A Look Ahead: Bio/Pharma’s Top Policy Issues in US Elections Aftermath

Following the US Presidential election this week, two industry groups, the Pharmaceutical Research and Manufacturers of America (PhRMA) and the Biotechnology Innovation Organization (BIO), issued statements broadly highlighting key policy issues of interest. What’s on the agenda?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Where will drug pricing policy move?

When taking office in January 2025, a major policy consideration for President-elect Donald Trump and Congress will be drug pricing in the US. Under the first Trump Administration (2016-2020), proposed policy measures emphasized increasing competition as a means to address drug pricing by improving the regulatory review and approval process for pharmaceuticals, including for generic drugs, potentially requiring drug pricing disclosures in direct-to-consumer advertising, and patent reforms.

A key decision by the new Administration will be how to proceed with drug-pricing measures enacted under the Inflation Reduction Act of 2022, which for the first time authorized and required the US government to negotiate drug prices under Medicare, the US federal government program for healthcare for individuals 65 years or older. Under current policy and the Medicare Drug Price Negotiation Program, certain drugs will be made available in Medicare Part B (prescription drugs administered in a clinical/hospital setting) or Medicare Part D (prescription drugs administered in an outpatient setting. i.e., purchased through pharmacies/retail channels) at prices negotiated between manufacturers and the US Secretary of Health and Human Services (HHS). Under the program, each year the HHS Secretary is authorized to select a set number of drugs for price negotiation on the basis of total Medicare spending on the drugs and certain other criteria. Eligibility for price negotiation is limited to small-molecule drugs that have been on the market for at least seven years and have no generic competitors, as well as to biologic drugs that have been on the market for at least 11 years and have no biosimilar competitors. Each drug’s negotiated price is subject to a ceiling amount that is based on its previous price, rebate amount, and length of time on the market.

Under the drug-price negotiation program, the HHS Secretary is authorized and required to select a specified number of drugs from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part D spending and from a list of 50 “negotiation-eligible drugs” with the highest Medicare Part B spending over a given 12-month period. It would limit the number of eligible drugs for negotiations to 10 Medicare Part D drugs in 2026, 15 Medicare Part D drugs in 2027, 15 Medicare Part B and D drugs in 2028, and 20 Medicare Part B and D drugs in 2029 and thereafter. In all, over the next several years under current policy, the US government would negotiate prices for up to 60 drugs covered under Medicare Part D and Part B, and up to an additional 20 drugs every year after that.

In August (August 2024), the US government released the negotiated drug prices for the first 10 drugs selected under the Medicare Drug Price Negotiation Program, with the first negotiated prices set to go into effect in 2026 under current law.

Other policy measures now on the table

Whether the new Administration keeps the Medicare Drug Price Negotiation Program in place or not or seeks to change it will be a top policy issue. Debate on drug pricing reforms in the US is and will continue to be a hotly debated with a number of policy proposals already on the table. To evaluate various policy alternatives for drug pricing reform, last month (October 2024), the US Congressional Budget Office (CBO), a federal agency that provides independent budget and economic analysis to Congress, issued a report to evaluate a set of policy approaches aimed at reducing the average prices of prescription drugs distributed through retail channels in the United States. To generate a list of policy approaches to analyze, the CBO considered current and previous Congressional legislative proposals, major proposals from the policy community, and the academic literature on health policy and prescription drug markets. CBO also examined various prescription drug pricing policies that are used in other high-income countries.

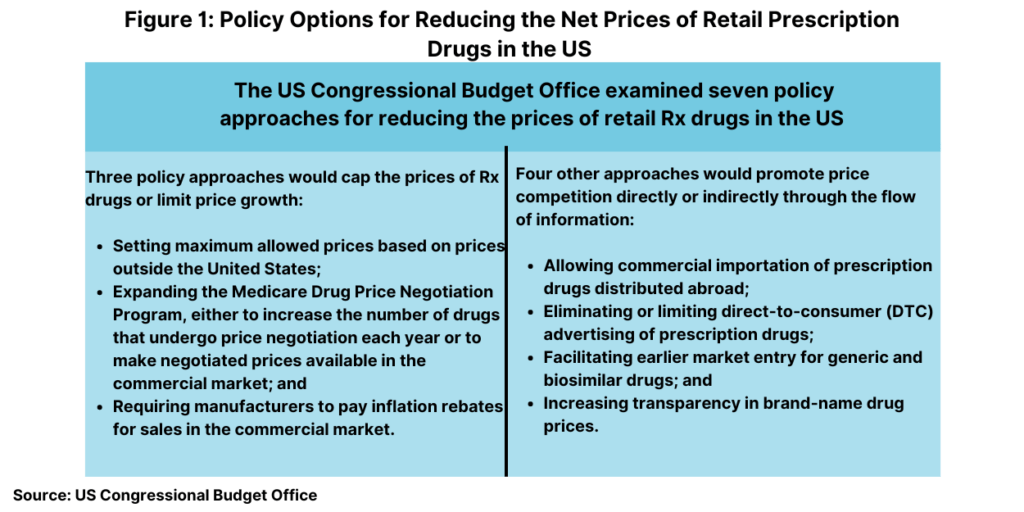

In all, it examined seven policy approaches in two broad categories: (1) approaches that would reduce the prices that drug manufacturers charge by capping those prices or limiting their rate of growth and (2) approaches that would promote price competition or affect the flow of information. Its analysis focused on prescription drugs purchased in retail settings, such as local brick-and-mortar pharmacies and mail-order pharmacies. Prices for drugs that are administered by physicians or other healthcare professionals in outpatient settings or hospitals were not within the scope of CBO’s analysis.

