Making the Innovation Cut: New Drug Approvals Thus Far in 2024

How is product innovation faring in the bio/pharma industry thus far in 2024? Through the end of October, FDA’s Center for Drug Evaluation and Research has approved 38 new drugs. Which companies and products have made the cut, and which may be best poised for market success?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

New drug approvals thus far in 2024

Although not following a strictly chronological path, examining the pace of new drug approvals is an important measure of product innovation in the bio/pharma industry. Through the end of October (as of October 31, 2024), the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) had approved 38 new molecular entities (NMEs) and biological therapeutics, compared to 46 new drugs approved through October 2023.

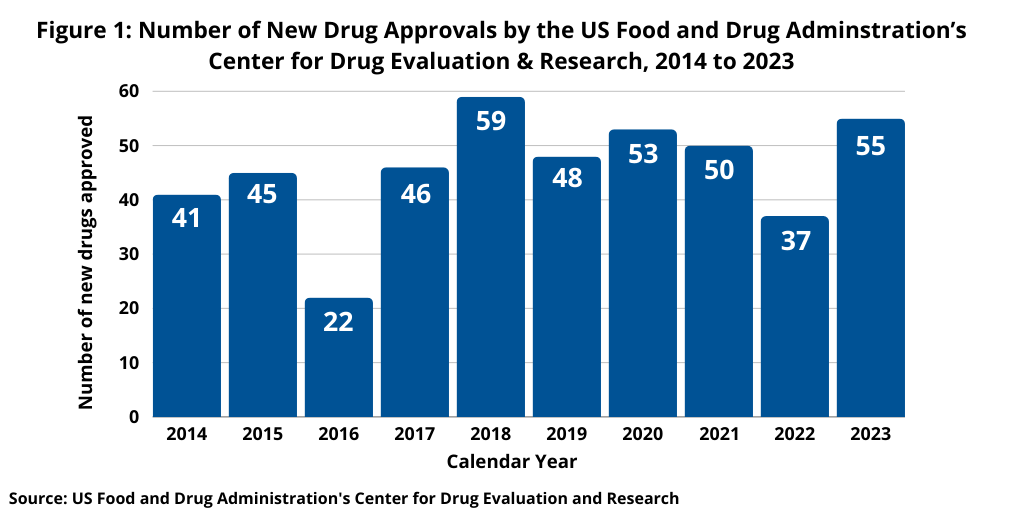

Last year (2023) saw an uptick in new drug approvals compared to 2022, which was a recent dip in new drug approvals. In 2023, FDA’s CDER approved 55 NMEs and new biological therapeutics, a 49% increase in the number of new drug approvals compared to 2022, when 37 new drugs were approved. The 55 new drugs approved in 2023 by FDA’s CDER was in line with recent years. In 2021, 50 NMEs and new biological therapeutics were approved and 53 in 2020. The 55 new drugs approved in 2023 represented the second highest level of approvals in the past decade, except for 2018 when 59 new drugs were approved (see Figure 1).

