API Watch: Small Molecules

Small molecules continue to dominate approvals of new molecular entities (NMEs), accounting for approximately three-quarters of NME approvals over the past several years. What have been the small molecules approved as new molecular entities thus far in 2020, and which new market entrants expected for 2020 have blockbuster potential? DCAT Value Chain Insights takes an inside look.

Small-molecule new drug approvals thus far in 2020

Small molecules continue to dominate approvals of new molecular entities (NMEs). As of the end of August (August 28, 2020), the US Food and Drug Administration’s Center for Drug Evaluation and Research had approved 38 NMEs. Of these 38 NME approvals, 29 were small molecules (27 drugs and two diagnostic agents) or 76% of the 38 NMEs approved thus far in 2020 by the FDA’s CDER. There have been two antibody drug conjugates (ADCs) and eight biologics approved as NMEs by CDER thus far in 2020.

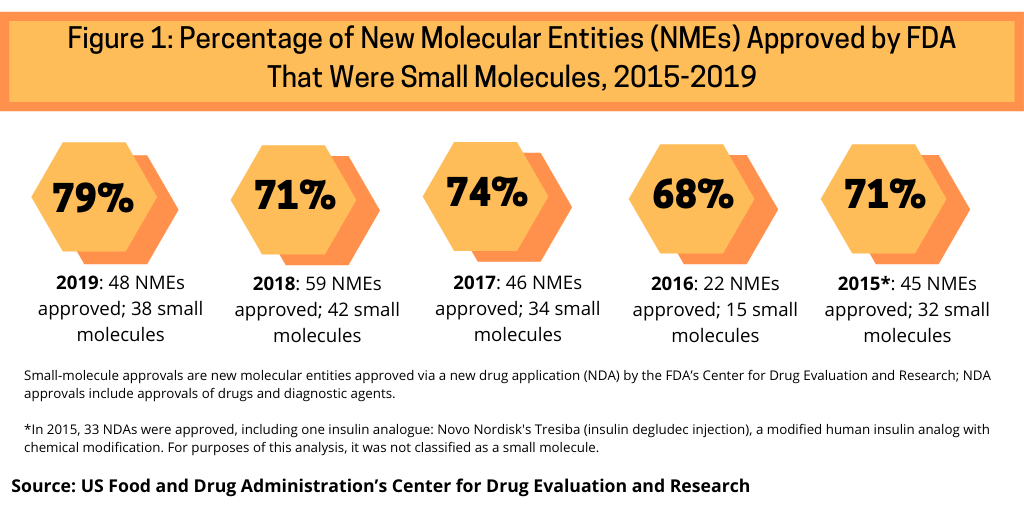

The dominance of small-molecules in NME approvals thus far in 2020 continues a recent trend. Between 2015 and 2019, small molecules have accounted for nearly three-fourths of NME approvals by the FDA’s CDER (see Figure 1). Small molecules dominated new drug approvals in 2019, accounting for 79% of all NME approvals, representing 38 of the 48 NMEs approved by the FDA in 2019. Small molecules were strong also in 2018, with small molecules accounting for 71% of NME approvals, 74% in 2017, 68% in 2016, and 71% in 2015.

Table I at the end of the article outlines the 29 small molecules approved thus far in 2020 by FDA’s CDER. Of these 29 products, the larger pharmaceutical companies accounted for 10 small-molecule NME approvals or approximately one-third of small-molecule product approvals. Novartis led with two small-molecule drug approvals: Isturisa (osilodrostat) for treating Cushing’s disease and Tabrecta (capmatinib) for treating non-small cell lung cancer in patients with specific mutations: those that lead to mesenchymal-epithelial transition or MET exon 14 skipping. Eli Lilly and Company had two small-molecule approvals, one for a drug and one for a diagnostic agent. The company received approval for Retevmo (selpercatinib), for treating three tumor types: non-small cell lung cancer, medullary thyroid cancer and other types of thyroid cancers in patients whose tumors have an alteration (mutation or fusion) in a specific gene (RET or “rearranged during transfection”). Lilly gained Retevmo through its 2019 acquisition of Loxo Oncology. Through its subsidiary Avid Radiopharmaceuticals, Lilly also received approval for Tauvid (flortaucipir F18), a diagnostic agent for patients with Alzheimer’s disease. It is the first drug used to help image a distinctive characteristic of Alzheimer’s disease in the brain called tau pathology, according to information from the FDA. Tauvid is a radioactive diagnostic agent for adult patients with cognitive impairment who are being evaluated for Alzheimer’s disease. Tauvid is indicated for positron emission tomography imaging of the brain to estimate the density and distribution of aggregated tau neurofibrillary tangles, a primary marker of Alzheimer’s disease

