Fine Chemicals: Which CDMOs/CMOs Are Expanding?

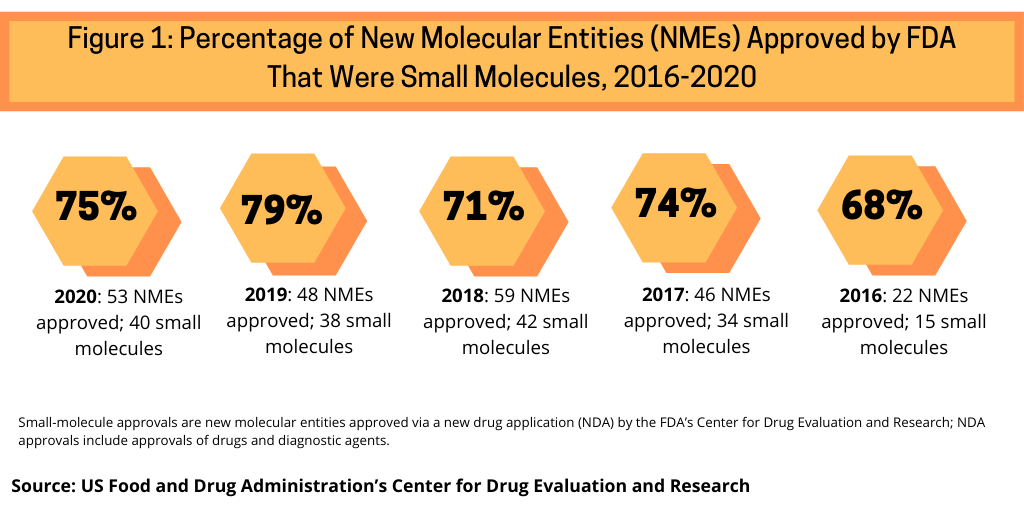

Small molecules continue to dominate new drug approvals, accounting for three-fourths of new molecular entities approved by the FDA in 2020, on par with recent years. What’s the impact for CDMOs/CMOs? The latest expansion activity announced in 2020 and 2021 to date.

New drug approvals and small molecules

Although biologics and small molecules are in near parity in early-stage drug development, small molecules continue to dominate in new drug approvals. In 2020, the US Food and Drug Administration’s Center for Drug Evaluation and Research approved 53 new molecular entities (NMEs), of which 40, or 75%, were small molecules (see Figure 1). This continues a recent trend of having approximately three-fourths of NME approvals be small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71%, 74% in 2017, and 68% in 2016, when a recent low of 22 NMEs were approved (see Figure 1).

CDMOs/CMOs expand in fine chemicals

Expansion activity of CDMOs and CMOs for active pharmaceutical ingredients (APIs) and intermediates proceeded at a measured pace in 2020 and 2021 to date. Investments have included expansions in high-potency active pharmaceutical ingredient (HPAPI) development and manufacturing, peptide synthesis, flow chemistry, and overall API development and manufacturing. Highlights of expansions, announced in 2020 and in 2021 to date, are outlined below.

Cambrex. In November (November 2020), Cambrex announced plans to invest more than $50 million to expand its mid-scale and large-scale API manufacturing capacity at its site in Charles City, Iowa. The expansion, which is slated to be operational in early 2022, will add three large-scale manufacturing work centers and one mid-scale work center to increase the site’s capacity by 30%. The investment is the company’s sixth major investment at the site in the past eight years, which included prior investments in mid- to large-scale API manufacturing and high-potency manufacturing.

In addition, in July (July 2020), Cambrex reported that it is investing $3.6 million at its Karlskoga, Sweden facility to increase drug-substance manufacturing capacity. The expansion, which will convert a previously customer-dedicated manufacturing train, will include an additional production line at 6-m³ scale to result in a 25% capacity increase at the facility. Engineering work was scheduled to be completed by November 2020. Cambrex’s site in Karlskoga has four pilot plants and five full-scale commercial production units. In 2019, a new 600-m2 process and analytical development facility was added to the site, along with a 3,000-m2 logistics center.