Small molecules versus biologics

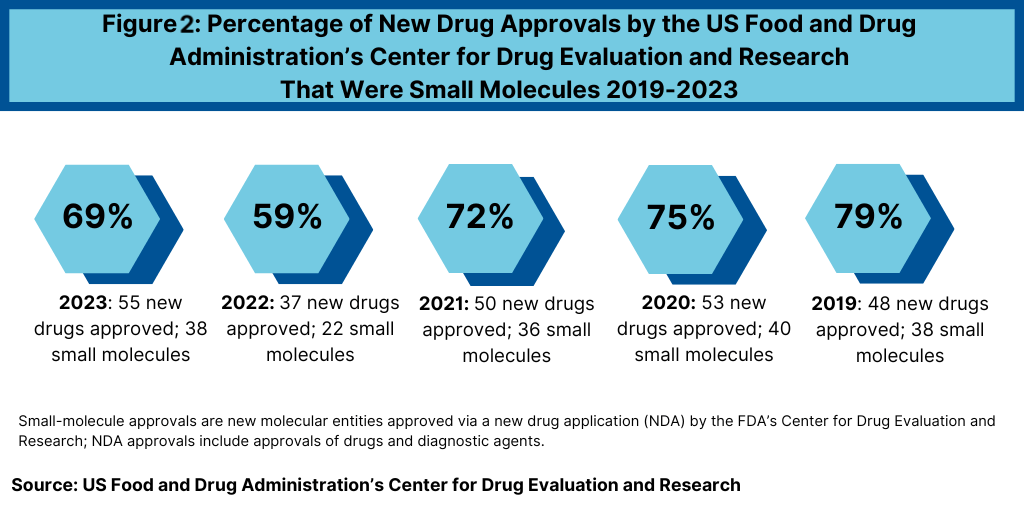

Another important trend to look at is the product mix of new drug approvals. Of the 38 new drug approvals thus far in 2024 (as of October 31, 2024), 26, or 68%, were small molecules (24 drugs and two diagnostic/imaging agents), and 12, or 32%, were biologics. That is on par with the mix in 2023, when FDA’s CDER approved 17 new biological therapeutics, which represented 31% of new drug approvals, and 38 small-molecule products or 69% of new drug approvals (see Figure 2).

The percentage of small-molecule approvals in 2023 was in line with recent years, except in 2022, which represented a recent low. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules or 22 of the 37 new drug approved. Between 2018 and 2021, small molecules averaged 74% of new drug approvals. In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, 79% in 2019, and 71% in 2018.

The decrease in small molecules’ share of new drug approvals in 2022 was largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics. The 17 new biologics approved in 2023 surpassed 2022 levels and matched a recent high in 2018, when 17 new biologics were approved by FDA’s CDER, far exceeding biologic approvals of 14 in 2021, 13 in 2020, and 10 in 2019.

Large bio/pharma companies versus mid-tier/small companies

The quantity of new drug approvals, alone, is not a singular measure of product innovation, but tracking it show some interesting trends, notably the increasing contribution of small bio/pharma companies, particularly in the small-molecule drug space.

Of the 38 new drugs approved thus far in 2024, 13, or 34%, were from large companies (defined as the top 25 bio/pharma companies based on 2023 revenues and one large medical technology company with approval of a diagnostic agent), and 25, or 66%, were from mid-sized or small companies. In looking at product mix, biologics accounted for more than half (54%) of new drug approvals by the large companies, but only 20% from mid-sized-to-small companies.

The large bio/pharma companies have had seven new biological therapeutics approved thus far in 2024 and five small-molecule drugs. For purposes of this analysis, new biological therapeutics only include those approved by FDA’s CDER, which reviews and approves new molecular entities and new biological therapeutics. Other biologic-based products, including blood products, vaccines, allergenics, tissues, and cellular and gene therapies, are reviewed and approved by a separate center within FDA, the Center for Biologics Evaluation and Research (CBER).

So which companies made the cut in biologics? The seven biologics approved from the large bio/pharma companies were: Amgen’s Imdelltra (tarlatamab-dlle) for treating extensive-stage small cell lung cancer; Astellas’ Vyloy (zolbetuximab-clzb) for treating gastric or gastroesophageal junction adenocarcinoma, a rare type of cancer of the esophagus; Eli Lilly and Company’s Ebglyss (lebrikizumab-lbkz) for treating moderate-to-severe atopic dermatitis (eczema); Lilly’s Kisunla (donanemab-azbt) for treating early symptomatic Alzheimer’s disease; Merck & Co.’s Winrevair (sotatercept-csrk) for treating pulmonary arterial hypertension, a rare disease in which blood vessels in the lungs thicken and narrow, causing strain on the heart; Pfizer’s Hympavzi (marstacimab-hncq) for preventing or reducing bleeding episodes related to hemophilia A or B; and Roche’s Piasky (crovalimab-akkz) for treating paroxysmal nocturnal hemoglobinuria (PNH), a rare blood disorder.

The five small-molecule drug approvals from the large bio/pharmaceutical companies were: AstraZeneca’s Voydeya (danicopan) for treating extravascular hemolysis with paroxysmal nocturnal hemoglobinuria, a rare blood disease; Bristol-Myers Squibb’s Cobenfy (xanomeline and trospium chloride) for treating schizophrenia; Gilead Sciences’ Livdelzi (seladelpar) for treating primary biliary cholangitis, a chronic autoimmune disease that damages the liver’s bile ducts, causing a buildup of bile and toxins; Johnson & Johnson’s Lazcluze (lazertinib) for treating non-small cell lung cancer; Roche’s Itovebi (inavolisib) for treating locally advanced or metastatic breast cancer. In addition, GE Healthcare gained FDA approval for Flyrcado (flurpiridaz F 18), a radioactive diagnostic drug to evaluate for myocardial ischemia and infarction.