Seven larger pharmaceutical companies each had one small-molecule approval. AstraZeneca received approval for Koselugo (selumetinib) for treating neurofibromatosis Type 1, a genetic disorder of the nervous system causing tumors to grow on nerves. Bayer received approval for Lampit (nifurtimox) for treating Chagas disease in certain pediatric patients younger than age 18. Chagas disease is a tropical neglected disease and is an inflammatory, infectious disease caused by the parasite, Trypanosoma cruzi. Through its $74-billion acquisition of Celgene in 2019, Bristol-Myers Squibb received approval for Zeposia (ozanimod) for treating relapsing forms of multiple sclerosis, a drug slated by some analysts for blockbuster potential. Otsuka Pharmaceutical received approval for Inqovi (decitabine and cedazuridine) for treating myelodysplastic syndromes, and Roche received approval for Evrysdi (risdiplam) for treating spinal muscular atrophy, a rare neuromuscular disease. ViiV Healthcare, a joint venture of GlaxoSmithKline and Pfizer with Shionogi as an additional shareholder, received approval of Rukobia (fostemsavir) a new treatment for HIV for patients who have tried multiple HIV medications and whose HIV infection cannot be successfully treated with other therapies because of resistance, intolerance, or safety considerations (see Table I at the end of the article).

Among mid-sized and smaller pharma companies, Dr. Reddy’s Laboratories received approval for Xeglyze (abametapir) for treating head lice in patients six months or older. Incyte gained FDA approval for Pemazyre (pemigatinib) for treating cholangiocarcinoma, a rare form of cancer that forms in bile ducts, and Jazz Pharmaceuticals received approval for Zepzelca (lurbinectedin) for treating metastatic small cell lung cancer. Neurocrine Biosciences received approval for Ongentys (opicapone) for treating “off episodes” in patients taking the drugs, levodopa and carbidopa, for the treatment of Parkinson’s disease. An “off” episode is a time when a patient’s medications are not working well, thereby leading to an increase in Parkinson’s symptoms, such as tremor and difficulty walking. Biohaven Pharmaceuticals received approval for Nurtec ODT (rimegepant), which is slated by some analysts as a potential blockbuster. Seattle Genetics received approval for Tukysa (tucatinib) for treating advanced unresectable or metastatic HER2-positive breast cancer.

Seattle Genetics, along with GlaxoSmithKline, were two companies that received approval of antibody drug conjugates (ADCs), a hybrid molecule type consisting of a monoclonal antibody with an attached small molecule-drug. ADCs are often oncology drugs with the small-molecule consisting of a cytotoxic small molecule; the monoclonal antibody facilitates targeted delivery to the tumor site. Seattle Genetics received approval of Trodelvy (sacituzumab govitecan-hziy) for treating metastatic triple-negative breast cancer in patients who received at least two prior therapies for metastatic disease. GlaxoSmithKline received approval for Blenrep (belantamab mafodotin-blmf), also an ADC, for treating relapsed or refractory multiple myeloma. Specifically, the drug was approved as a monotherapy for the treatment of multiple myeloma in adult patients who have received at least four prior therapies and whose disease is refractory to at least one proteasome inhibitor, one immunomodulatory agent, and an anti-CD38 monoclonal antibody, and who have demonstrated disease progression on the last therapy. Blenrep, which was developed and is commercialized by GSK, uses Seattle Genetics’ ADC technology.

