Generic Drugs: Blockbusters Facing US Patent Expiry

A slate of blockbuster drugs is scheduled to come off patent in the US in the near term. Which products and companies face generic-drug incursion? Plus the latest numbers and trends in US generic drug approvals.

Generics and biosimilars: market potential

The near-term fortunes of the generics and biosimilars sector will largely rest on one of the largest patent cliffs upcoming over the next five years (2022–2026) with a cumulative brand loss by innovators of $188 billion in developed markets, according to IQVIA estimates. The resulting revenue opportunities for the generics and biosimilar sectors are significant: $17 billion for generics and $39 billion for biosimilars for the period 2022–2026, according to IQVIA estimates.

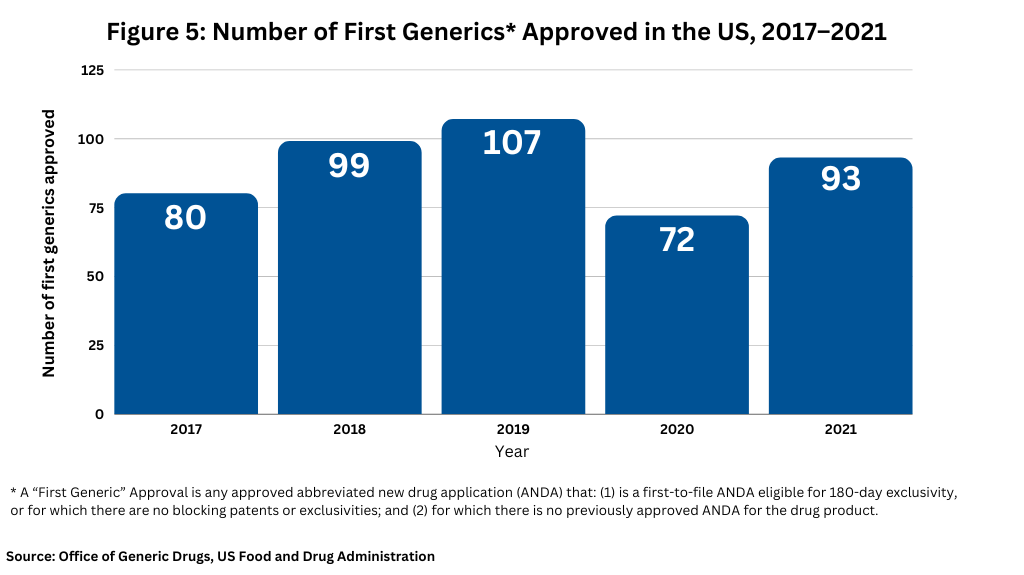

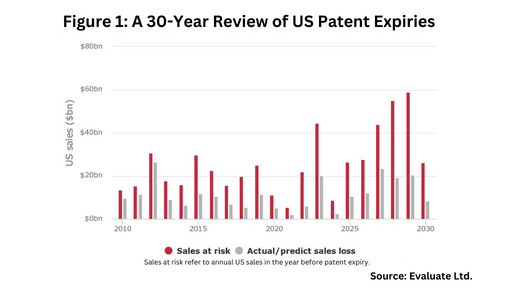

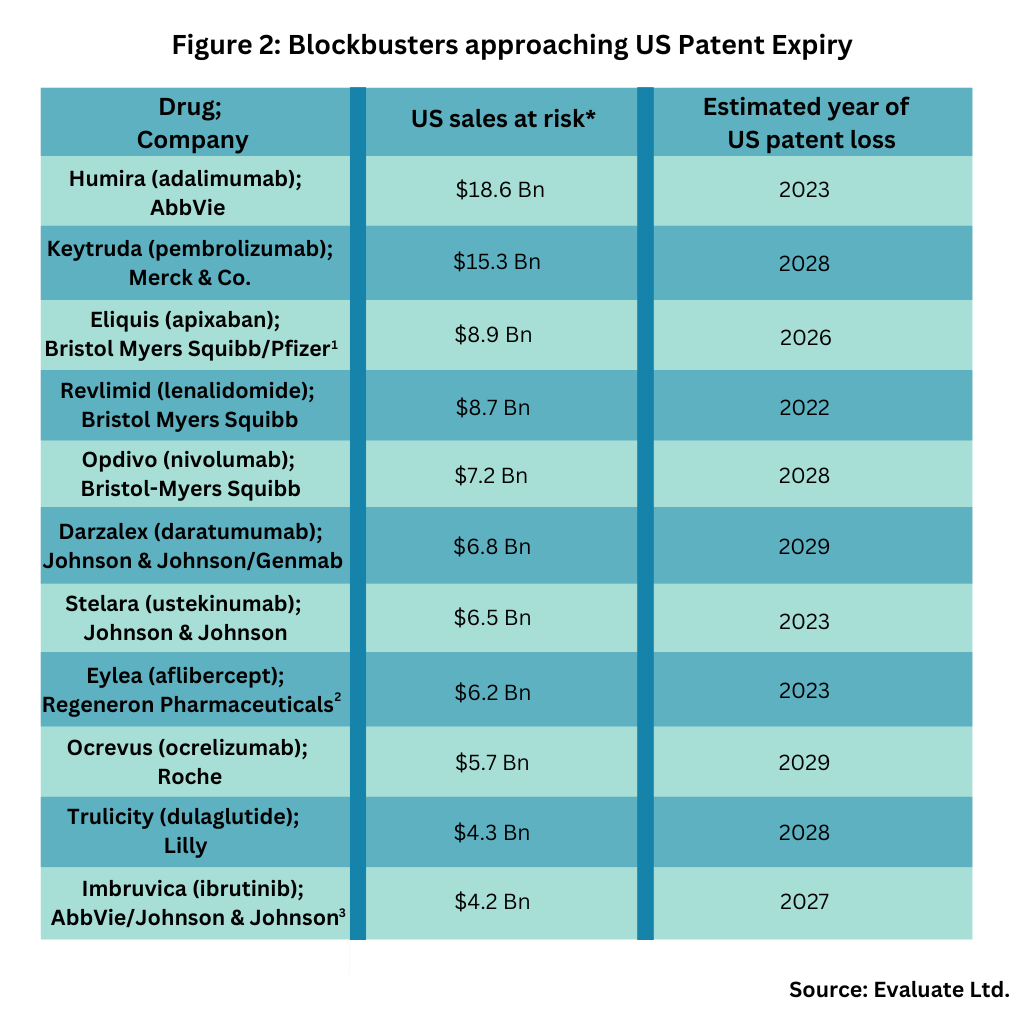

The US market is prime to be large player in this upcoming wave of patent expiries. Figure 1 outlines patent expiries in the US over the past 30 years, showing the strong near-term market opportunity in the US, and Figure 2 outlines key blockbuster products coming off patent in the US in the near term, based on an analysis from Evaluate Ltd.

Key products coming of US patents in the near term include: AbbVie’s Humira (adalimumab), AbbVie’s top-selling product and one of the industry’s top-selling products (indicated for treating multiple diseases: rheumatoid arthritis, plaque psoriasis, ankylosing spondylitis, Crohn’s disease, and ulcerative colitis); Merck & Co.’s immunotherapy for treating multiple cancers, Keytruda (pembrolizumab); and Bristol-Myers Squibb’s (BMS) cancer immunotherapy, Opdivo (nivolumab). BMS is already facing generic-drug incursion in 2022 for Revlimid (lenalidomide), a drug for treating myelodysplastic syndrome, multiple myeloma, and mantle cell lymphoma and will later face generic-drug competition for Eliquis (apixaban), an anticoagulant, for which it is partnered with Pfizer (see Figure 2).

Both AbbVie and Johnson & Johnson (J&J) face near-term generic drug competition for Imbruvica (ibrutinib), a drug for or treating various B cell cancers, including certain forms of lymphoma. J&J is also facing near-term US generic drug incursion for Darzalex (daratumumab), a drug for treating various types of multiple myeloma, and for Stelara (ustekinumab), a drug for treating plaque psoriasis and psoriatic arthritis (see Figure 2).

