Generics Outlook: Biologics Patent Cliff Looming

What is the outlook for the global generic-drug market? A looming biologics patent cliff and double-digit growth for specialty generics bodes well for the market, but what is the outlook for other sectors in the generics market? DCAT Value Chain Insights takes an inside look on what the market may hold.

Global market outlook for generic drugs

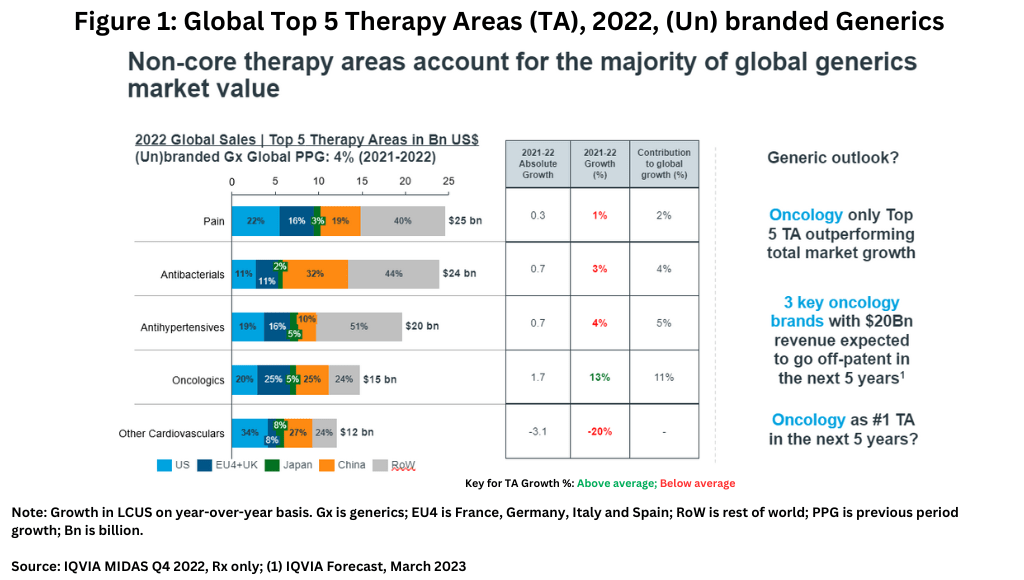

Unlike the innovator drug market where oncology, immunology, and diabetes drugs account for core therapeutic sectors and leading growth areas, non-core therapy areas account for the majority of the global generics market’s value (see Figure 1), led by pain-management drugs, antibacterials, and antihypertensives. In the generics market, oncology, which is the leading therapeutic sector among innovator drugs, is the only top five therapeutic area in innovator drugs that is also outperforming total market growth in the generics market (see Figure 1). However, three major oncology brands with revenues of $20 billion are expected to go off-patent in the next five years, so it is likely that this will become a very significant field for generics growth, especially as biosimilar adoption intensifies (1).

On a geographic basis, North America represents a shrinking share of the global generics market value due to rising competition and downward pricing pressures. Although the US generics market has begun to stabilize since 2019, strong pricing pressures remain. In turn, non-core geographic markets have greater generics growth potential. For example, over the past five years, volume and sales growth in Africa/the Middle East have outperformed the market average. In India and the Commonwealth of Independent States (C.I.S), higher value growth has been driven by branded generics uptake.

Specialty generics, which represent approximately 14% of the generics market, are defined by IQVIA as medicines that treat specific, complex diseases with four or more of the following attributes: initiated only by a specialist; administered by a practitioner; require special handling; unique distribution; high cost; warrants intensive patient care; and requires reimbursement assistance. Sales of specialty generics have outpaced growth of traditional generics and increased at a compound annual growth rate of 10% between 2017 and 2022 to reach sales of approximately $42 billion.

For biosimilars, the global biosimilars market is expected to double over the next five years and provide approximately $400 billion in cost saving to healthcare systems.

US generics market

In the US market, biosimilars launched to date now account for 25% of the total volume of referenced molecules prescribed in the US, according to an April 2023 report by the IQVIA Institute for Human Data Science, The Use of Medicines in the US 2023: Usage and Spending Trends and Outlook to 2027, although there is wide variation in uptake across molecules reflecting differences in strategies adopted by originator and biosimilar manufacturers, payer and pharmacy benefit managers’ (PBM) decisions, as well as clinician and patient preferences. The impact from losses of exclusivity for biologics and the introduction of biosimilars has increased dramatically in the past three years, with brand sales of those products dropping by $33 billion over the past five years compared to $4 billion over the prior five years and reflecting a growing role for biosimilars.

Currently, biosimilars represent 7% of the total biologics volume in the US with an additional 20% of volume accessible to biosimilars (i.e., originator medicines for which a biosimilar is on the market), according to the IQVIA report. Beginning in 2023, an additional 4% of volume is expected to become accessible as immunology drugs, such as adalimumab (reference product, AbbVie’s Humira), ustekinumab (reference product, Johnson & Johnson’s Stelara), and tocilizumab (reference product, Roche’s Actemra) face biosimilar competition.

Most of the impact from losses of exclusivity in 2020 through 2022 in the US market was from biosimilars introduced in the prior three years, including three molecules in the oncology market —bevacizumab (reference product, Roche’s Avastin), rituximab (reference product, Roche’s and Biogen’s Rixutan), and trastuzumab (reference product, Roche’s Herceptin), which have contributed to a significant increase in brand losses due to loss of exclusivity. Biologic brand losses were $8 billion each in 2020 and 2021 and $9 billion in 2022 in the US market, lifting the total to $33.4 billion in the past five years, according to the IQVIA report.

Small-molecule brand losses were much less than historic averages in the past two years as few products with higher spending lost exclusivity, and deflationary effects of earlier expiries were not as strong. Small molecules contributed $49.4 billion in brand losses to loss of exclusivity over the past five years, down from $68.4 billion in the prior five years.

Reference

1. P. Van Arnum, “Pharma Industry Outlook: Where is the Growth,” DCAT Value Chain Insights, April 20, 2023.

Editor’s Note: This article was updated with additional information on the US generics market.