a monotherapy treatment for adult patients with relapsed or refractory multiple myeloma who have received at least four prior therapies including an anti-CD38 monoclonal antibody, a proteasome inhibitor and an immunomodulatory agent. Roche received approval for two rare disease drugs: Enspryng (satralizumab) for treating neuromyelitis optica spectrum disorder, a chronic disorder of the brain and spinal cord dominated by inflammation of the optic nerve and inflammation of the spinal cord, and Evrysdi (risdiplam) for treating spinal muscular atrophy, a neuromuscular disorder.

AstraZeneca, Bayer, Bristol-Myers Squibb, Novartis, Novo Nordisk, Otsuka, and Sanofi each had one NME approval in 2020, which include approvals for rare diseases for drugs by AstraZeneca, Bayer, Novartis, Otuska, and Sanofi (see Figure 4). AstraZeneca received approval for a rare disease drug, Koselugo (selumetinib), for treating neurofibromatosis Type 1, a genetic disorder of the nervous system causing tumors to grow on nerves. Bayer received approval for a rare disease drug, Lampit (nifurtimox), for treating Chagas disease, a parasitical infectious disease. Bristol-Myers Squibb (BMS) received approval for Zeposia (ozanimod) for treating elapsing forms of multiple sclerosis. BMS gained the drug through its $74-billion acquisition of Celgene in November 2019.

Novartis received approval for a rare disease drug Tabrecta (capmatinib), for treating metastatic non-small cell lung cancer whose tumors have a mutation that leads to mesenchymal-epithelial transition (MET) exon 14 skipping as detected by an FDA-approved test. Novo Nordisk received approval for Sogroya (somapacitan-beco), human growth hormone. Otuska received approval for a rare disease drug, Inqovi (cedazuridine; decitabine), for treating adult patients with myelodysplastic syndromes and chronic myelomonocytic leukemia. Sanofi received approval for Sarclisa (isatuximab-irfc), for treating multiple myeloma in combination with pomalidomide and dexamethasone to treat adults who have received at least two prior therapies, including lenalidomide and a proteasome inhibitor.

Among mid-sized companies, one noteworthy entry comes from Sumitomo BioPharma, which received two NME approvals resulting from its $3-billion strategic alliance with Roviant Sciences, a New York-based healthcare company. In December 2019, Sumitomo Dainippon Pharma and Roivant Sciences completed a strategic alliance, and Sumitomo Dainippon Pharma formed a new company, Sumitovant Biopharma as a wholly owned subsidiary. Sumitovant Biopharma then became the parent company of five biopharma companies for which Roivant transferred its ownership interest: Myovant Sciences, Urovant Sciences, Enzyvant Therapeutics, Altavant Sciences, and Spirovant Sciences. In 2020, Myovant Sciences and Urovant Sciences each had one NME approval (see Table I at the end of article). Sumitomo BioPharma/Myovant Sciences received approval for Orgovyx (relugolix) for treating advanced prostate cancer, and Sumitomo BioPharma/Urovant Sciences for treating Gemtesa (vibegron) for treating overactive bladder.

Reference

1. M. Christel, “Pharm Exec’s Top 50 Companies in 2020,” Pharmaceutical Executive, June 1, 2020, Volume 40, Issue 6.

| Table 1: New Molecular Entities Approved in 2020 by the US Food and Drug Administration’s Center for Drug Evaluation and Research | ||

| Company | Proprietary Name (active ingredient); NDA or BLA | Indication |

| Acacia Pharma | Byfavo (remimazolam); NDA | Sedation |

| Acacia Pharma | Barhemsys (amisulpride); NDA | To prevent nausea and vomiting after surgery |

| Almirall | Klisyri (tirbanibulin); NDA | Actinic keratosis of the face or scalp |

| Alnylam Pharmaceuticals | Oxlumo (lumasiran); NDA | Hyperoxaluria type 1, a rare genetic disease leading to kidney disorders. |

| Amivas | artesunate; NDA | Severe malaria |

| AstraZeneca | Koselugo (selumetinib); NDA | Neurofibromatosis Type 1, a genetic disorder of the nervous system causing tumors to grow on nerves |

| Bayer Healthcare | Lampit (nifurtimox); NDA | Chagas disease in certain pediatric patients younger than age 18 |

| BioCryst Pharmaceuticals | Orladeyo (berotralstat); NDA | Hereditary angioedema |

| Biohaven Pharmaceuticals | Nurtec ODT (rimegepant); NDA | Migraines |

| Blueprint Medicines | Gavreto (pralsetinib); NDA | Non-small lung cancer |

| Blueprint Medicines | Ayvakit (avapritinib); NDA | Unresectable or metastatic gastrointestinal stromal tumor (GIST) |

| Bristol-Myers Squibb/Celgene | Zeposia (ozanimod); NDA | Relapsing forms of multiple sclerosis |

| Cassiopea | Winlevi (clascoterone); NDA | Acne |

| Deciphera Pharmaceuticals | Qinlock (ripretinib); NDA | Advanced gastrointestinal-stromal tumors |

| Dr. Reddy’s Laboratories | Xeglyze (abametapir); NDA | Head lice |

| Eiger Biopharmaceuticals | Zokinvy (lonafarnib); NDA | Rare conditions related to premature aging |

| Eli Lilly and Company/Avid Radiopharmaceuticals | Tauvid (flortaucipir F-18); NDA | Diagnostic agent for patients with Alzheimer’s disease |

| Eli Lilly and Company/Loxo Oncology | Retevmo (selpercatinib); NDA | Certain lung and thyroid cancers |