Mid-tier & small bio/pharma companies: new drug approvals

Small-molecules by far dominated new approvals from mid-sized to small companies, with many of the drugs indicated for rare diseases. Below is a roundup of small-molecule drug approvals from mid-sized and small companies thus far this year (as of October 31, 2024):

- Akebia Therapeutics’ Vafseo (vadadustat) for treating anemia due to chronic kidney disease;

- Allecra Therapeutics’ Exblifep (cefepime, enmetazobactam) for treating complicated urinary tract infections;

- Ascendis Pharma’s Yorvipath (palopegteriparatide) for treating hypoparathyroidism, a rare disease where the parathyroid glands behind the thyroid do not produce enough parathyroid hormone;

- Basilea Pharmaceutica’s Zevtera (ceftobiprole medocaril sodium for injection), an antibiotic for treating certain bloodstream infections, bacterial skin and associated tissue infections, and community-acquired bacterial pneumonia;

- Botanix’s Sofdra (sofpironium) for treating primary axillary hyperhidrosis, a chronic disorder characterized by uncontrollable excessive sweating without a recognizable cause;

- Day One Biopharmaceuticals’ Ojemda (tovorafenib) for treating relapsed or refractory pediatric low-grade glioma (i.e., brain tumor);

- Intrabio’s Aqneursa (levacetylleucine) for treating Niemann-Pick disease type C, a rare genetic disease resulting in progressive neurological symptoms and organ dysfunction;

- Geron’s Rytelo (imetelstat) for treating low- to intermediate-1 risk myelodysplastic syndromes, a group of progressive bone marrow disorders;

- Idorsia’s Tryvio (aprocitentan) for treating hypertension;

- Ispen’s Iqirvo (elafibranor) for treating primary biliary cholangitis in combination with ursodeoxycholic acid;

- Italfarmaco’s Duvyzat (givinostat) for treating Duchenne muscular dystrophy, a severe, inherited disease that causes progressive muscle weakness and degeneration;

- Iterum Therapeutics’ Orlynvah (sulopenem etzadroxil, probenecid) for treating uncomplicated urinary tract infections;

- LNHC’s Zelsuvmi (berdazimer) for treating molluscum contagiosum, a skin infection;

- Lumicell’s Lumisight (pegulicianine), an optical imaging agent for detecting cancerous tissue;

- Madrigal Pharmaceuticals’ Rezdiffra (resmetirom) for treating noncirrhotic non-alcoholic steatohepatitis (NASH), a nonalcoholic fatty liver disease where liver inflammation, over time, can lead to liver scarring and liver dysfunction;

- Servier’s Voranigo (vorasidenib) for treating Grade 2 astrocytoma or oligodendroglioma, two types of low-grade brain tumors;

- Sun Pharma’s Leqselvi (deuruxolitinib) for treating severe alopecia areata, a common autoimmune disease, causing sudden hair loss;

- Verona Pharma’s Ohtuvayre (ensifentrine) for treating chronic obstructive pulmonary disease;

- X4 Pharmaceuticals’ Xolremdi (mavorixafor) for treating WHIM syndrome (warts, hypogammaglobulinemia, infections and myelokathexis); and

- Zerva Denmark’s Miplyffa (arimoclomol), for treating Niemann-Pick disease type C

On the biologics side, small-to-mid-sized bio/pharma companies have had five biologics approved thus far in 2024. These are: BeiGene’s Tevimbra (tislelizumab-jsgr) for treating unresectable or metastatic esophageal cancer; Galderma’s Nemluvio (nemolizumab-ilto) for treating prurigo nodularis, a chronic skin disorder with itchy nodules; Hugel-Aesthetics’ Letybo (letibotulinumtoxinA-wlbg) for temporarily improving the appearance of moderate-to-severe glabellar lines (i.e., so-called “frown lines”); ImmunityBio’s Anktiva (nogapendekin alfa inbakicept-pmln) for treating bladder cancer; and Incyte’s Niktimvo (axatilimab-csfr) for treating chronic graft-versus-host disease.