Other blockbusters facing near-term US patent expiry are: Roche’s Ocrevus (ocrelizumab), a drug for treating certain forms of multiple sclerosis; Eli Lilly and Company’s Trulicity (dulaglutide), a drug to treat Type 2 diabetes; and Regeneron Pharmaceuticals’ Eylea (aflibercept), a drug for treating age-related macular degeneration, macular edema, and diabetic retinopathy. Regeneron is partnered with Bayer for the drug, with Regeneron holding rights in the US and Bayer outside the US (see Figure 2).

1 Bristol-Myers Squibb (BMS) and Pfizer jointly develop and commercialize Eliquis, an anticoagulant discovered by BMS. Pfizer funds between 50% and 60% of all development costs depending on the study. Profits and losses are shared equally on a global basis except in certain countries where Pfizer commercializes Eliquis and pays BMS a sales-based fee.

2 Regeneron Pharmaceuticals has exclusive rights to Eylea in the US. Bayer HealthCare owns the exclusive marketing rights outside the US, where the companies share equally profits. Sales data reflect Regeneron’s share only.

3AbbVie and Johnson & Johnson have a collaboration for Imbruvica, which provides Janssen with an exclusive license to commercialize Imbruvica outside of the US and co-exclusively with AbbVie in the US.

US generic drug approvals

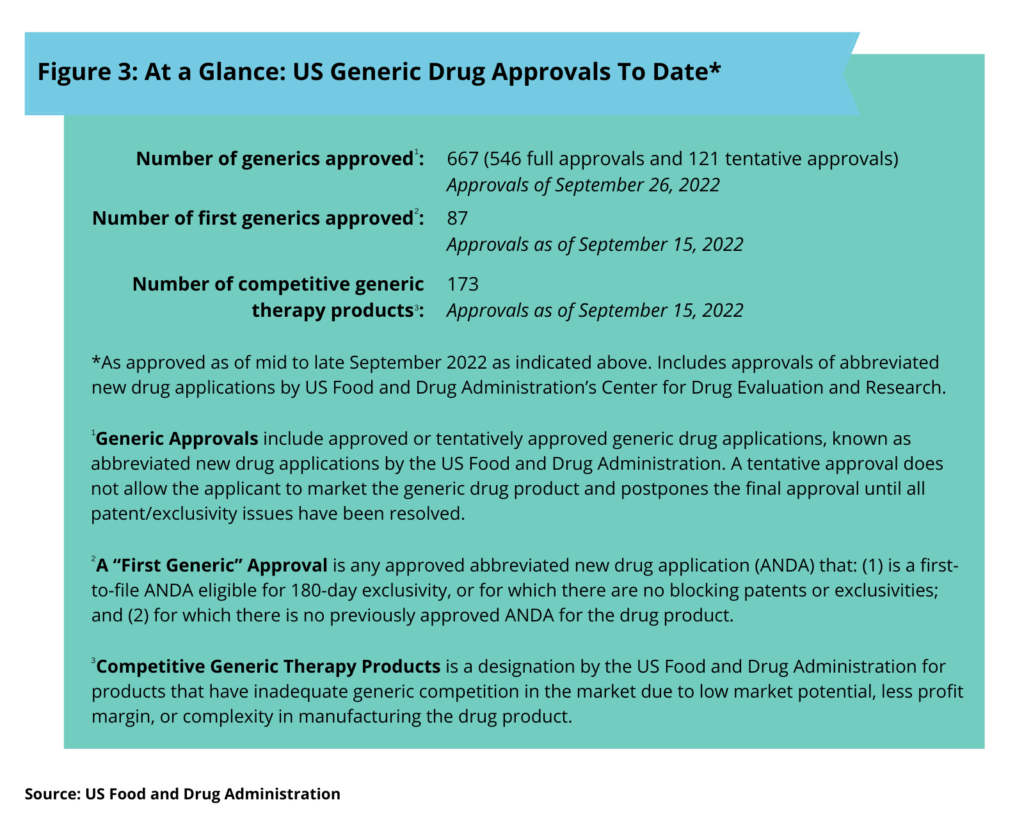