Small molecules and blockbuster potential

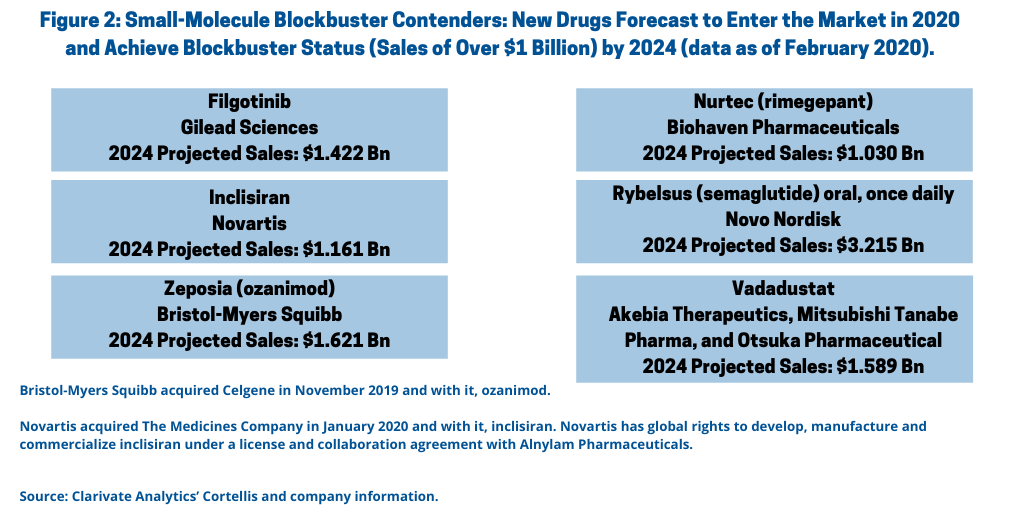

How do small molecules fare in future market strength? A recent analysis (data as of February 2020) from Clarivate Analytics’ Cortellis, with further analysis by BioWorld, identifies 11 drugs that are expected to enter the market in 2020 and achieve blockbuster status by 2024; of these 11 drugs, six are small molecules (see Figure 2).

Novo Nordisk’s Rybelsus (semaglutide) oral, once daily. Novo Nordisk’s Rybelsus (semaglutide) an oral, once-daily medicine for treating Type II diabetes, is a strong contender for blockbuster status with 2024 projected sales of $3.215 billion, according to the Clarivate Analytics’ Cortellis analysis. Rybelsus (semaglutide) oral tablets were approved by the FDA in September 2019 to improve control of blood sugar in adult patients with Type 2 diabetes, along with diet and exercise. Rybelsus was the first glucagon-like peptide (GLP-1) receptor protein treatment approved for use in the US that does not need to be injected, according to the FDA. Novo Nordisk has an injectable version of semaglutide in Ozempic, which was first approved by the FDA in 2017 and which posted 2019 sales of DKK 11.237 billion ($1.6 billion).

The oral administration of Rybelsus is one of the competitive advantages it will have over injectable GLP-1 agonists, according to an analysis by BioWorld, which provided further examination of the disease landscape of the blockbuster list. Cardiovascular (CV) safety data were also added to the drug’s label in January 2020. Additional filings for adults with Type 2 diabetes have also been submitted in the European Union and Canada. Rybelsus combines the convenience of a once-daily pill with the glucose-lowering activity and the CV benefits of injectable GLP-1 agonists, which is seen as the main reason it could have a major impact on the diabetes market, according to the BioWorld analysis.

Bristol-Myers Squibb’s Zeposia (ozanimod). Bristol-Myers Squibb’s (BMS) Zeposia (ozanimod) for treating relapsing forms of multiple sclerosis is a potential blockbuster for the company with projected 2024 sales of $1.621 billion, according to the Clarivate Analytics’ Cortellis analysis, and which was acquired by BMS in its $74-billion acquisition of Celgene in 2019. The drug was approved by the FDA earlier this year (March 2020), and by the European Medicines Agency in May (May 2020).

Ozanimod is an oral agonist of the sphingosine 1-phosphatase (S1P) 1 and 5 receptors. It will compete against other oral drugs to treat relapsing forms of MS with similar mechanisms of action: Novartis’ Gilenya (fingolimod), which was approved in 2010, Novartis’ Mayzent (siponimod), which was approved in 2019, and Merck KGaA’s Mavenclad (cladribine), which was also approved in 2019. On a competitive basis, both Mayzent and Gilenya require additional testing before a patient can take either drug, which may offer further potential for ozanimod, according to the BioWorld analysis. Competition from other oral MS drugs with similar mechanisms of action, include: Biogen’s Tecfidera (dimethyl fumarate), Sanofi’s Aubagio (teriflunomide), and Johnson & Johnson’s investigational drug ponesimod. Other oral competitors with different mechanisms are Biogen’s and Alkermes’ Vumerity (diroximel fumarate), which was approved by the FDA in October 2019.

