New DCAT Study Examines Business Continuity Planning and Risk Management

A newly released DCAT Research & Benchmarking study details how bio/pharmaceutical companies and suppliers are managing business continuity risks resulting from the COVID-19 pandemic and how lessons learned are affecting their approach to supply-chain risk management overall.

Managing business continuity risks

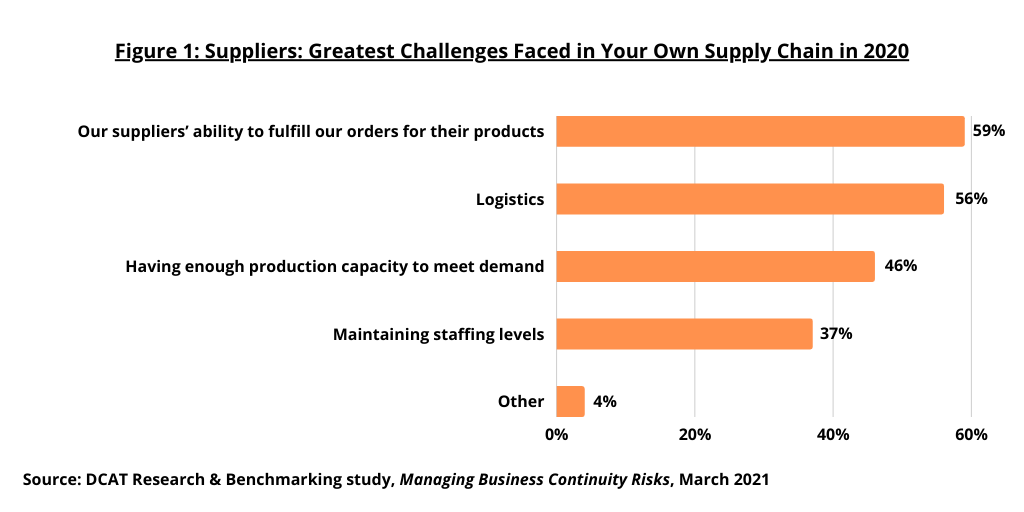

Maintaining business operations in the face of supply-chain disruptions has become a major concern of most bio/pharmaceutical companies and their suppliers. The COVID-19 pandemic is only the latest event, albeit the most severe and extended, to have impacted the global movement of bio/pharmaceutical materials and finished goods over the last decade. More so than previous events, however, it has been especially difficult for supply-chain managers because of its global nature and the way it disrupted operations of manufacturing sites and the shipment of materials and finished products to and from those sites (see Figure 1).

The pandemic has focused attention on the robustness and adequacy of companies’ business continuity plans. A business continuity plan is a set of policies and procedures intended to enable a company to maintain operations during a disruptive event (such as the COVID-19 pandemic) and/or quickly recover operations following a disruptive event. The plans typically address a broad range of events and incorporate a variety of strategies and tactics to prevent or mitigate the impact of supply interruptions on their operations.

Because of its suddenness, longevity, and global nature, the COVID-19 pandemic has tested the effectiveness of business continuity plans. The DCAT Research and Benchmarking Committee, composed of executives from DCAT member companies, determined that harvesting the experience gained and lessons learned about the effectiveness of business continuity plans would be an important contribution to the DCAT membership. The committee developed a 30-question survey tool that was administered to DCAT members in the fourth quarter of 2020. The final report, Managing Business Continuity Risks, has recently been published and details how member companies are managing business continuity risks resulting from the COVID-19 pandemic and how that experience is affecting their approach to supply-chain risk management in general. DCAT will hold a webinar on the survey results on April 27, 2021 from 10:00 AM to 11:00 AM ET. DCAT member companies only can access the full report and register for the webinar. See here for further information.

Effectiveness of business continuity plans

The survey explored separately the business continuity plans (BCPs) companies had for their internal operations and their plans for dealing with suppliers. The survey showed that most responding bio/pharma companies (90%) and suppliers (87%) had BCPs in place for their internal manufacturing operations when the pandemic hit. However, the plans were only somewhat effective: 46% of bio/pharma company respondents and 40% of supplier respondents said their BCPs addressed “most” of the problems they faced as a result of the pandemic, but over 50% of each group indicated that their plans addressed only “some” or “a few” of their challenges.

About two-thirds of bio/pharma and supplier respondents had a BCP to govern supplier relationships; the rest either relied on their staff, or on the suppliers themselves, to monitor and address supply problems. Most respondents indicated that their plans were very or somewhat effective.

The shortcomings in BCPs partly reflects the unique nature of the pandemic. It has been a long-lasting event impacting the entire global supply chain, but most BCPs were developed in anticipation of localized events of relatively short-term duration such as labor disputes and weather events. To address the shortcomings, the majority of respondents have been making changes to their BCPs while most companies that did not have BCPs have initiated efforts to put them in place.

Only about half of bio/pharma and supplier respondents required their suppliers to have a BCP, but in the aftermath of COVID, most expect to do so in the future. Of those requiring their suppliers to have BCPs, the requirement in most cases extended only to their Tier 1 (immediate) suppliers and not farther down in their supply chains (i.e., suppliers to their suppliers). Even if they don’t require formal BCPs, three-quarters of bio/pharma companies expect their suppliers to have contingency plans specific to the materials they buy from those suppliers.

Bio/pharma and supplier companies use annual performance reviews to get updated on their suppliers’ BCPs. Suppliers are more likely than bio/pharma companies to get BCP information as part of their vendor selection or due-diligence procedures (Committee members were surprised about this). Nearly a quarter of respondents did not routinely collect information on supplier BCPs.

