Is Novartis on the Right Track?

With five new molecular entities launched in 2019 and two potential blockbusters targeted for launch in 2020, is the strategy of Novartis CEO Vas Narasimhan to drive growth in the company’s Innovative Medicines business, including in new modalities in cell and gene therapies, as well as a plan for digital transformation, working?

Deal-making in its growth strategy

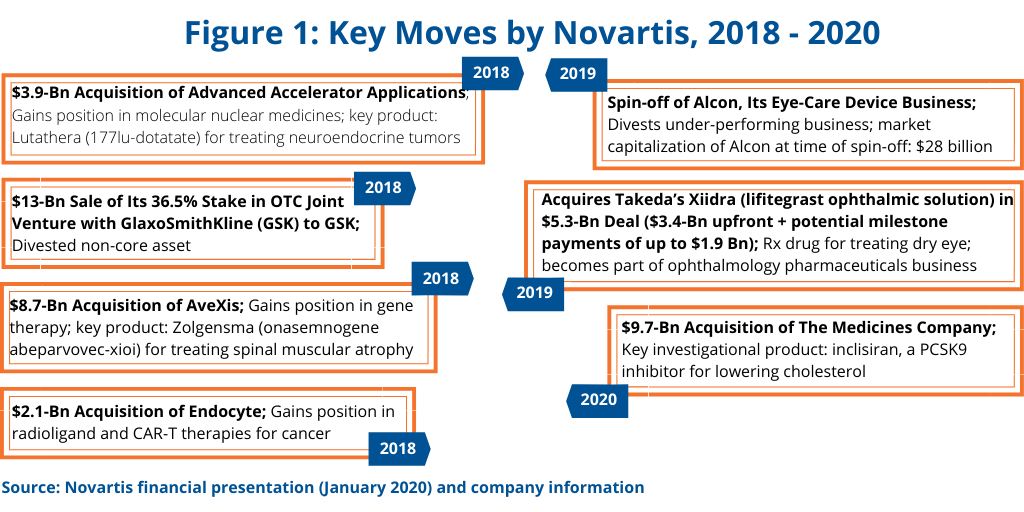

In outlining the company’s growth strategy in reporting its 2019 financial results, Novartis CEO Vas Narasimhan highlighted key moves made between 2018 and 2020 thus far to meet the company’s goal of being “a focused medicines company powered by advanced therapy platforms and data science.” Key to Novartis’ growth plan has been the divestiture of non-core or underperforming assets while making targeted acquisitions in its Innovative Medicines business to strengthen its mainstay prescription-drug business (see Figure 1).

|

|

Vasant Narasimhan, MD, CEO, Novartis |

Key divestments were the sale of its 36.5% stake in its consumer healthcare joint venture with GlaxoSmithKline (GSK) to GSK for $13 billion in 2018 and the spin-off of Alcon, its eye-care device business, in 2019. The Novartis–GSK joint venture was formed in 2015 as part of Novartis’ portfolio transformation, which comprised a three-part transaction with GSK, including the combination of Novartis’ over-the-counter business with the GSK consumer healthcare business into the joint venture. Novartis also acquired certain oncology products and pipeline compounds from GSK and divested its non-influenza vaccines business to GSK.

In 2019, Novartis completed the spin-off of its eye-care device business, Alcon. Novartis had acquired Alcon in 2011, with the business at that time including surgical and vision-care products and ophthalmic pharmaceuticals. In January 2016, Novartis began the process of creating two businesses with the transfer of Alcon’s ophthalmic pharmaceuticals to the Novartis Innovative Medicines Division. The ophthalmology pharmaceuticals business continues to be part of Novartis.

Adding to its ophthalmology pharmaceuticals business was one of the recent acquisitions cited by Novartis in the company’s growth strategy (see Figure 1); it included a $5.3-billion deal in which Novartis acquired a prescription drug to treat dry eye.

Other noteworthy deals made by Novartis include deals involving what some analysts project as potential blockbusters. In 2018, Novartis acquired AveXis, a gene-therapy company, for $8.7 billion, which netted Novartis with Zolgensma (onasemnogene abeparvovec-xioi), a gene therapy for treating spinal muscular atrophy in pediatric patients with a certain mutation. Last month (January 2020), it completed the acquisition of The Medicines Company, for $9.7 billion, which provided the company with inclisiran, a PCSK9 inhibitor for lowering cholesterol.

The company also added to its position in molecular nuclear medicines in 2018 with its $3.9-billion acquisition of Advanced Accelerator Applications; the key product gained was Lutathera (177lu-dotatate) for treating neuroendocrine tumors, which added to the company’s oncology franchise. It also acquired in 2018 Endocyte for $2.1 billion, which further strengthened the company’s position in radioligands and CAR T therapies.