Figure 1 outlines the seven policy approaches examined by CBO and the anticipated effect on average drug prices. CBO assessed how each of these seven approaches would affect average retail drug prices in 2031, when the total retail prescription drug market is projected to surpass $690 billion. For each approach, the effects would depend on the specifics of the policy. The estimated effects of the approaches on price are characterized by size: An average price reduction of more than 5% is considered large; a reduction of 3% to 5% is moderate; a reduction of 1% to 3% is small; a reduction of 0.1% to 1% is very small.

Capping Rx drug prices or limiting prices growth

Broadly, three of the approaches would operate by capping the prices of prescription drugs or limiting price growth as outlined below.

Set maximum allowed prices based on prices outside the United States. In CBO’s assessment, a policy approach that used the prices of brand-name prescription drugs in high-income foreign countries to set maximum prices for those drugs would lower average prices in the US by a large amount (more than 5%).

Expand the Medicare Drug Price Negotiation Program. Another option would be to expand the number of drugs for inclusion under the Medicare Drug Price Negotiation Program. The first cohort of drugs to undergo price negotiation was announced in August 2023, their negotiated prices were announced in August 2024, and the negotiated prices will take effect in 2026. Beginning with the second cohort of drugs to undergo price negotiation (which will be selected in 2025), negotiated prices will take effect at the start of the second calendar year following selection. Medicare Part D plans will then be able to purchase the drug at its negotiated price, and enrollees’ cost sharing for the drug will be based on that price.

CBO examined two policies that would expand the Medicare Drug Price Negotiation Program. The first would increase the number of drugs whose prices get negotiated each year, which it says would lead to a very small (0.1% to 1%) or a small (1% to 3%) reduction in average drug prices in 2031. The second policy would make negotiated prices available to all commercial purchasers, which CBO would lower average prices by a small amount (1% to 3%).

Require manufacturers to pay inflation rebates for sales in the commercial market. CBO estimates that extending the Medicare Part D inflation rebate to sales in the commercial market would result in a small reduction (1% to 3%) in average drug prices in 2031.

Promoting price competition or affecting the flow of information

Four other approaches would operate by promoting price competition or by affecting the flow of information as outlined below.

Allow commercial importation of prescription drugs distributed outside the United States. This policy would require the HHS Secretary to allow the large-scale importation of prescription drug products from other countries. CBO estimates this would lead to a very small reduction (0.1% to 1.0%) in average drug prices in the United States.

Eliminate or limit direct-to-consumer prescription drug advertising. CBO examined policies that would either eliminate direct-to-consumer prescription drug advertising or prohibit it for three years after a drug’s initial approval for sale. CBO concluded that the result would be a very small reduction (0.1% to 1.0%) in average drug prices.

Facilitate earlier market entry for generic and biosimilar drugs. A diverse set of policies embodied in legislation recently introduced in Congress and analyzed by CBO would accelerate market entry for generic and biosimilar drugs. CBO estimates that these policies would reduce average drug prices by a very small amount (0.1% to 1.0%) or by less than 0.1%.

Industry reaction

As a whole, the industry has been critical of the drug-pricing measures authorized under the Inflation Reduction Act. The Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies in the US, has raised concerns over a lack of transparency and accountability in the drug-negotiation process and the overall dampening effect of drug-pricing measures on product innovation. While supporting efforts to lower overall healthcare costs, PhRMA contends that the drug-pricing measures under the drug-negotiation process do not achieve the desired goal of lowering drug prices as they do not take into account the role that third-parties, insurance companies, and pharmacy benefit managers (PBMs) have in setting drug prices.

With the recent election in the US, PhRMA further emphasized that position as well as its interest in working with the new Administration on policy to support product innovation and patient access to medicines. “During his first term, President Trump led the charge… to ensure more of the rebates they [PBMs] negotiate are passed onto patients at the pharmacy counter,” said PhRMA President and CEO Stephen J. Ubl, in a November 6, 2024, statement. “We will continue working with policymakers to advance bipartisan PBM reforms that lower costs and reduce barriers to patient access.”

He also emphasized the need to have policy that supports product innovation. “We want to work with his administration [Trump Administration] to further strengthen our innovation ecosystem that enables the United States to lead the world in medicine development,” said PhRMA’s Ubl. “New medicines are transforming our ability to prevent, treat, and cure deadly disease, improving patient lives, and helping to avoid the most expensive parts of our healthcare system.”

For its part, the Biotechnology Innovation Organization (BIO), which represents the biotechnology industry in the US, also emphasized its interest in working with the new Administration on policies that are supportive of product innovation. “We look forward to working closely with President-elect Trump, his incoming Administration, and members of Congress on both sides of the aisle to ensure that we have leadership in government that advances the ‘virtuous circle’ of innovation coming from America’s great biotechnology companies,” said BIO President & CEO John F. Crowley, in a November 6, 2024, statement. “The public health and our national security are best served by strong leadership that respects and advances science and medicine and ensures that the United States and our allies continue to lead the world in biotechnology.”