There is a global standard for business continuity planning, ISO 22301, but the majority of bio/pharma and supplier respondents were not aware of it. Still, about a quarter of bio/pharma companies required their suppliers to be in compliance with ISO 22301.

Monitoring suppliers

Monitoring of suppliers’ ability to fulfill customer requirements has increased. Among bio/pharma respondents, 60% said they are asking for more information from their suppliers than they did pre-pandemic while two-thirds of suppliers are demanding more information from their own suppliers. Most suppliers reported that business continuity and supply-chain security discussions have become a regular part of customer meetings.

Most bio/pharma and supplier companies charge staff with monitoring supply risks as part of their regular responsibilities, but bio/pharma companies are more likely to use additional resources to monitor supplier risks. Those additional resources include dedicated risk-management staff, credit bureaus, and market intelligence services. About one quarter of suppliers rely on self-reporting from their own suppliers.

More companies are monitoring conditions deeper in their supply chains, but that practice is not yet widespread. Among bio/pharma company respondents, 40% indicated they are monitoring developments at their Tier 2 suppliers (i.e., the suppliers to their direct suppliers), but 60% remain focused just on their Tier 1 (direct) suppliers. Forty percent (40%) of supplier companies reported that their customers had engaged directly with at least a few of their Tier 2 suppliers. Among supplier companies, 70% are monitoring only their direct suppliers while a quarter are going below that.

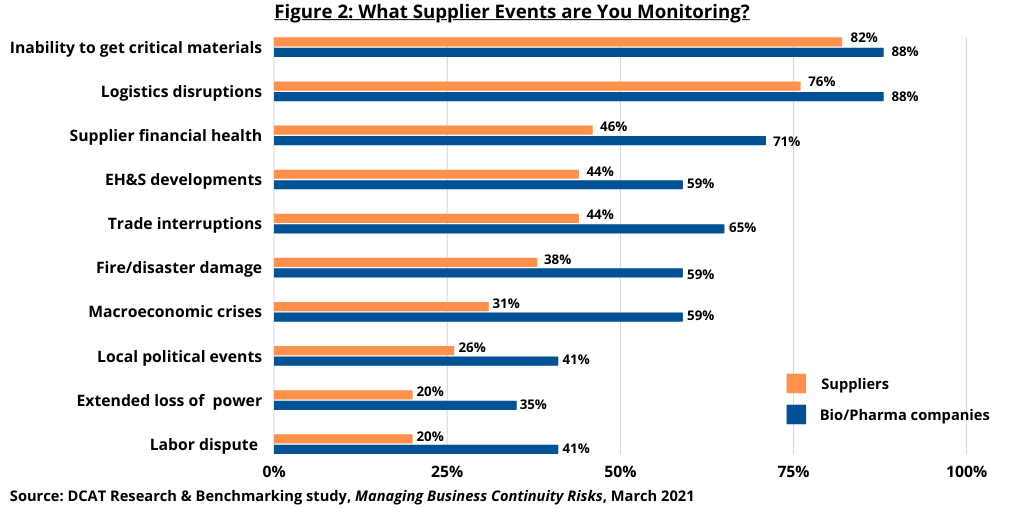

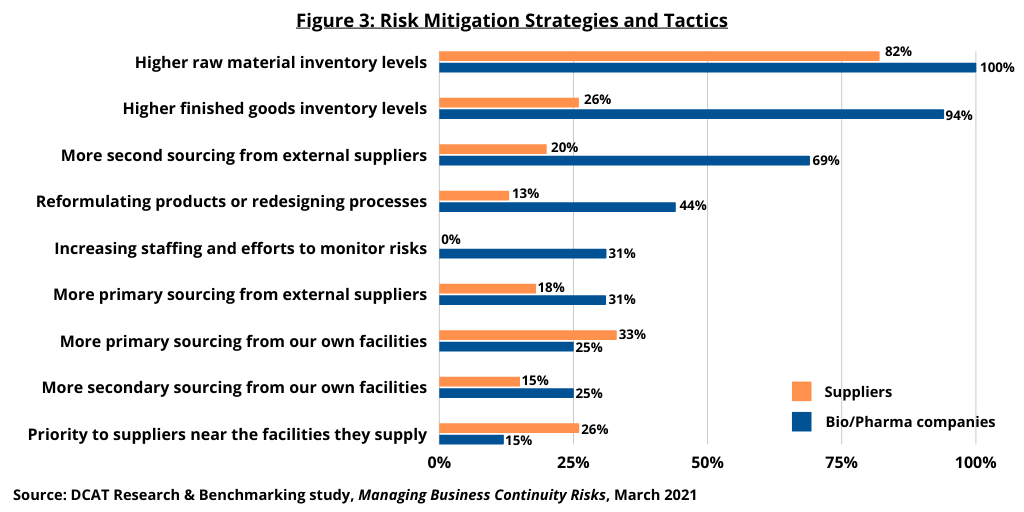

Both bio/pharma and supplier companies are overwhelmingly focused on their suppliers’ level of safety stocks for key materials and on their capacity to increase production of those materials. Environmental mediation plans were a distant third-place concern. Bio/pharma companies were also asking their suppliers to identify their sources of critical materials. Both bio/pharma companies and supplier companies actively monitor a broad array of events that could threaten their supply chains (see Figures 2 and 3 above).