A Brexit Deal or No Deal and the Pharma Industry

The UK and the European Union (EU) are resuming negotiations this week (September 29 to October 2, 2020) for a deal that would define the UK’s future relationship with the EU post Brexit. As the clock winds down to reach a deal or not, the pharma industry is asking that the EU and the UK to prioritize medicines in trade talks, including measures for manufacturing. What is the industry seeking?

UK and EU negotiations

The EU and the UK are coming to the table once again to reach common ground for a deal that would define the UK’s future relationship with the EU as the UK nears the end of a transition period to reach such a deal. After a multi-year process to exit the EU, the UK officially exited the EU earlier this year on January 31, 2020 and entered into a 11-month transition period until the end of 2020 to work out or not its future relationship with the EU. During the transition period, EU law and rules are still applicable across the UK, and the UK remains part of the EU single market and custom union until the end of the year (2020).

But how the UK will leave the EU is the question both parties are now facing. The UK will formally exit the EU in all ways by the end of the transition period on December 31, 2020, but it has yet to be seen if the EU and the UK will be able to work out a new trade deal. Earlier this month (September 2020), UK Prime Minister Boris Johnson said that both parties will have to come to an agreement by mid-October to move forward with a deal; if no consensus is made, Johnson says the UK will leave the EU without a deal defining its future relationship with the EU.

The final scheduled round of negotiations between the EU and UK began this week (September 28 to October 2, 2020) in Brussels. This latest round of negotiations is considered crucial to meet the self-imposed deadline of October 15 for reaching a deal, which coincides with an October 15–October 16, 2020 meeting of the European Council, which consists of heads of state or government of EU countries, the President of the European Council, and the President of the European Commission. That mid-October deadline, although asserted by the UK Prime Minister to be the deadline for reaching a trade deal, may be pushed out further. Michel Barnier, the EU negotiator, said in comments made earlier this month (September 2020) that the end of October (October 2020) is a strict deadline that would give EU member states, the European Parliament, and the European Council enough time to sign off on a deal. “We must have a final agreement by the end of October if we are to have a new partnership in place by 1 January 2021,” said Barnier in a September 2, 2020 statement. “As I have already explained, this is the only way to give enough time to the European Parliament and the Council to have their say. This is a legal and democratic necessity. Everyone, everywhere must be realistic about this strict deadline.”

The groundwork for the negotiations between the EU and UK took an uncertain turn, however, when the UK’s House of Commons passed legislation, the UK Internal Market Bill, this week (September 29, 2020), which provides authority for the UK government to override parts of the Withdrawal Agreement signed between the EU and UK earlier this year (2020). Critics charge that the bill violates international law by overriding part of the Withdrawal Agreement and puts into question the viability of a potential deal between the UK and the EU. Others assert the legislation is needed to protect free trade with Northern Ireland and will only be used if talks on a border solution with the EU fail. The bill is still subject to approval by the UK’s other house of parliament, the House of Lords, where it has less support and would likely not be considered until later this year (2020).

The passage of the bill, even though thus far by only one house of parliament, puts a mark on how a key part of the negotiations between the UK and EU will proceed with respect to the Northern Ireland Protocol and how it will be interpreted and further defined through a final deal between both parties. The Northern Ireland Protocol, which was negotiated by UK Prime Minister Boris Johnson as part of the Withdrawal Agreement, would come into effect on January 1, 2021. It is designed to prevent a so-called “hard border” between Northern Ireland, a non-EU country, and Ireland, an EU country, by keeping Northern Ireland subject to the EU’s custom rules and single market for goods. Products entering Northern Ireland from the UK would be subject to checks and controls, but what those checks would be is a point of negotiation between the EU and the UK and has become a point of strong debate in the current round of negotiations.

What the pharma industry is seeking in a Brexit deal

During the multi-year process of trying to secure a deal between the EU and UK in the UK’s exit from the EU, the pharmaceutical industry in the UK and the EU have supported a trade deal between the parties as a means to ensure the supply of medicines in the UK and EU and that position continues today. Earlier this week (September 28, 2020), the Association of the British Pharmaceutical Industry (ABPI), which represents innovator, research-based pharmaceutical companies in the UK, and the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents national pharmaceutical associations and innovator, research-based pharmaceutical companies in Europe, issued a joint statement calling on the UK government and the European Commission to prioritize medicines in trade talks as a means to ensure the supply of medicines and to continue to realize opportunities in research and development.

