The Biopharmaceutical Industry and Bioprocessing: What to Expect in 2021

The most important developments impacting the biopharma industry and bioprocessing in 2021 are COVID-19-related as vaccine and therapeutic development and biomanufacturing continue at a rapid pace. The pandemic is also accelerating other trends: higher R&D spending, outsourcing, and facility regionalization.

What to expect in 2021

In this second installment of BioPlan Associates’ two-part article series (see Part 1) on key developments in biopharmaceutical manufacturing, we look toward likely trends in 2021. The most important developments, particularly in the near-term, are related to the COVID-19 pandemic. This particularly includes the biopharmaceutical industry not just rapidly initiating unprecedented, accelerated vaccine and therapeutic development, but also following through in record time with manufacturing and distribution at unprecedented scales. These trends will persist in 2021 while many other ongoing trends in bioprocessing will accelerate due to the pandemic, the industry’s robust response, and the preparations for future pandemics.

In 2020, BioPlan’s annual survey and report on biopharmaceutical manufacturing capacity and production included analysis of the segment’s initial responses to COVID-19 (1). In BioPlan’s upcoming (2021) annual survey, we have included questions and deeper probing into the likely long-term impacts of the COVID-19 pandemic. The new study, which includes input from bioprocessing professionals from biopharma companies, CDMOs/CMOs, and other suppliers, will be released in April 2021. BioPlan is currently gaining input from the industry; to participate, click here.

Expansion of pandemic responses

|

|

Eric S. Langer |

Pandemic-related R&D and manufacturing will continue to expand into 2021 and beyond. There are currently approximately 400 COVID-19-related vaccines and therapeutics in research and development. These numbers will likely stabilize as some early projects are dropped and new projects with presumed better prospects, funding, etc. get underway. In terms of bioprocessing expenditures, including purchases of supplies, and outsourcing to CMOs and CROs, COVID-19- related activities, expenditures, and revenue will continue to expand existing markets in 2021 throughout most of the bioprocessing sector.

The COVID-19 industry response will further ramp up in 2021, likely including large investments in expanding vaccines and therapeutics manufacturing capacity, building of new facilities, and more outsourcing. Near-future COVID-19 product development efforts will include rapid preparation for commercial manufacturing, new facilities, and expansions. In addition, according to BioPlan’s research, significantly greater outsourcing will be done as decisions to strategically outsource become no longer optional due to staff and resource shortages. The “make-vs-buy” decision regarding additional capacity will hinge more on availability of skilled staff resources than on simply adding new production suites. CDMOs, CROs, and bioprocessing equipment suppliers will see even more revenue in 2021 vs. 2020, a record year for many.

Diversification in biopharma

|

|

Ronald A. Rader |

In 2021, we expect the biopharmaceutical/pharmaceutical industry response to COVID-19 to begin to further diversify to include research on more infectious disease pathogens. This includes much broader civil and biodefense efforts by governments worldwide. COVID-19 has demonstrated how poorly many governments’ planning was for a serious epidemic, much less a pandemic. The current COVID-19 response is for a pathogen that is not all that disruptive or deadly, compared to most biological warfare agents or even influenza. For example, worldwide mortality from the 1918 influenza pandemic was in the range of 5%-10% while COVID-19 mortality rates are an order of magnitude of approximately 10 times lower.

Defenses, including vaccines and therapeutics, need to be developed for existing and new pathogens considered a potential pandemic risk. There will likely be long post-COVID analysis and discussions regarding societal and government responses to more serious threats, such as aerosol-transmissible Ebola or weaponized tularemia. In this context, more preparation is clearly needed as part of nations’ public health policy. But with pandemic preparation up to governments, suitable responses will require political action and large expenditures.

Vaccines and therapeutics for “emerging pathogens” will likely see greater funding worldwide. In the coming years, this expansion will likely further add several billion dollars per year worldwide in R&D, outsourcing, supplies sales, and new facilities within the bioprocessing sector. More countries will see a need to have their own pandemic/biodefense R&D and manufacturing capacity. Non-pandemic government-funding R&D is also expected to expand in 2021. This includes budgets of the National Institutes of Health and the Centers for Disease Control and Prevention likely receiving significant boosts in funding in 2021.