Also, in 2020, Cambrex completed an expansion of its solid-form screening and crystallization process-development facility in Edinburgh, Scotland. The expansion doubled the facility’s total footprint to 15,000 square feet, refurbished existing laboratory space, and added an additional 3,500 square feet of laboratory space.

Piramal Pharma Solutions. In December (December 2020), Piramal Pharma Solutions (PPS), a CDMO of APIs and drug products, announced it is investing approximately $32 million to expand its facility in Riverview, Michigan with additional capacity for API development and manufacturing. The expansion will consist of more than 25,000 square feet, which includes 8,500 square feet of production space. Capacity will increase in large-scale manufacturing with the addition of new reactors capable of handling up to 4,000 L. PPS is also adding two new kilo labs for process development and manufacture for clinical trials at scales up to 100 L as well as new equipment that is designed to handle potent compounds. The expansion is planned to be ready beginning in the summer of 2022 and is expected to add approximately 20 new hires to the site, which would bring the total headcount at the site to more than 180 employees.

In addition, early last year (January 2020), PPS announced an investment of CAD$25 million ($19 million) to expand its facility in Aurora, Ontario, Canada with the addition of 10,500 square feet of manufacturing space in a new wing for API manufacturing overall and including HPAPI manufacturing, two new reactor suites as well as a dedicated filter dryer room and a portable filter dryer. The expansion is expected to be completed and operational in 2021.

Seqens. In November (November 2020), Seqens announced an investment of EUR 65 million ($77 million) to increase capacity and implement new technologies at five sites in France: its R&D center and four production sites for APIs and intermediates. The investment is supporting the supply of drug substances for essential medicines in France as part of a plan by the French government to fortify its supply chains in response to the COVID-19 pandemic.

In September (September 2020), Seqens inaugurated a HPAPI manufacturing unit at its site in Villeneuve-La-Garenne, France with an investment of EUR 30 million ($35 million). Also, in 2020, the company announced investments in flow chemistry through the addition of a new GMP pilot plant at its R&D center in Porcheville, France. Seqens is also increasing production of isopropanol, a solvent used in the production of intermediates and APIs with a new unit in Isere, France. The new isopropanol unit will have a capacity of 45,000 tons for domestic production and is scheduled to come on stream early in 2022.

MilliporeSigma. Last September (September 2020), MilliporeSigma announced a $65-million expansion of its HPAPI and antibody drug conjugate (ADC) manufacturing capabilities and capacity at its facility near Madison, Wisconsin that will allow for large-scale manufacturing of potent compounds. The new 70,000-square-foot commercial building is designed to handle single-digit nanogram occupational exposure limit materials. The facility will incorporate containment areas to produce linker and payload materials for ADCs. The facility will join the company’s facility in St. Louis, Missouri, which specializes in ADC bio-conjugation, APIs, excipient, and adjuvants manufacturing. Completion is expected by mid-2022.

Carbogen Amcis. Carbogen Amcis, a Bubendorf, Switzerland-based CDMO of APIs and drug products, announced plans in 2020 (August 2020) for a new API manufacturing facility in Hunzenschwil, Switzerland. The project is slated to begin in 2021 and will progress in several phases with the new facility expected to be operational by the summer 2024. In addition to the new Swiss API manufacturing facility, additional investments are planned to improve some existing technologies and to increase capacity of the company’s current Swiss sites, such as adding chromatography equipment, new reactors in production, and new laboratories.

CordenPharma. . In November (November 2020), CordenPharma announced plans to further invest in capacity and technology for peptide manufacturing at its site in Colorado, CordenPharma Colorado. Earlier in 2020, the company completed an expansion of its solid-phase peptide synthesis (SPPS) manufacturing capacity with the addition of an extra-large 3,000-L SPPS vessel. The company plans to invest in new manufacturing techniques to improve the productivity of its peptide assets, in particular through the deployment of process analytical technology (PAT). In addition, a long-term expansion initiative was approved. Under the first phase of the expansion, customized automated synthesizer production lines will be installed to support GMP manufacturing. This infrastructure will further strengthen existing peptide manufacturing in the low- to mid-kg scale range and complement current large-scale manufacturing capabilities at CordenPharma Colorado. Also in 2020, CordenPharma announced plans to expand its SSPS manufacturing capacity at its Center of Excellence for Peptide Process Development and non-GMP manufacturing site in Frankfurt, Germany. Along with increasing available lab space by 25%, a dedicated explosion-proof area will be added, which is supported by a tailored tank farm to allow for the introduction of regular solvents, as well as compatibility with green peptide manufacturing. The expanded peptide manufacturing, explosion-proof area and tank farm will be available starting in the third quarter of 2021.