Blockbuster strength

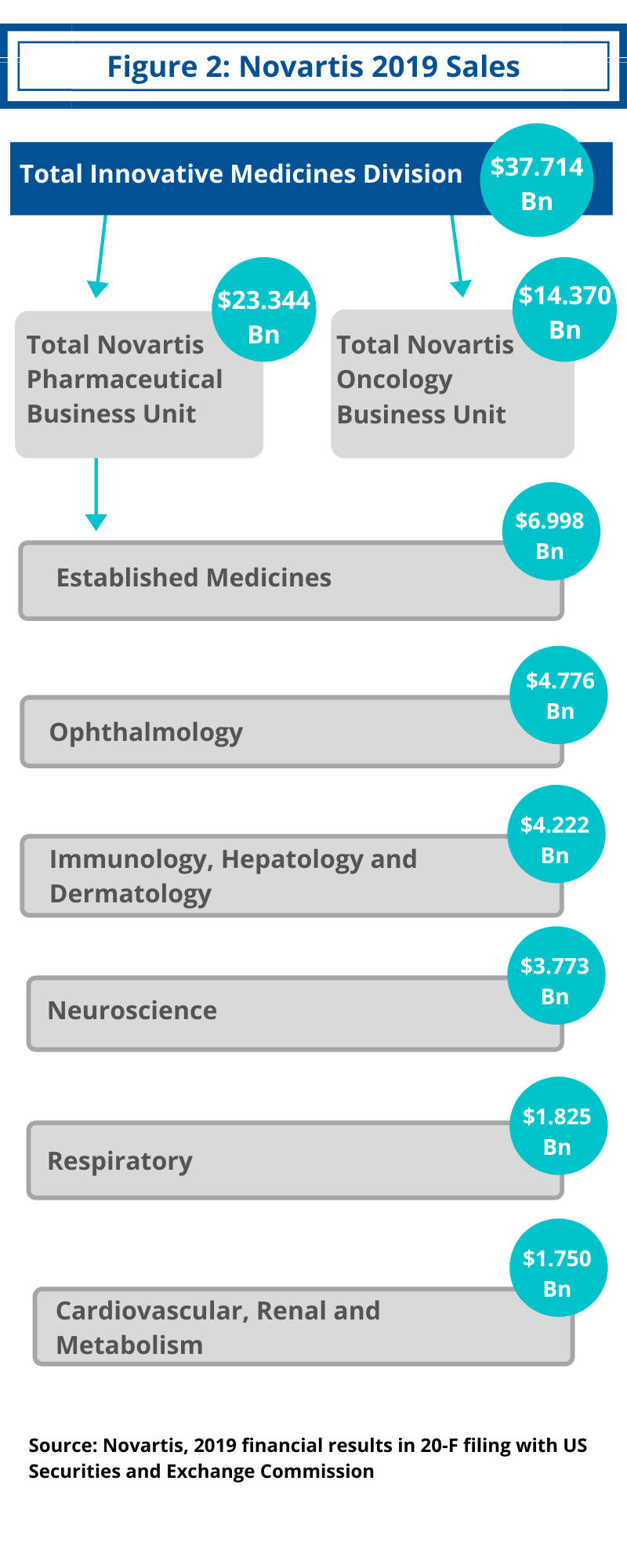

Key for Novartis will be to bolster its Innovative Medicines Division, which consists of the company’s innovative prescription drug business. In 2019, Novartis’ Innovative Medicines posted net sales of $37.7 billion, a gain of 8% in local currencies and 11% in constant currencies, comparative to 2018 (see Figure 2).

In 2019, Novartis had 15 blockbuster drugs, defined as drugs with sales of $1 billion or more (see Table I at the end of article). Its oncology business franchise had the largest number of blockbusters with seven drugs. These included: Tasigna (nilotinib); Sandostatin (octreotide); Afinitor/Votubia (everolimus); Promacta/Revolade (eltrombopag); Tafinlar + Mekinist (dabrafenib + trametinib); Gleevec/Glivec (imatinib); and Jakavi (ruxolitinib).

Its top three-selling products came from three different therapeutic franchises (see Table I at the end of article). Cosentyx (secukinumab), for treating psoriasis, ankylosing spondylitis and psoriatic arthritis, posted sales of nearly $3.6 billion in 2019. Gilenya (fingolimod), for treating relapsing forms of multiple sclerosis, had sales of $3.2 billion. Lucentis (ranibizumab), for treating age-related macular degeneration, had sales of nearly $2.1 billion in 2019.