US politics and cost controls

The US is by far the leader in biopharmaceutical/pharmaceutical R&D and sales revenue, with the US market being a primary source for funding industry R&D and innovative products coming to market. But politics in the US could disrupt this situation. The recent US Presidential and Congressional elections included candidates of both parties calling to fix problems for the high costs for pharmaceuticals, with biopharmaceuticals generally costing the most and the primary targets. This suggests politicians might see a post COVID-19 avenue to pass new law(s) implementing some forms of pharmaceutical price controls. Reductions in biopharmaceutical/pharmaceutical company revenue will also result in reductions in R&D or other investments activities.

However, the public’s post-COVID-19 response to price controls in the US, which may decrease R&D, innovation, and cures, may be an uphill battle. Even though the US is the only major country without some price controls, the emphasis on the need for high levels of innovation will likely resonate with the general public, at least over the near future.

The exemplary biopharmaceutical industry response to the COVID-19 pandemic, its success in rapidly bringing massive amounts of new vaccines to market, has through at least 2021, will significantly help in boosting public perceptions of the biopharmaceutical industry. As vaccination ramps up throughout 2021, public views of the industry and acceptance of innovation will continue to be important.

Acceleration of existing trends

Industry and government responses to the COVID-19 pandemic have generally resulted in the acceleration of most of the major trends that were already affecting the bioprocessing sector as we discussed in the first part of this article series (see “Biomanufacturing Capacity and Supplies: COVID’s Impact”). Other ongoing trends affecting the broader biopharmaceutical industry accelerating in 2021 are outlined below.

More money. R&D and outsourcing budgets will continue to see increases. Bioprocessing supplier revenue will continue to grow, likely often matching the more than 20% growth reported in 2020 by many of the largest suppliers. Otherwise, the many companies having slowed down or even halted much or even all R&D, market research, etc. during 2020 can be expected to spend some of their unspent budgets in addition to 2021 expenditures.

Industry growth. In 2021, there will be further growth in essentially all biopharmaceutical markets, which has been rather steadily increasing at or less than 12% annually. COVID-19 vaccine sales alone worldwide will significantly increase overall industry revenue.