In addition, in October (October 2020), CordenPharma completed the addition of a new HPAPI laboratory at its facility in Boulder, Colorado. The new laboratory is capable of handling highly potent compounds with an occupational exposure limit as low as 1 ng/m3. The company provides development and manufacturing services of HPAPIs from clinical to commercial scale.

Evonik. In May (May 2020), Evonik reported that it is investing EUR 25 million ($27 million) to expand its facilities in Dossenheim and Hanau, Germany to support contract manufacturing of APIs and advanced intermediates. The first stage of the expansion project is scheduled to be completed by the middle of 2021, with the entire project expected to be finalized prior to 2024. The company says that the expansion will support complex API projects, such as those associated with oncological, antiviral, and other specialized drug products and that typically require a range of advanced technologies, including continuous processing, pegylation, catalysis, and cryogenic chemistry.

Recipharm. In 2020, Recipharm, a CDMO of APIs and drug products, completed its £505 million ($629 million) acquisition of Consort Medical, a CDMO of APIs, drug products, and drug devices. Consort Medical was the parent company of Aesica, a CDMO of APIs and drug products, and Bespak, a CDMO of drug devices. In addition, in December 2020, Recipharm announced that it will invest $2.5 million to expand clinical GMP capacity for APIs at its facility in Israel, which will include the investment of a full chemical unit, including a number of new R&D laboratories and technologies. The expansion is expected to be fully operative by the end of 2021.

Regis Technologies. This month (February 2021), Regis Technologies announced the completion of a expansion of its laboratory facilities in Morton Grove, Illinois for API development. The expansion, which doubles the company’s capacity to take on new development projects, is now fully operational. The new 9,000-square-foot expansion includes additional process chemistry and analytical laboratories, a dedicated ICP-MS suite, additional climate-controlled storage, 14 additional fume hoods, several new kilo-scale reactors, and process safety equipment for reaction calorimetry measurements to ensure safe control and scale-up. In addition, the new laboratories have an advanced variable air volume air system for clean energy-efficient operations.

Ajinomoto Bio-Pharma Services. Ajinomoto Bio-Pharma Services, a CDMO of small- and large-molecule APIs and drug products, is expanding its small-molecule manufacturing capabilities with the addition of a new production facility in Visakhapatnam, India. Construction of the 8,500-square-meter facility began at the end of July 2020 and is expected to be completed by mid-2022. The new small-molecule manufacturing facility doubles the production capacity at the site to 310 cubic meters for APIs and intermediates and has dedicated equipment to manage Occupational Exposure Band Level 4 high-potency ingredients.

Sterling Pharma. In late September 2020, Sterling Pharma Solutions, a Dudley, UK-based CDMO of small-molecule APIs and intermediates, acquired a small-molecule API manufacturing facility in Germantown, Wisconsin from Alcami, a CDMO. The new facility bolstered Sterling’s US presence. The acquisition followed other recent investments by Sterling totaling $46 million, which included a $1.5-million investment into the company’s facility in North Carolina.

In addition, in December (December 2020), Sterling formed a strategic partnership with ADC Biotechnology (ADC Bio), a Chester, UK-based CDMO of antibody drug conjugates (ADCs), with the intent to acquire ADC Bio. Under the partnership, Sterling will make an investment in ADC Bio with a view to acquiring ADC Bio in the first quarter of 2021, subject to due diligence. The partnership/potential acquisition combines Sterling’s small-molecule expertise with ADC Bio’s bio-conjugation capabilities.

Lonza. In December (December 2020), Lonza announced a long-term, strategic collaboration for bioconjugation with an undisclosed biopharma company for the commercialization of antibody-drug conjugates (ADCs) at its site in Visp, Switzerland. Under the agreement, Lonza will construct two bioconjugation suites totaling 1,500 m2 of active manufacturing space within a pre-existing shell. The high throughput bioconjugation suites will be capable of handling highly-potent materials for cancer therapies and will initially manufacture two therapies. The new dedicated facility will employ around 200 staff, with operations expected to start from the end of 2022.

