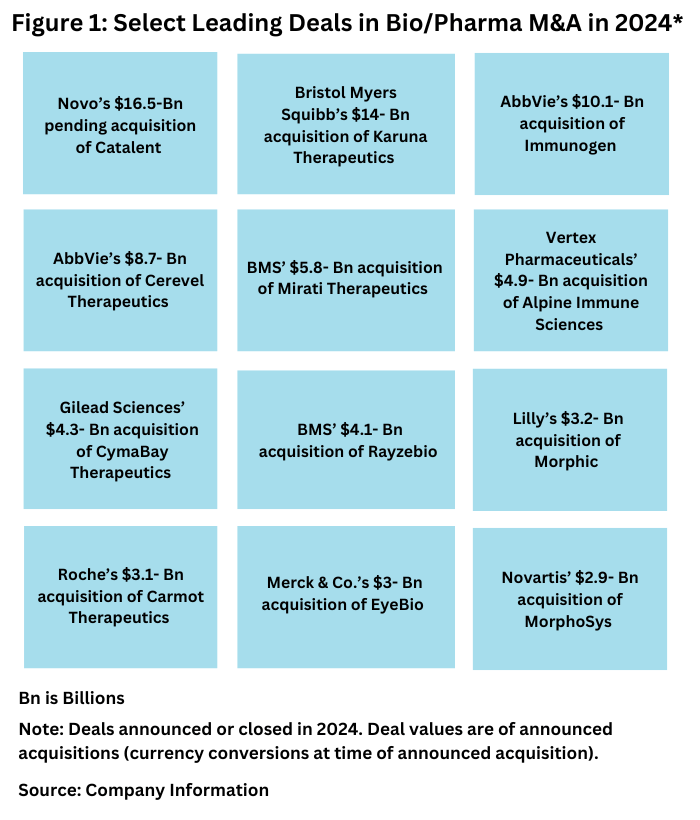

Bio/Pharma M&A: The Leading Deals From 2024

Novo Holding’s pending $16.5-billion acquisition of Catalent was the deal of the year, driven by Novo’s interest to gain manufacturing capacity. But what pure-play bio/pharma M&A stood out?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

No mega deal in 2024 but other deals of note

Although there were no mega deals in 2024, there were several acquisitions of note either announced or completed in 2024. Using a threshold of a least approximately $3 billion, companies making key moves in 2024 were Novo Nordisk, Bristol-Myers Squibb, AbbVie, Vertex Pharmaceuticals, Gilead Sciences, Roche, and Novartis.

Novo’s $16.5-billion pending acquisition of Catalent. The largest acquisition in 2024 was unique in that it was not a deal among bio/pharma companies but of a large bio/pharmaceutical company acquiring a CDMO to expand its manufacturing network. In February (February 2024), Novo Holdings, the parent company of Novo Nordisk, announced plans to acquire the CDMO Catalent for $16.5 billion as a means for Novo to add manufacturing capacity for its blockbuster glucagon-like peptide 1 (GLP-1) agonists for treating Type 2 diabetes and obesity, Ozempic/Wegovy/Rybelsus (semaglutide). The deal, which is expected to close later this year (2024), will net Novo three fill–finish sites and related assets in Anagni, Italy, Bloomington, Indiana, and Brussels, Belgium. After closing, Novo Holdings plans to sell the three fill–finish sites to Novo Nordisk for $11 billion. The Catalent acquisition is expected to gradually increase Novo Nordisk’s filling capacity from 2026 and onwards. The deal moved further to closing when earlier this month (December 6, 2024), the European Commission approved Novo Holdings’ acquisition of Catalent well as Novo Nordisk’s subsequent acquisition of the three manufacturing sites from Novo Holdings The completion of the acquisition remains subject to the fulfilment of further customary closing conditions, including regulatory approvals in other jurisdictions, but Novo Nordisk says it still expects the acquisition to be completed toward the end of 2024.

Bristol Myers Squibb’s $14-billion acquisition of Karuna Therapeutics. The largest deal directly among bio/pharmaceutical companies in 2024 was Bristol-Myers Squibb’s (BMS) $14-billion acquisition of Karuna Therapeutics, a Boston-based bio/pharmaceutical company specializing in neuroscience-based drugs. The acquisition was announced in December 2023 and completed in March 2024. The acquisition netted BMS Karuna’s KarXT (xanomeline and trospium chloride), which was approved in September 2024 under a new name, Cobenfy, for treating schizophrenia in adults. It is the first antipsychotic drug approved to treat schizophrenia that targets cholinergic receptors as opposed to dopamine receptors, which has long been the standard of care. The drug is also in registrational trials both as an adjunctive therapy to existing standard-of-care agents in schizophrenia and for the treatment of psychosis in patients with Alzheimer’s disease, with potential to expand to additional indications, including bipolar I disorder and Alzheimer’s disease agitation. The acquisition also included early-stage and preclinical assets.