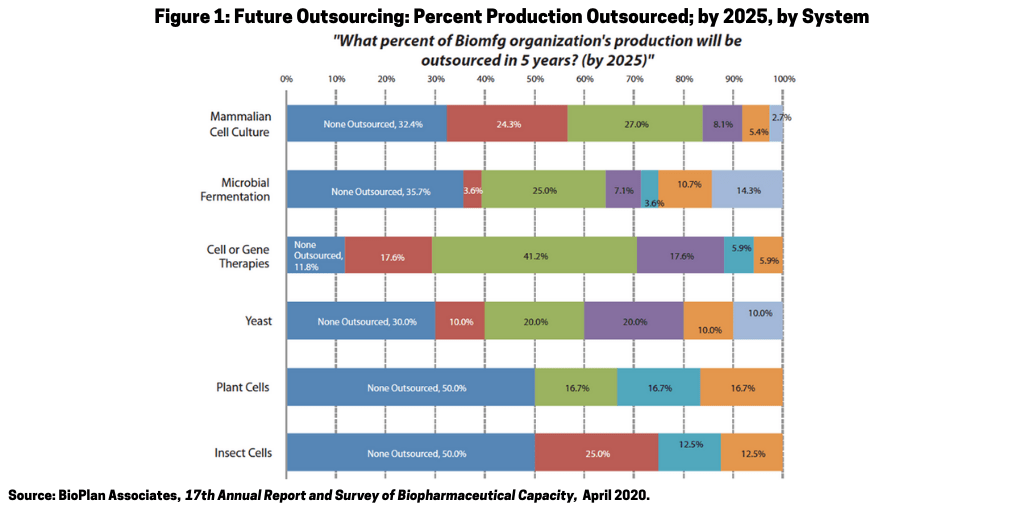

Outsourcing. The trend for more outsourcing to CMOs and CROs will increase in 2021. Figure 1 shows the 2020 BioPlan survey responses concerning expectations for percent of bioprocessing to be outsourced in five years (by 2025). Even more COVID-19-related projects will be outsourced while others will outsource more of their non-COVID-19-related projects. This includes increases in CMO revenue due to COVID-19 likely surpassing the estimated 15% increase in recent years attributable to biosimilars. Even small and lesser-capable CMOs and CROs will see more business as the larger ones become even more busy with COVID-19-related projects.

Mergers and acquisitions. We expect even more corporate mergers and acquisitions (M&A) in 2021 than the usual baseline. This includes some of the minority of developer and supplier companies financially damaged by the pandemic being acquisition targets or seeking out mergers with other companies. Last year’s (2020) restructuring (lowering) of US corporate taxes is expected to overall result in US companies having more cash to spend, including profits previously stuck in foreign countries being moved to the US, and much of this will likely go to M&A.

Digitalization/automation. There will be even more movement to digital platforms and automation in 2021. Companies are increasing their internal digital communications infrastructures, including to deal with more work from home, more regionalization, and more dissemination of R&D and manufacturing to more territories. Also, the pandemic is overall resulting in more rapid automation as companies seek to minimize reliance on human workers with all the management problems, required infrastructure, and costs they bring.

New therapeutics. Biopharmaceutical approvals will likely increase in 2021, including those with filings and reviews postponed or slowed in 2020 due to COVID-19. Plus, there will likely be rapid approvals of COVID-19 vaccines and therapeutics and more biosimilars. There will be more diversity in the molecular forms and product classes among the approvals and in the pipeline, such as antibody-drug conjugates, mRNA and other oligonucleotide-based drugs, antibodies with novel construction, and cellular and gene therapies.

Supply chains and supply-chain security. Many companies are expanding in-house storage and holding more supplies in storage to avoid long wait times, such as keeping 18 months vs. 6-12 months-worth of single-use supplies in storage. Many are evaluating their supply-chain security for raw materials and even plastics. If they are “essential” and produced offshore, then discussions of on-shoring or second-sourcing will become increasingly important.

Facilities regionalization. This is one of the few newer trends in response to the pandemic. This involves bioprocessing and supplier companies building more new facilities in more countries/regions, with these primarily addressing regional markets and serving as backup to each other. The prior moves toward consolidation of facilities in a few centralized locations are now being reconsidered, or even reversed.

Process intensification. Advancing technology continues to incrementally improve bioprocessing productivity by making more with the same process lines or the same amount with smaller process lines. Process intensification includes the continued growth in productivity, particularly continued incremental increases in average upstream titers and, to a much lesser extent, increases in downstream yield. Process intensification complements the trend for regionalization, with it easier to transfer processes or clone whole facilities that are at smaller scale to begin with.

Continuous processing. Related to or potentially considered part of process intensification, there will be even more interest in adopting continuous processing. It remains to be seen whether sufficient new and upgraded products/technology will provide improved perfusion and continuous chromatography systems.

BioPlan’s 2021 Survey

To keep on top of these important trends, particularly as the industry evolves its response to the COVID-19 pandemic, BioPlan Associates asks for your participation in its annual survey on biopharmaceutical manufacturing capacity and production.

Reference

1. E.S. Langer, et al, BioPlan Associates, 17th Annual Report and Survey of Biopharmaceutical Capacity and Manufacturing, April 2020, see the report.

About the authors

For further information, contact the authors, Ronald Rader, Senior Director, Technical Research, BioPlan Associates (rrader@bioplanassociates.com, +1 301-921-5979) and Eric Langer, President and Managing Partner, BioPlan Associates (elanger@bioplanassociates.com, +1 301-921-5979).