In addition, in November (November 2020), Lonza opened the first of two manufacturing suites for ADC drug-linker (payload) manufacturing at its site in Visp, Switzerland. The first manufacturing suite handles compounds with occupational exposure levels down to 1ng/m3 and is dedicated to the manufacturing platform for ADC drug linkers. The suite began operations in March 2020. A second suite is slated to be operational in 2021 for HPAPI and payload development and manufacturing programs.

Novasep. Novasep is investing EUR 6.5 million ($7.7 million) to expand capacity and increase flexibility in an API manufacturing workshop at its site in Chasse-sur-Rhône, France. The revamping of this workshop and installation of two new synthesis reactors (4,000-L Hastelloy & 1,600-L glass-lined) is intended to increase plant flexibility and capacity for low- to medium-volume APIs. The project also involves repositioning a high-pressure hydrogenation reactor, currently located in the workshop, in a new dedicated area. The project is scheduled to be fully operational by the end of 2021.

Helsinn. In late July (July 2020), Helsinn Advanced Synthesis, a CDMO of APIs, advanced intermediates, HPAPIs, and anticancer compounds, opened a dedicated anti-cancer bay at its manufacturing plant in Biasca, Switzerland. The new bay is used for the development, analysis, and manufacturing of clinical and commercial anticancer APIs.

WuXi STA. In 2020, WuXi STA, a subsidiary of WuXi AppTec, opened a large-scale oligonucleotide API manufacturing facility in Changzhou, China. This facility supports the process R&D and manufacture of oligonucleotide APIs from preclinical to commercial. The new facility, with over 30,000 square feet, is located at WuXi STA’s Changzhou, China site. With its operation, the Changzhou site can manufacture oligonucleotide APIs up to a 1 mol/synthesis run. The Changzhou site provides services involving small-molecule, oligonucleotide and peptide process R&D and manufacturing from laboratory to commercial scales.

In addition, the company opened in the first quarter of 2020 an HPAPI facility at its site in Changzhou, China, its second HPAPI facility. WuXi STA’s first HPAPI facility, located at its Shanghai Jinshan site in China, supports process R&D and kilo-scale production. The newly added HPAPI facility in Changzhou includes HPAPI labs and a pilot plant (250-L–1,000-L reactors) capable of handling APIs with occupational exposure limits down to 0.05 µg/m3.

In the peptide field, the company is adding a new large-scale (up to 1,000-L synthesizer) production plant in Changzhou, China. The expansion provides the company with an integrated peptide API platform from preclinical to commercial scales.

Biocon. Biocon announced in 2020 that it is investing $100 million in a new fermentation production facility for drug substances and intermediates in Visakhapatnam, India. The facility will be the company’s third fermentation production facility and is scheduled to be commissioned by the end of 2021. The company’s existing fermentation production facilities are in Bangalore, India. With its $100-million investment for a greenfield fermentation production facility in Visakhapatnam, Biocon will be able to provide large-scale capacities from multiple sites (Bangalore and Visakhapatnam) for complex fermentation products.

Asymchem. Asymchem, a Morrisville, North Carolina-based CDMO announced in 2020 an investment in Snapdragon Chemistry, a Waltham, Massachusetts-headquartered provider of flow-chemistry process design and technology development services, to provide funding to Snapdragon for it to complete its expansion plan to build cGMP drug-substance manufacturing suites. Asymchem led the investment round along with participation from Snapdragon’s previous investors.

Sai Life Sciences. Sai Life Sciences, a Hyderabad, India-headquartered CDMO of intermediates and APIs and discovery chemistry services, announced late last month (January 2021) plans to expand its API development and manufacturing at its Manchester, UK site. The expansion involves an increase in capacity from 20 to 75 fume cupboards and an increase in employees from 24 to 50-plus scientists. A further expansion will see the addition of a GMP kilo lab later in 2021.

