FDA Issues Report on Drug Shortages

Notable drug shortages have made recent news. The FDA has issued its annual report on drug shortages by outlining the extent of drug shortages in calendar year 2022 and the steps it is taking to mitigate shortages.

Drug shortages in 2022

As part of an annual requirement to report on drug shortages to Congress, the US Food and Drug Administration (FDA) outlined key data on drug shortages and the steps it is taking to mitigate drug shortages. For calendar year (CY) 2022, FDA was notified of 1,293 potential drug and biological product shortage situations by 150 manufacturers. The number of new shortages tracked by FDA’s Center for Biologics Evaluation and Research (CBER) and FDA’s Center for Drug Evaluation and Research (CDER) was 49 in CY 2022, compared to a peak of 251 new shortages during CY 2011 (see Figure 1). In the past year, FDA says it has seen manufacturers in the US and abroad continue to experience quality issues as well as struggle with capacity constraints. Additionally, as demand increased for numerous drugs over the last several years as a result of the COVID-19 pandemic, as well as due to an earlier-than-typical flu and respiratory virus season, FDA says it has seen additional strain on the pharmaceutical supply chain.

Preventing drug shortages

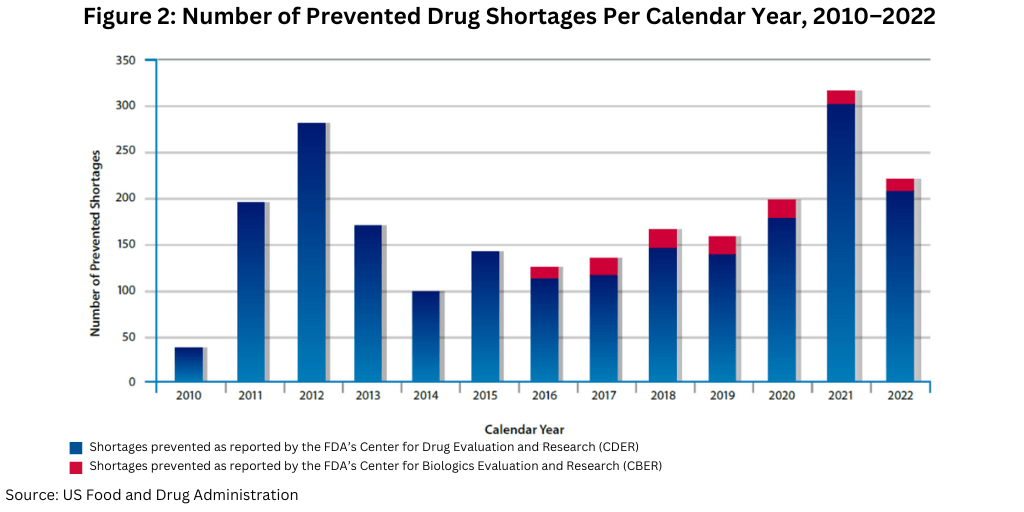

In CY 2022, FDA worked with manufacturers to successfully avoid a large number of drug shortages, helping to prevent 222 shortages (see Figure 2). For a comparison to recent years, FDA helped prevent 199 shortages in CY 2020 and 317 in CY 2021.

Ongoing drug shortages

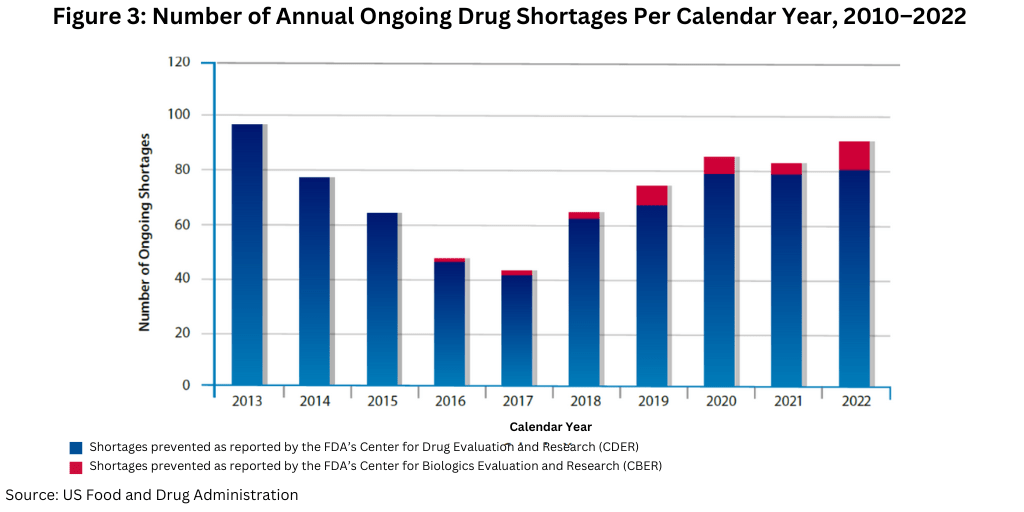

Another data point to note is the number of ongoing shortages yet to be resolved from previous years. As of December 31, 2022, FDA had identified 86 ongoing CDER- and CBER-tracked drug shortages. This number has continued to remain steady over the past couple years; there were 86 ongoing shortages for CY 2020 and 83 ongoing shortages for CY 2021 (see Figure 3).

