The Top 25 Supply Chain Organizations

Which companies have the highest ranked global supply-chain organizations? The Gartner Group’s annual study ranks the top 25 supply-chain organizations with four bio/pharma companies and one chemical company making the mark.

Ranking the top supply-chain organizations

In the Gartner Supply Chain Top 25 rankings, the management consulting firm, Gartner, identifies and ranks leading supply-chain organizations and the best practices and characteristics of these top performers.

The Gartner Supply Chain Top 25 rankings are derived from a list of companies from a combination of the Fortune Global 500 and the Forbes Global 2000 with an annual revenue threshold of at least $12 billion. Companies without physical supply chains are excluded.

Companies are ranked based on a composite score that comprises two main components: business performance and opinion. Business performance in the form of public financial and ESG (environmental, social, governance) data provides a view into how companies have performed in the past three years while the opinion component offers an eye to future potential and reflects leadership in the supply-chain community. These two components are combined into a total composite score. The composite score is based on the following components: peer opinion, 25%; Gartner research opinion, 25%; return on physical assets, 15%; inventory turns, 5%; revenue growth, 10%; and an ESG component score, 20%.

Composite Score: (Peer Opinion*25%) + (Gartner Research Opinion*25%) + (Return on Physical Assets*15%) + (Inventory Turns*5%) + (Revenue Growth*10%) + (ESG Component Score*20%)

Companies are derived from a combination of the Fortune Global 500 and the Forbes Global 2000 of companies of at least $12 billion in revenue.

Source: The Gartner Group

“The leading companies on our list are notable for pursuing new avenues of growth at a time when disruptions remain a near constant threat,” said Mike Griswold, Vice President Team Manager with the Gartner Supply Chain practice, in commenting on the rankings. “The best supply-chain organizations are embracing the moment by both pursuing growth while also evolving more sophisticated risk management approaches.”

Companies making the Top 25

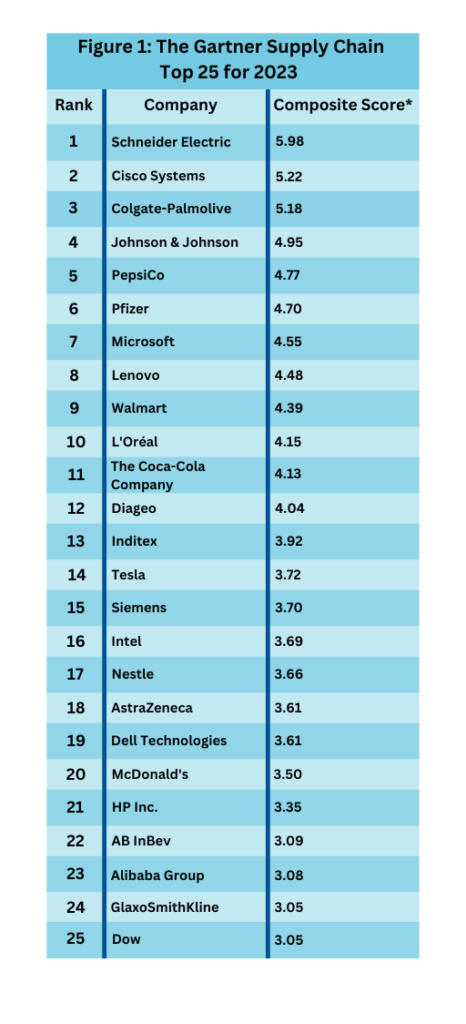

Schneider Electric claimed the top position in the list this year (2023), followed in second place by Cisco Systems, which capped a run of three consecutive years in the top position through 2022. Colgate-Palmolive, Johnson & Johnson (J&J), and PepsiCo rounded out the top five positions. Tesla, AB Inbev, GlaxoSmithKline, and Dow were the new entrants on the list (see Figure 1).

“Schneider Electric’s work embodies multiple trends we see among top supply-chain organizations this year, such as embracing an ecosystem approach that has helped reduce the carbon footprint of some key suppliers by 10% in less than two years,” Griswold said. “Sustainability continues to be front and center for the members of our list, with 19 companies once again achieving perfect ESG scores.”

In addition to J&J, three other bio/pharmaceutical companies made the Top 25: Pfizer (ranked number sixth ), AstraZeneca (number 18th), and GlaxoSmithKline (ranked number 24th) (see Figure 1). Dow, the lone chemical company on the list and a new entrant to the Top 25, was ranked 25th.

Gartner continues to recognize sustained supply-chain performance via the “Masters” category, which was first introduced in 2015. To be considered Masters, companies must have attained top-five composite scores for at least seven out of the last 10 years. Amazon, Apple, Procter & Gamble ,and Unilever all qualified for the Masters category in 2023.

Key characteristics of leading supply-chain organizations

For 2023, the Gartner rankings showed that the Top 25 supply-chain organizations and Masters companies demonstrated three key characteristics as outlined below.

Identifying and capturing new opportunities. The Gartner analysis says that supply-chain leaders strike a balance between driving growth while achieving stability with a heightened focus on risk management amid a volatile economic environment. The study showed that the best supply-chain organizations are positioning themselves as a partner for growth while also seeking to master supply-chain risks.

“The most advanced supply chains are investing in being stronger and more profitable than their competitors in turbulent times,” said Gartner’s Griswold. “An antifragile strategy that supports rapid mitigation and recovery from existing disruptions, as well as the ability to anticipate and avoid future supply risks also provides a platform to exploit new opportunities for growth.”

Driving individual and collective progress. The Gartner analysis of the top supply-chain organizations says that chief supply-chain officers are achieving high-priority objectives by shifting from “one-to-many networks” to “many-to-many ecosystems.” The Gartner study said that these leaders are developing partnering and data-sharing capabilities while shaping mindsets and governance to build enterprise-, platform- and purpose-centric ecosystems.

The ecosystem trend, said the Gartner study in its top rankings, is most evident in areas, including net-zero emissions goals, regenerative agriculture, and supporting living wages throughout an organization’s global supply-chain network. The use cases where these types of many-to-many ecosystems are required for scale and progress will only increase over time, says the firm. A significant challenge looming on the horizon relates to standards for the build-out of nationwide charging grids for electric vehicles.

Transforming the way their organizations work. Among the most mature global supply chains, the term “connected” is being applied to customers, suppliers, partners and their employees and is a key feature of leading supply-chain organizations, according to the Gartner study. Leading organizations, according to the study, are those in which supply-chain leaders are altering the ways employees approach their jobs by leveraging various technology solutions. These allow workers to maintain awareness of their environments through alerts and performance management to boost productivity through physical and logical automation and drive innovation and collaboration with others through connected platforms. Many leading organizations consider the machines working alongside and in support of human workers to be an extension of their workforce. For example, the Gartner study points out that significant investments have been made in developing and automating sensors on factory and warehouse floors over the past few years. Several are using automation, digitalization, and analytics to drive higher efficiency and product quality in these environments.