So how are generic drug approvals in the US trending this far in 2022? Thus far in 2022 (as of mid-to late September), the US Food and Drug Administration’s Center for Drug Evaluation and Research had approved 667 generic products, 547 full approvals and 121 tentative approvals (see Figure 3). Generic approvals include approved or tentatively approved generic drug applications. A tentative approval does not allow the applicant to market the generic drug product and postpones the final approval until all patent/exclusivity issues have been resolved.

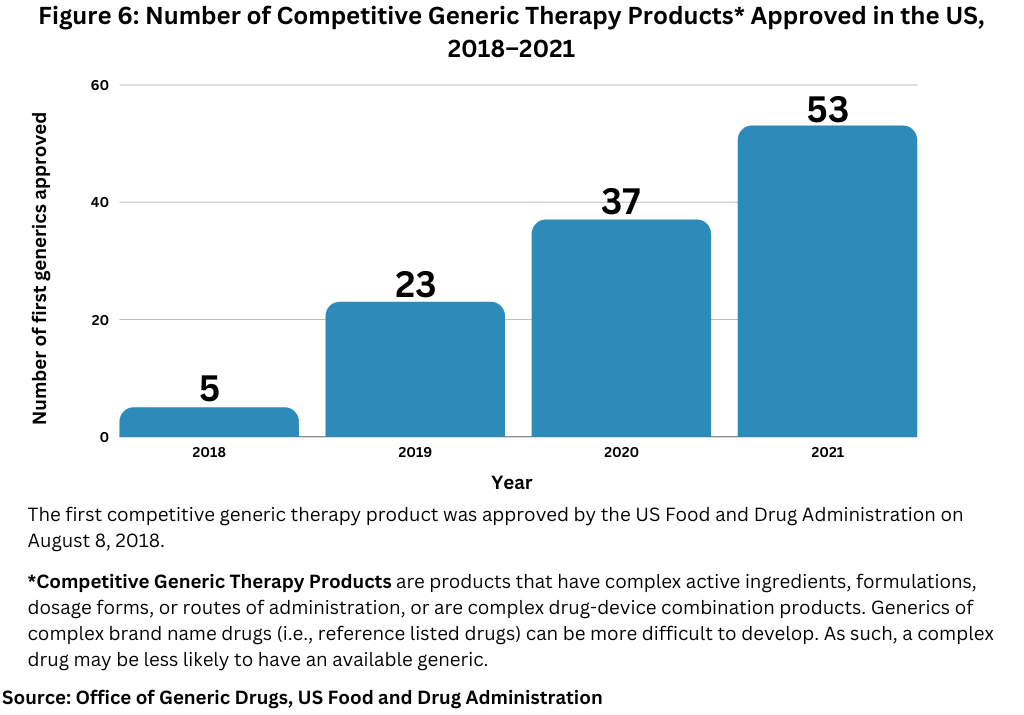

A “first generic” approval is any approved abbreviated new drug application (ANDA) that: (1) is a first-to-file ANDA eligible for 180-day exclusivity, or for which there are no blocking patents or exclusivities; and (2) for which there is no previously approved ANDA for the drug product. The FDA provides priority in reviewing applications of first generic drugs as a means to provide access to needed therapies where no competition previously existed.

A competitive generic therapy products approval is a designation by the FDA for products that have inadequate generic competition in the market due to low market potential, less profit margin, or complexity in manufacturing the drug product. The designation as a “competitive generic therapy product” is a relatively new approval pathway by the FDA to expedite the development and review of a generic drug for products that lack competition. The first competitive generic therapy product was approved in August 2018.