In addition, in August (August 2020), the company opened a new research and technology center in Hyderabad. The new 83,000-square-foot facility houses research capabilities and advanced technology platforms. It has 24 chemistry labs with 250 fume hoods, analytical labs, a fully equipped technology suite, and a dedicated process safety lab. The new center is part of a $150-million multi-year investment initiative by the company to expand and upgrade its R&D and manufacturing facilities, add scientific and leadership talent, and strengthen automation and data systems.

Flamma. In 2020, Flamma SpA, a CDMO of small-molecule APIs, started construction for a new R&D building at the company’s headquarters in Chignolo d’Isola, Bergamo, Italy. The expansion will quadruple its R&D space. The R&D building will accommodate 50 additional employees and additional R&D and analytical development laboratories as well as offices and meeting rooms. In addition to these features, there will be a lab for high containment and specialized chemistries. The new R&D building in Italy will serve as a complement to the R&D work being done at Flamma USA in Malvern, Pennsylvania, located outside of Philadelphia.

Almac. Almac Sciences, part of the Almac Group, a Craigavon, UK-based CDMO, reported earlier this year (January 2021) that it had secured £2 million ($2.7 million) of support from Invest Northern Ireland (INI), Northern Ireland’s regional economic development agency, to accelerate a program of biocatalysis/enzyme research. The new funding will further develop a program to establish in silico-informed metaGenomic Harvesting Technology (INSIGHT), a platform built from multi-disciplinary research of computational, metagenomics, biology, and chemistry methodologies. The project aims to improve the enzyme-discovery process to allow more robust enzymes to supersede multi-step chemical routes currently used to produce pharmaceutical intermediates and products. The project involves the development of an enzyme identification platform based around Almac’s existing metagenomic data mining using enzyme modelling/engineered lead diversity screening.

Onyx Scientific. In 2020, Onyx Scientific announced an investment to expand its UK facility for a commercial API license. As part of the initiative, Onyx invested to implement quality-by-design and design-of-experiments principles into its API development and manufacturing practices. The company will also expand its team of scientists as well as its analytical and quality assurance teams. Following license approval, its UK facility will have the capacity to manufacture low volumes of drug substance, particularly for orphan drugs. This new service will complement Onyx’s facilities in North Carolina and India, which offer larger-scale manufacturing.

AGC Pharma Chemicals. AGC, a manufacturer of glass, chemicals and high-tech materials, announced in April (April 2020) plans to expand facilities at its pharmaceuticals CDMO business subsidiary, AGC Pharma Chemicals Europe, headquartered in Spain. The expansion will upgrade existing production facilities to 1.3 times the capacity of current production levels and establish a new micronization facility for APIs. In addition, a new R&D facility will be built to enable development of processes from lab scale to commercial production. The new R&D facility is scheduled to begin operation in March 2021 while the expanded facility is scheduled to begin operations in May 2022. AGC Pharma Chemicals Europe, a synthetic pharmaceutical CDMO, was acquired from Boehringer Ingelheim in March 2019 to establish synthetic pharmaceutical production capability in Europe for the supply of APIs and intermediates. In October 2019, the name was changed from Malgrat Pharma Chemicals to its current name, AGC Pharma Chemicals Europe.

Dipharma. In 2020, Dipharma reported that it had completed a new cGMP quality control laboratory and cGMP kilolab at its site in Kalamazoo, Michigan. The new cGMP manufacturing suite offers a range of services for molecules from preclinical to the commercial stage. With the construction of the new kilolab, Dipharma has cGMP capability at its US subsidiary, Kalexsyn.

PharmaBlock Sciences. In 2020, PharmaBlock Sciences (Nanjing), a provider of chemistry products and services for pharmaceutical R&D and commercial production, launched a Chemistry and Engineering Technology Center (CETC) in Shangyu, Zhejiang Province, China. The CETC, located next to its Zhejiang GMP manufacturing site, covers an area of 32,300 ft2 and represents an investment of $8 million. The CETC is focused on flow chemistry, micropacked bed reactions, biocatalysis, and engineering technologies, including separation, crystallization, and the application of differential scanning calorimetry, and process simulation. Among these technologies, PharmaBlock is focusing on the application of micropacked bed in flow hydrogenation, which may be applied at lab scale, but also in pilot and manufacturing scale at PharmaBlock, with a daily output of 100 kg to 1,000 kg.