AbbVie’s $10.1-billion acquisition of Immunogen. Bio/pharma companies with oncology drug assets are always a much sought-after acquisition target, and AbbVie’s $10.1-billion acquisition of Immunogen, a Waltham, Massachusetts-based bio/pharmaceutical company fit that bill. The acquisition was announced in November 2023 and completed in June (June 2024). With the acquisition, AbbVie gained Immunogen’s Elahere (mirvetuximab soravtansine-gynx), an antibody drug conjugate for treating platinum-resistant ovarian cancer. ADCs are composed of both biologic and small-molecule components and consist of a small-molecule compound (for oncology applications, typically a cytotoxic compound) linked to a monoclonal antibody. . ImmunoGen’s pipeline includes other ADCs: a Phase I asset, IMGN-151, an anti-FRα ADC for ovarian cancer with the potential for expansion into other solid tumor indications. Pivekimab sunirine, currently in Phase II development, is an anti-CD123 ADC targeting blastic plasmacytoid dendritic cell neoplasm (BPDCN), a rare blood cancer, which was granted FDA breakthrough therapy designation for treating relapsed/refractory BPDCN. The acquisition was the latest in ADC-based deals. Pfizer’s $43-billion acquisition of Seagen, a Bothell, Washington-based bio/pharma company specializing in ADCs and other oncology drugs, in 2023 was the largest M&A last year.

AbbVie’s $8.7-billion acquisition of Cerevel Therapeutics. AbbVie made another acquisition in 2024, one to boost its position in neuroscience-based drugs, with its $8.7-billion acquisition of Cerevel Therapeutics, a Cambridge, Massachusetts-based bio/pharmaceutical company. The companies announced the deal last December (December 2023) and completed it in August (August 2024). Cerevel has a pipeline of multiple clinical-stage and preclinical candidates with potential across several diseases, including schizophrenia, Parkinson’s disease, and mood disorders.

A key clinical product is emraclidine, an antipsychotic being evaluated in Phase Ib/II studies for treating schizophrenia. The drug is also being evaluated for treating dementia-related psychosis in Alzheimer’s disease and Parkinson’s disease. Emraclidine is currently in a Phase I study in elderly healthy volunteers in support of a potential Alzheimer’s disease psychosis program. The acquisition added to AbbVie’s pipeline within neuroscience, which includes tavapadon, for treating early Parkinson’s disease, currently in Phase III studies and for which AbbVie reported earlier this month (December 2024) that it is on track to submit a new drug application to the US Food & Drug Administration (FDA) in 2025. Other neuroscience drugs in AbbVie’s pipeline include CVL-354, in Phase I, for treating major depressive disorder, and darigabat, in Phase II development for treatment-resistant epilepsy and panic disorder.

BMS’ $5.8-billion acquisition of Mirati Therapeutics. Earlier this year (January 2024), Bristol-Myers Squibb (BMS) completed its acquisition of Mirati Therapeutics, a San Diego, California-based bio/pharmaceutical company, in a $5.8-billion deal ($4.8 billion at closing and $1.0 billion in contingency value rights payments). The acquisition was announced in October 2023. With the acquisition, BMS added a commercialized lung-cancer medicine, Krazati (adagrasib), to its oncology portfolio as well as several clinical assets. These drug candidates include Mrtx1719, in Phase I development for treating several cancers, including non-small-cell lung cancer (NSCLC), cholangiocarcinoma (bile duct cancer), and melanoma, and Mrtx1133, in Phase I development, for treating pancreatic cancer, NSCLC, and colorectal cancer.

Vertex Pharmaceuticals’ $4.9-billion acquisition of Alpine Immune Sciences. One of the larger acquisitions first announced in 2024 was Vertex Pharmaceuticals’ $4.9-billion acquisition of Alpine Immune Sciences, a Seattle, Washington-based clinical-stage bio/pharmaceutical company developing protein-based immunotherapies. The deal was announced in April (April 2024) and completed in May (May 2024). Alpine’s lead molecule, povetacicept (ALPN-303), is in Phase III development to treat IgA nephropathy, a progressive, autoimmune disease of the kidney that can lead to end-stage-renal disease.