Mitigating drug shortages

In its report, FDA outlined the steps it is taking to mitigate drug shortages. Mitigation efforts begin once FDA confirms that a shortage exists or may occur. The actions FDA can take to prevent or mitigate a shortage include, as appropriate, the following:

• Identifying the extent of the shortfall and determine if other manufacturers are willing and able to increase production to make up the gap;

• Expediting FDA’s inspections and reviews of submissions submitted by affected manufacturers attempting to restore production;

• Expediting FDA’s inspections and reviews of submissions from competing entities who are interested in starting new production or increasing existing production of products in shortage;

• Expediting the release of lots of certain licensed biological products regulated by CBER or CDER;

• Reviewing requests for extensions of expiration dating;

• Exercising temporary regulatory flexibility for new sources of medically necessary drugs;

• Working with the affected manufacturers to ensure adequate investigations into the root cause of the shortage;

• Working with the Assistant Secretary for Preparedness and Response under the US Department of Health and Human Services on efforts under the Defense Production Act for the development of COVID-19 vaccines and therapeutics and supply-chain activities;

• Developing risk-mitigation measures to allow individual batches of a drug product to be released even when quality assurance requirements were not met; and

• Establishing communication channels with stakeholders and other interested parties.

Depending on the severity of the potential shortage and the surrounding circumstances, FDA can use one or more of these mitigation tools or seek to develop other options within its legal authority. When selecting specific tools, FDA says it continues to work with manufacturers to tailor their responses to the specific situations. As a part of these actions, FDA also frequently communicates available information about a potential shortage or existing shortage to affected stakeholders and monitors the shortage until it has been resolved.

For example in using some of these mitigation tools, FDA expedited the review of 199 submissions in CY 2022 and prioritized 30 establishment inspections to address drug shortages in CY 2022

Other actions: quality management maturity

One other way FDA is working with drug manufacturers to mitigate drug shortages is work by CDER to establish a program to incentivize drug manufacturers to invest in quality management maturity (QMM). QMM practices help drug manufacturers reduce the likelihood of supply-chain disruptions (caused by a decreased supply or an increased demand) and can lead to reduced costs, increased customer satisfaction, and greater operational efficiencies, according to FDA.

CDER’s specific QMM accomplishments in CY 2022 include the following as outlined below.

• CDER completed two pilot programs that evaluated best practices and developed frameworks to distinguish levels of QMM.

• CDER published a white paper on QMM, which highlighted the benefits of the program to different stakeholders (patients, providers, payors, purchasers, pharmacies, and pharmaceutical manufacturers) and identified key considerations that impact program development.

• CDER hosted a QMM public workshop (2,000 global attendees) that shared learnings from the pilot programs and provided an opportunity for FDA to solicit feedback. Ninety-nine percent of over 400 attendees who responded to a workshop poll believed that purchasers of drug products or APIs should “consider the QMM of the facility that manufacturers them,” according to information from FDA.

• Peer-reviewed journal articles on a quality benchmarking study (based on collaboration with Dunn & Bradstreet and the University of St. Gallen in Switzerland) and lessons learned from QMM pilots (domestic finished dosage form and foreign active pharmaceutical ingredient pilots) were published.

• An FDA advisory committee met and voted unanimously in favor of CDER establishing a QMM program, and work is actively ongoing.

Looking ahead: priorities of FDA

FDA has identified two key priorities in its efforts to address drug shortages: the need to gain better insight into the drug supply chain and the need to increase the resilience of the supply chain.

An obvious connection is that problems in the drug supply chain can create or worsen drug shortages. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law in 2020, includes authorities and requirements meant to enhance FDA’s ability to identify, prevent, and mitigate possible drug shortages by improving the agency’s visibility into the drug supply chain, but FDA says more is needed. While such provisions do include a requirement for manufacturers to notify FDA of active pharmaceutical ingredient (API) manufacturing discontinuances or interruptions and for drug manufacturers to report annually the amount of drugs they manufacture, manufacturers are not required to notify FDA of increases in demand that they are unlikely to be able to meet without meaningful shortfall or delay.

In addition, FDA points to the need to improve supply-chain resiliencey. FDA says that redundancy in the supply chain (as opposed to reliance on a single facility or geographic region) increases supply agility and potential solutions to alleviate shortages that occur due to regional or localized supply disruptions and that could ultimately create or exacerbate a drug shortage. For example, if a manufacturing facility needs to temporarily close, or its operations are curtailed by factors such as travel restrictions, quarantines, or social distancing requirements, it is important to have alternative facilities available to manufacture the drug or its API. The agency points to the importance of a provision under the CARES Act that requires certain manufacturers to develop a redundancy risk-management plan that identifies and evaluates the risks to the drug supply at establishments manufacturing a drug or its API.