| Epizyme | Tazverik (tazemetostat); NDA | Epithelioid sarcoma |

| Esperion Therapeutics | Nexletol (bempedoic acid); NDA | Adults with heterozygous familial hypercholesterolemia or established atherosclerotic cardiovascular disease who require additional lowering of LDL-C |

| Gilead Sciences | Veklury (remdesivir); NDA | Adult and pediatric patients 12 years of age and older and weighing at least 40 kg for treating COVID-19 requiring hospitalization. |

| Gilead Sciences/Immunomedics | Trodelvy (sacituzumab govitecan-hziy); BLA | Adult patients with metastatic triple-negative breast cancer who received at least two prior therapies for metastatic disease |

| GlaxoSmithKline | Blenrep (belantamab mafodotin-blmf); BLA | Certain type of multiple myeloma |

| Horizon Therapeutics | Tepezza (teprotumumab-trbw); BLA | Thyroid eye disease |

| Incyte | Pemazyre (pemigatinib); NDA | Cholangiocarcinoma, a rare form of cancer that forms in bile ducts |

| Jazz Pharmaceuticals | Zepzelca (lurbinectedin); NDA | Metastatic small cell lung cancer |

| Lundbeck | Vyepti (eptinezumab-jjmr); BLA | Preventive treatment of migraine in adults |

| Macrogenics | Margenza (margetuximab-cmkb); BLA | HER2+ breast cancer |

| MorphoSys | Monjuvi (tafasitamab-cxix); BLA | Relapsed or refractory diffuse large B-cell lymphoma |

| Neurocrine Biosciences | Ongentys (opicapone); NDA | Parkinson’s disease “off” episodes |

| Nippon Shinyaku | Viltepso (viltolarsen); NDA | Duchenne muscular dystrophy |

| Novartis | Tabrecta (capmatinib); NDA | Certain form of non-small cell lung cancer |

| Novo Nordisk | Sogroya (somapacitan-beco); BLA | Human growth hormone |

| Otsuka | Inqovi (cedazuridine; decitabine); NDA | Adult patients with myelodysplastic syndromes and chronic myelomonocytic leukemia |

| RadioMedix | Detectnet (copper dotatate CU-64); NDA | Detection of certain types of neuroendocrine tumors |

| Recordati | Isturisa (osilodrostat); NDA | Adults with Cushing’s disease who either cannot undergo pituitary gland surgery or have undergone the surgery but still have the disease |

| Regeneron Pharmaceuticals | Inmazeb (atoltivimab; odesivimab; maftivimab); BLA | Ebola virus |

| Rhythm Pharmaceuticals | Imcivree (setmelanotide); NDA | Obesity and the control of hunger associated with pro-opiomelanocortin deficiency, a rare disorder that causes severe obesity that begins at an early age |

| Ridgeback Biotherapeutics | Ebanga (ansuvimab-zykl); BLA | Ebola virus |

| Roche’s Genentech | Enspryng (satralizumab); BLA | Neuromyelitis optica spectrum disorder |

| Roche’s Genentech | Evrysdi (risdiplam); NDA | Spinal muscular atrophy |

| Sanofi | Sarclisa (isatuximab-irfc); BLA | Multiple myeloma under certain conditions |

| Seagen (formerly Seattle Genetics) | Tukysa (tucatinib); NDA | Advanced unresectable or metastatic HER2-positive breast cancer |

| Sebela Pharmaceuticals | Pizensy (lactitol); NDA | Chronic idiopathic constipation in adults |

| Sumitomo BioPharma/Myovant Sciences | Orgovyx (relugolix); NDA | Advanced prostate cancer |

| Sumitomo BioPharma/Urovant Sciences | Gemtesa (vibegron); NDA | Overactive bladder |

| Trevena | Olinvyk (oliceridine); NDA | Management of acute pain |

| Ultragenyx Pharmaceutical | Dojolvi (triheptanoin); NDA | Molecularly long-chain fatty acid oxidation disorders |

| University of California Los Angeles and the University of California, San Francisco | Gallium 68 PSMA-11 (Gallium 68 PSMA-11); NDA | Detection and localization of prostate cancer |

| Viela Bio | Uplizna (inebilizumab-cdon); BLA | Neuromyelitis optica spectrum disorder |

| ViiV Healthcare | Rukobia (fostemsavir tromethamine); NDA | HIV |

| Y-mAbs Therapeutics | Danyelza (naxitamab-gqgk); BLA | High-risk refractory or relapsed neuroblastoma |

| Zionexa | Cerianna (fluoroestradiol F-18); NDA | Diagnostic imaging agent for certain patients with breast cancer |

|

NDA is new drug application. BLA is biologics license application. Avid Radiopharmaeutials is a subsidiary of Eli Lilly and Company. Bristol-Myers Squibb acquired Celgene in 2019. Eli Lilly and Company acquired Loxo Oncology in February 2020. Gilead Sciences acquired Immunomedics in October 2020. Sebela Pharmaceuticals acquired Braintree Laboratories in 2018. Sumitomo Dainippon Pharma and Roivant Sciences completed strategic alliance and formation of new company, Sumitovant Biopharma, a wholly owned subsidiary of Sumitomo Dainippon Pharma in December 2019. Sumitovant Biopharma became the parent company of the five biopharma companies for which Roivant transferred its ownership interest: Myovant Sciences, Urovant Sciences, Enzyvant Therapeutics, Altavant Sciences, and Spirovant Sciences. ViiV Healthcare is a joint venture of GlaxoSmithKline and Pfizer with Shionogi as an additional shareholder. Source: US Food and Drug Administration’s Center for Drug Evaluation and Research |

||