Novartis’ inclisiran. Novartis’ inclisiran for treating familial hypercholesterolaemia, an inherited disorder that results in high levels of low-density lipoprotein cholesterol (LDL-C), is another potential blockbuster that is a small molecule. Novartis acquired the drug in its $9.7-billion acquisition of The Medicines Company, in January 2020. Projected 2024 sales are $1.161 billion, according to the Clarivate Analytics’ Cortellis analysis.

In December 2019, The Medicines Company submitted a new drug application for inclisiran to the FDA for use in secondary prevention patients with atherosclerotic cardiovascular disease and familial hypercholesterolaemia. Inclisiran is a small interfering RNA (siRNA) drug and PCSK9 (proprotein convertase subtilisin/kexin type 9) inhibitor. It would compete against PCSK9-targeting antibodies, such as Sanofi’s and Regeneron Pharmaceuticals’ Praluent (alirocumab) and Amgen’s Repatha (evolocumab) as well as other cholesterol-lowering drugs such as statins.

Gilead Sciences’ filgotinib. Gilead Sciences’ filgotinib for treating rheumatoid arthritis, one of several targeted indications, has projected 2024 sales of $1.422 billion, according to the Clarivate Analytics’ Cortellis analysis. The drug is an oral inhibitor of Janus kinase (JAK) 1; overactivation/dysregulation of JAK1 can lead to autoimmune responses, according to the BioWorld analysis. Filgotinib is currently up for approval as a treatment for rheumatoid arthritis, with marketing applications for the initial indication filed in the European Union in August 2019, in Japan in October 2019, and in the US in December 2019. Gilead Sciences is using a priority review voucher with the FDA to shorten the review time by four months. Gilead is partnered with Galapagos and Eisai, which will market filgotinib in various regions.

The drug will compete against other drugs to treat rheumatoid arthritis with different mechanisms of action, such as AbbVie’s Humira (adalimumab), BMS’ Orencia (abatacept), Sobi’s Kineret (anakinra), Sanofi’s and Regeneron’s Kevzara (sarilumab), Roche’s Actemra (tocilizumab), and Roche’s/Biogen’s Rituxan (rituximab) as well as multiple other JAK inhibitors, including Pfizer’s Xeljanz (tofacitinib), Eli Lilly and Company’s Olumiant (baricitinib) and AbbVie’s Rinvoq (upadacitinib).

Gilead and Galapagos are also testing filgotinib as a treatment for ulcerative colitis, Crohn’s disease, psoriatic arthritis and ankylosing spondylitis, potentially resulting in five approvals over the next four years, according to the BioWorld analysis.

Akebia Therapeutics’, Mitsubishi Tanabe Pharma’s, and Otsuka Pharmaceutical’s vadadustat. Akebia Therapeutics’, Mitsubishi Tanabe Pharma’s, and Otsuka Pharmaceutical’s vadadustat for treating anemia related to chronic kidney disease is another potential blockbuster expected to be launched in 2020 with 2024 projected sales of nearly $1.6 billion, according to the Clarivate Analytics’ Cortellis’ analysis.

Akebia is developing the drug in partnership with Otsuka Pharmaceutical and Mitsubishi Tanabe Pharma. In 2016, Akebia entered into a collaboration and license agreement with Otsuka for the development and commercialization of vadadustat in the US and in 2017, Akebia expanded its relationship with Otsuka to develop and commercialize vadadustat in Europe, China, Russia, Canada, Australia, the Middle East, and certain other territories. In 2015, Akebia entered into a collaboration agreement with Mitsubishi Tanabe Pharma with exclusive development and commercialization rights to vadadustat in Japan and certain other Asian countries. The drug received regulatory approval in Japan in June (June 2020) and was launched in Japan last month (August 2020). Filings in the US and the European Union are planned.

Biohaven Pharmaceuticals’ Nurtec (rimegepant). Biohaven Pharmaceuticals’ Nurtec (rimegepant) for treating migraines is another drug with expected launch in 2020 with blockbuster potential. Clarivate Analytics’ Cortellis projects 2024 sales of $1.03 billion. The drug was approved by the FDA earlier this year (February 2020). It is a new oral option for patients with acute, or episodic, attacks of migraines and is the second oral small-molecule calcitonin gene-related peptide (CGRP) antagonist approved; the other was Allergan’s Ubrelvy (ubrogepant), which was approved by the FDA in December 2019. These two oral medicines follow three injectables in the CGRP class that entered the market in 2018, according to the BioWorld analysis.