Gilead Sciences’ $4.3-billion acquisition of CymaBay Therapeutics. In March (March 2024), Gilead Sciences completed its $4.3-billion acquisition of CymaBay Therapeutics, a Newark, California-based clinical-stage bio/pharmaceutical company. The acquisition netted Gilead a late-stage asset, seladelpar, an oral drug for treating primary biliary cholangitis (PBC), a rare, chronic, autoimmune disease of the bile ducts that can cause liver damage and possible liver failure. The drug was subsequently granted accelerated approval by FDA, under the name, Livdelzi, in August (August 2024).

BMS’ $4.1-billion acquisition of Rayzebio. Radiopharmaceuticals have been a target for M&A among some companies, and Bristol Myers Squibb (BMS) joined the ranks with its $4.1-billion acquisition of RayzeBio, a San Diego, California-based clinical-stage radiopharmaceutical company, The acquisition was announced in December 2023 and completed in February (February 2024). RayzeBio has a position in actinium-based radiopharmaceutical therapeutics targeting solid tumors, including gastroenteropancreatic neuroendocrine tumors (GEP-NETs), small-cell lung cancer, hepatocellular carcinoma, and other cancers. Its lead program is RYZ101 (225Ac-dotatate), a small-cell lung cancer drug candidate in Phase III development targeting somatostatin receptor 2 (SSTR2) in patients with SSTR-positive GEP-NETs who have previously been treated with lutetium-177-based somatostatin therapies. Its pipeline also includes: RYZ801, a proprietary peptide for treating hepatocellular carcinoma, now in investigational new drug (IND)-enabling studies; an asset targeting CA9, which is expressed in renal cell cancer and currently in IND-enabling studies; and multiple preclinical assets to treat solid tumors. On the manufacturing side, BMS also gained a radiopharmaceutical manufacturing facility in Indianapolis, Indiana.

Roche’s $3.1-billion acquisition of Carmot Therapeutics. Looking to target the strength of the market for diabetes and obesity drugs, Roche acquired Carmot Therapeutics, a Berkeley, California-based bio/pharmaceutical company, in a deal worth up to $3.1 billion ($2.7 billion at closing plus $400 million in potential milestone payments). The deal was announced last December (December 2023) and closed in January (January 2024).

The acquisition provides Roche with three clinical-stage assets with potential in treating obesity and diabetes. These include: (1) CT-388, a once-weekly subcutaneous injectable in Phase II, for treating obesity in patients with and without Type 2 diabetes; (2) CT-996, a once-daily oral small-molecule drug, in Phase I, for treating obesity in patients with and without Type 2 diabetes; and (3) CT-868, a once-daily subcutaneous injectable, in Phase II, for treating Type 1 diabetes patients with overweight or obesity. These drug candidates are incretins, which are gut hormones that are secreted after food intake and play a role in modulating blood glucose by stimulating insulin secretion and suppressing appetite. Roche says the incretin-based portfolio could also be expanded to other indications where incretins play a role, including cardiovascular, retinal, and neurodegenerative diseases.

Novartis’ $2.9-billion acquisition of MorphoSys. Novartis advanced its antibody-based oncology drug portfolio with its EUR 2.7 billion ($2.9 billion) acquisition of MorphoSys, a Planegg, Germany-based bio/pharmaceutical company. The deal was announced in February (February 2024) and completed in May (May 2024). Novartis’ acquisition of MorphoSys took a negative turn, just months after the acquisition was completed, with Novartis reporting in October (October 2024), that it took an $800-million impairment charge to the acquired assets’ goodwill value. The acquisition was primarily focused on MorphoSys’ pelabresib, a drug in late-stage development, for treating myelofibrosis, a rare type of blood cancer. In its third-quarter 2024 results, Novartis reported that based on its review of 48-week data from Phase III studies, that longer follow-up time was needed to determine, in consultation with health authorities, the regulatory path for pelabresib in myelofibrosis. At the time of the announced acquisition in February (February 2024), Novartis had expected a regulatory filing with the US Food and Drug Administration in the second half of 2024. The acquisition included other MorphoSys’ pipeline of antibody-based drugs, but not MorphoSys’ lone commercial product, Monjuvi/Minjuvi (tafasitamab-cxix), for which the global rights were gained separately by Incyte Pharmaceuticals, a Wilmington, Delaware-based bio/pharmaceutical company.