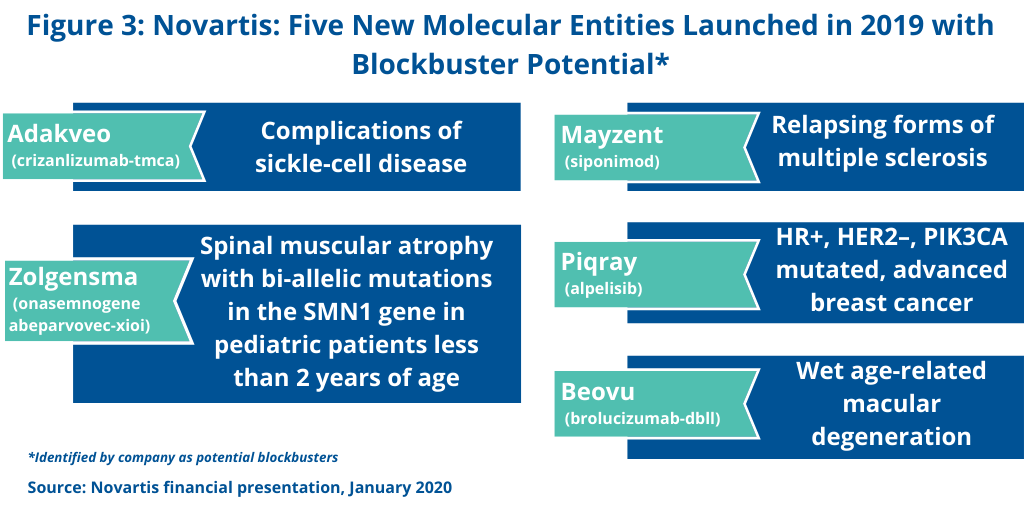

Novartis is banking on future blockbusters from new molecular entities (NMEs) launched in 2019 and targeted to be launched in 2020. In its 2019 financial results, the company identified five NMEs that were launched in 2019 and which the company projects future blockbuster status (see Figure 3). These include: Adakveo (crizanlizumab-tmca) for treating complications of sickle-cell disease; Beovu (brolucizumab-dbll) for treating age-related macular degeneration; Mayzent (siponimod) for treating relapsing forms of multiple sclerosis; Piqray (alpelisib) for treating HR+, HER2–, PIK3CA-mutated, advanced breast cancer; and the gene therapy, Zolgensma (onasemnogene abeparvovec-xioi) for treating spinal muscular atrophy with bi-allelic mutations in the SMN1 gene in pediatric patients less than two years of age.

On looking ahead, a recent analysis of Cortellis, the life sciences intelligence solutions from Clarivate Analytics, pegged two Novartis drugs targeted for launch in 2020 with potential blockbuster status. The first is inclisiran, which Novartis acquired in its $9.7-billion acquisition of The Medicines Company. The drug, a PCSK9-targeting small interference RNA (siRNA) drug for lowering cholesterol, is projected by Clarivate to reach $1.16 billion in sales by 2024. The second drug by Novartis with projected product launch in 2020 is a subcutaneous formulation of ofatumumab for treating multiple sclerosis. The drug has the same active ingredient as is in Novartis’ anticancer drug, Arzerra. Clarivate projects $1.26 billion of revenues in 2024.

| Table I: Novartis’ Blockbuster Drugs, 2019* |

|||

|

Drug |

Business Franchise |

Indication |

Net Product Sales |

| Cosentyx (secukinumab) |

Immunology, Hepatology Dermatology | Psoriasis, ankylosing spondylitis and psoriatic arthritis | $3.551 Bn |

| Gilenya (fingolimod) |

Neuroscience | Relapsing multiple sclerosis | $3.223 Bn |

| Lucentis (ranibizumab) |

Ophthalmology | Age-related macular degeneration | $2.086 Bn |

| Tasigna (nilotinib) |

Oncology | Chronic myeloid leukemia | $1.880 Bn |

| Entresto (sacubitril/valsartan) |

Cardiovascular, Renal and Metabolism | Chronic heart failure | $1.726 Bn |

| Sandostatin (octreotide) |

Oncology | Carcinoid tumors and acromegaly | $1.585 Bn |

| Afinitor/Votubia (everolimus) |

Oncology | Breast cancer/giant cell astrocytoma with tuberous sclerosis complex | $1.539 Bn |

| Promacta/Revolade (eltrombopag) |

Oncology | Immune thrombocytopenia; severe aplastic anemia | $1.416 Bn |

| Tafinlar+Mekinist (dabrafenib + trametinib) |

Oncology | BRAF V600+ metastatic & adjuvant melanoma; advanced non-small cell cancer | $1.338 Bn |

| Galvus Group (vildagliptin) |

Established Medicines | Diabetes | $1.297 Bn |

| Gleevec/Glivec (imatinib) |

Oncology | Chronic myeloid leukemia and GIST** | $1.263 Bn |

| Xolair (omalizumab) |

Respiratory | Severe allergic asthma & chronic spontaneous urticaria | $1.173 Bn |

| Jakavi (ruxolitinib) |

Oncology | Myelofibrosis and polycytomia vera | $1.114 Bn |

| Diovan Group (valsartan) |

Established Medicines | Hypertension | $1.064 Bn |

| Exforge Group (amlodipine and valsartan) |

Established Medicines | Hypertension | $1.025 Bn |

|

* Blockbuster is defined as sales of $1 billion or more. |

|||