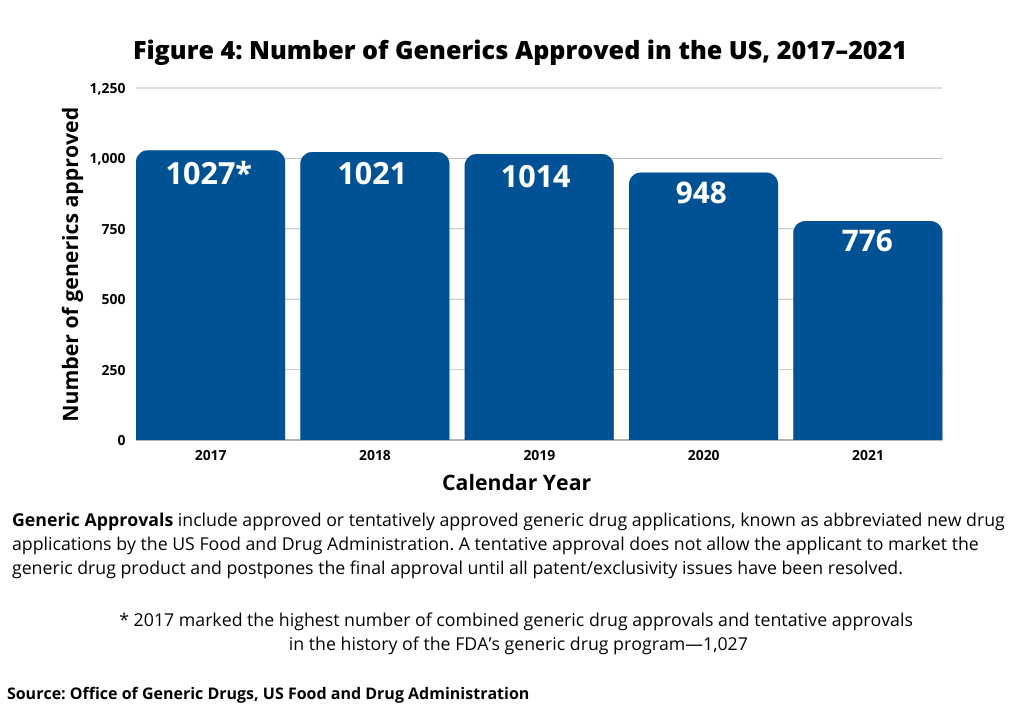

In looking at trends in US generic drug approvals, after reaching a recent high of 1,027 generic-drug approvals in 2017, the largest number of generic drug approvals by the FDA in a single year, the number of generic drug approvals in the US fell to 948 in 2020 and 776 in 2021. Figure 4 below shows the five-year trend in the number of US generic approvals.

Figure 5 and Figure 6 below show the number of approvals for first generics and competitive generic therapy products approved in the US over the past five years.

First generic drugs provide access to needed therapies that treat a wide range of medical conditions and where no competition previously existed. Because of their importance to public health, the FDA prioritizes review of submissions for these products. In 2021, the FDA approved 93 first generic drugs (see Figure 5). Among these approvals, the FDA’s Office of Generic Drugs identified several first-generics that it deemed as significant in 2021. Some of these first-generic approvals included: linaclotide for treating irritable bowel syndrome and chronic idiopathic constipation; apremilast for treating moderate-to-severe plaque psoriasis; enzalutamide for treating prostate cancer; lenalidomide for treating multiple myeloma, anemia, and certain lymphomas; tofacitinib for treating certain types of arthritis and ulcerative colitis; varenicline, a smoking cessation product; linagliptin for treating Type 2 diabetes; and dasatinib for treating chronic myeloid leukemia.

Competitive generic therapy products approvals is also a designation by FDA to encourage generic drug competition for products that have inadequate generic competition in the market due to low market potential, less profit margin, or complexity in manufacturing the drug product. The first competitive generic therapy product was approved in August 2018. The FDA reached a milestone in 2021, when in total, it approved the 100th competitive generic therapy product since the first approval of such a product in 2018. Overall, the FDA approved 53 competitive generic therapy products in 2021, its highest single-year total since the first competitive generic therapy product was approved in 2018 (see Figure 6).