“Industry trade bodies ABPI and EFPIA have always been clear that, despite preparing for all outcomes, getting a comprehensive trade deal is the best outcome for the UK and EU,” said the ABPI and the EFPIA in their joint statement. “With time running short, there is an urgent need for technical agreements now which are essential for both sides…[W]ith just 15 weeks to go until the end of the Brexit transition period, and despite guidance from both sides, companies are working in the dark on some critical issues around regulation of medicines, supply and how countries will work together to identify and share medicines safety issues and alerts.”

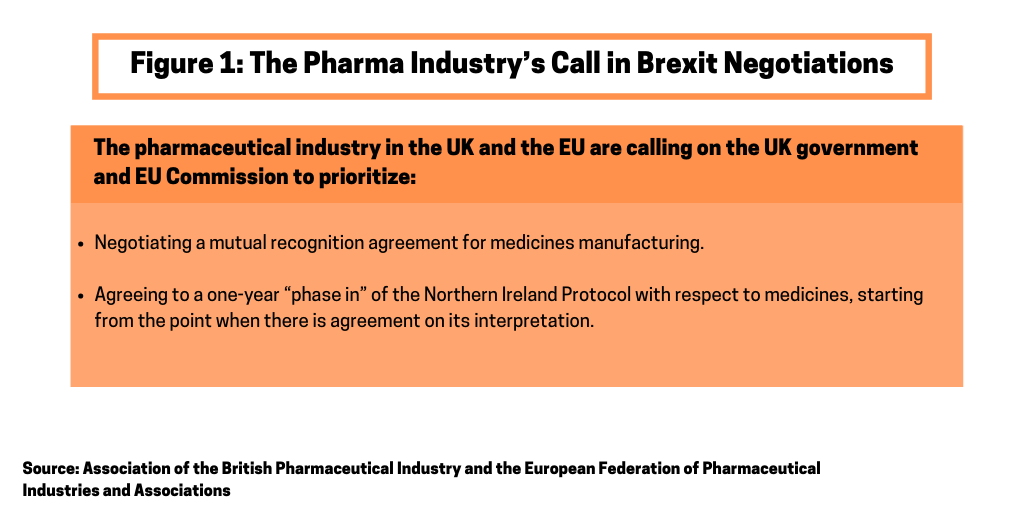

Specifically, the UK and EU pharmaceutical industry is calling on the UK government and European Commission to prioritize two key actions in their trade talks: (1) negotiating a mutual recognition agreement for medicines manufacturing; and (2) agreeing to a one-year phase-in of the Northern Ireland Protocol with respect to medicines, starting from the point when there is agreement on its interpretation (see Figure 1).

A mutual recognition agreement for medicines manufacturing

The ABPI and the EFPIA are calling for a mutual recognition agreement (MRA) for medicines manufacturing as part of any final deal that may be reached between the UK and the EU. They cite the high volume of trade between the UK and the UK for medicines and higher costs for testing and delays in medicines supply if a MRA is not secured. Each month, 45 million packs of medicines move from the UK to the EU, and 37 million packs move from the EU to the UK. “Without a technical agreement in the form of a Mutual Recognition Agreement, when the medicine arrives in the EU, it would be then re-tested, adding cost and delay in reaching patients,” said the ABPI and the EFPIA in their joint statement.

They say that a MRA on good manufacturing practice (GMP), including batch release and testing, would see both sides accept each other’s tests and inspections—as they do now—and avoid the introduction of unnecessary duplications. They assert that failing to agree to this as soon as possible and before the end of the transition period, which ends on December 31, 2020, could mean introducing a delay of around four to six weeks to the supply of medicines as they are re-tested.

The ABPI and the EFPIA also point out that MRAs are often signed outside of trade agreements. “Doing so means that, should a comprehensive trade deal not be reached, negotiators will still have a clear way forward to remove significant risk to medicines supply in January [January 2021],” they pointed out in their joint statement.