| Table I: Approvals of Small Molecules by the US Food and Drug Administration’s Center for Drug Evaluation and Research thus far in 2020 (as of August 28, 2020). | ||

| Company | Brand name (active ingredient) | Indication |

| Acacia Pharma | Barhemsys (amisulpride) | Prevention of nausea and vomiting after surgery |

| Acacia Pharma | Byfavo (remimazolam) | Induction and maintenance of procedural sedation in adults undergoing procedures lasting 30 minutes or less |

| Amivas | Artesunate (artesunate) | Severe malaria |

| AstraZeneca | Koselugo (selumetinib) | Neurofibromatosis Type 1, a genetic disorder of the nervous system causing tumors to grow on nerves |

| Bayer Healthcare | Lampit (nifurtimox) | Chagas disease in certain pediatric patients younger than age 18 |

| Biohaven Pharmaceuticals | Nurtec ODT (rimegepant) | Migraines |

| Blueprint Medicines | Ayvakit (avapritinib) | Unresectable or metastatic gastrointestinal stromal tumor with a rare mutation, a platelet-derived growth factor receptor alpha (PDGFRA) exon 18 mutation, including D842V mutations |

| Braintree Laboratories | Pizensy (lactitol) | Chronic idiopathic constipation |

| Bristol-Myers Squibb/Celgene | Zeposia (ozanimod) | Relapsing forms of multiple sclerosis |

| Cassiopea | Winlevi (clascoterone) | Acne |

| Deciphera Pharmaceuticals | Qinlock (ripretinib) | Advanced gastrointestinal stromal tumor |

| Dr. Reddy’s Laboratories | Xeglyze (abametapir) | Head lice |

| Eli Lilly and Company/Loxo Oncology | Retevmo (selpercatinib) | Non-small cell lung cancer, medullary thyroid cancer and other types of thyroid cancers in patients whose tumors have an alteration (mutation or fusion) in a specific gene (RET or “rearranged during transfection”) |

| Eli Lilly and Company/Avid Radiopharmaceuticals | Tauvid (flortaucipir F18) | Diagnostic agent for patients with Alzheimer’s disease |

| Epizyme | Tazverik (tazemetostat) | Epithelioid sarcoma, a rare soft tissue cancer |

| Esperion Therapeutics | Nexletol (bempedoic acid) | Heterozygous familial hypercholesterolemia or established atherosclerotic cardiovascular disease in patients who require additional lowering of low-density lipoprotein (LDL) cholesterol |

| Incyte | Pemazyre (pemigatinib) | Cholangiocarcinoma, a rare form of cancer that forms in bile ducts |

| Jazz Pharmaceuticals | Zepzelca (lurbinectedin) | Metastatic small cell lung cancer |

| Neurocrine Biosciences | Ongentys (opicapone) | “Off episodes” in patients with Parkinson’s disease |

| Novartis | Isturisa (osilodrostat) | Cushing’s disease |

| Novartis | Tabrecta (capmatinib) | Non-small cell lung cancer in patients with specific mutations: those that lead to mesenchymal-epithelial transition or MET exon 14 skipping. |

| NS Pharma | Viltepso (viltolarsen) | Duchenne muscular dystrophy |

| Otsuka Pharmaceutical | Inqovi (decitabine and cedazuridine) | Myelodysplastic syndromes |

| Roche | Evrysdi (risdiplam) | Spinal muscular atrophy |

| Seattle Genetics | Tukysa (tucatinib) | Advanced unresectable or metastatic HER2-positive breast cancer |

| Trevena | Olinvyk (oliceridine) | Moderate to severe acute pain |

| Ultragenyx Pharmaceutical | Dojolvi (triheptanoin) | Molecularly long-chain fatty acid oxidation disorders |

| ViiV Healthcare | Rukobia (fostemsavir) | HIV |

| Zionexa | Cerianna (fluoroestrdiol F18) | Diagnostic imaging agent for certain patients with breast cancer |

|

Bristol-Myers Squibb acquired Celgene in 2019. Eli Lilly and Company acquired Loxo Oncology in 2019. Avid Radiopharmaceuticals is a subsidiary of Eli Lilly and Company. ViiV Healthcare is a joint venture of GlaxoSmithKline and Pfizer with Shionogi as an additional shareholder. Source: US Food and Drug Administration’s Center for Drug Evaluation and Research |

||