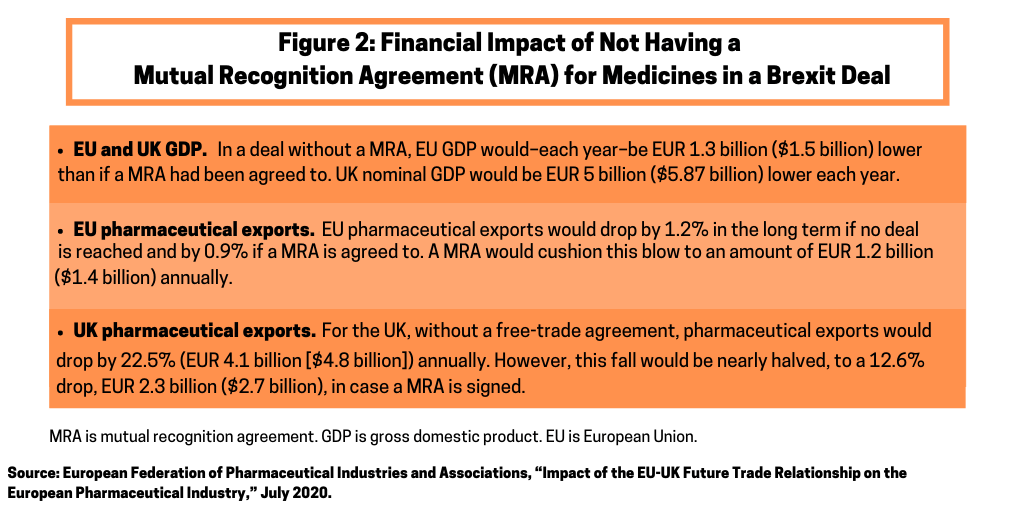

The parties also point out the negative economic impact to both the UK and EU if a MRA is not reached (See Figure 2) before the end of the transition period. They say that not agreeing to a MRA would see companies being forced to undertake duplicative processes, such as testing operations in both the UK and the EU, and could encourage companies to look outside the UK and EU to locate new R&D and manufacturing sites. The ABPI and the EFPIA say that the supply and economic issues can be mitigated by agreeing to a deal that includes a MRA, or by agreeing to a MRA in parallel to formal trade negotiations.

Phase-in to the Northern Ireland Protocol with respect to medicines

|

|

Richard Torbett |

The second priority for the pharmaceutical industry in negotiations between the UK and EU is a phase-in period for the regulation of medicines under the Northern Ireland Protocol. Under the Northern Ireland Protocol, medicines in Northern Ireland would be governed by EU rules and regulations, but these rules would be enforced by the UK’s medicines regulatory body, the Medicines and Health products Regulatory Agency (MHRA). “How the regulations will be interpreted and implemented has still not been clarified,” say the ABPI and the EFPIA in their joint statement. “Companies are therefore in the dark as to the rules they must follow as they try to prepare for the end of the transition period and finalize their routes of supply to Northern Ireland.”

The ABPI and the EFPIA point out that without further guidance on new rules and regulations, medicines may not be able to be legally dispensed in Northern Ireland from January 1, 2021. It is estimated that this applies to the majority of Northern Ireland’s future medicines supply. “With just 15 weeks until the end of the transition period, it is impossible for companies to implement any complex changes that might be required. Both the UK and the EU should consider the potential impact on patients in Northern Ireland,” the ABPI and the EFPIA said in their joint statement. They are calling for a one-year phase-in process, starting from the point when the UK and EU reach agreement on the interpretation of the Northern Ireland Protocol, to avoid disruption to supply in Northern Ireland.

Pharma industry stresses its priorities

As negotiations between the UK and EU continue, the pharma industry is making clear of the need to mitigate uncertainty to assure medicines supply in Europe. “It is absolutely clear that it’s in nobody’s interest–and certainly not patients–to face the future with uncertainty around how medicines will be regulated, tested and moved throughout Europe and the UK,” said Richard Torbett, ABPI’s Chief Executive, in the September 28, 2020 statement.

Those sentiments are further echoed by the EFPIA. “Recognizing the dual impact of the UK leaving the EU and the pandemic, it is imperative that the EU and UK negotiators facilitate these objectives by agreeing on a MRA on batch release and testing and a phase-in process to the application of the Northern Ireland Protocol for medicines,” said Nathalie Moll, the EFPIA’s Director General.