2020 Vision: Small Molecules

Small molecules dominate recent new drug approvals, but how are they factoring in the recent or potential revenue gains of the top pharma companies? DCAT Value Chain Insights examines the winners and contenders among small-molecule drugs.

Small molecules and recent new drug approvals

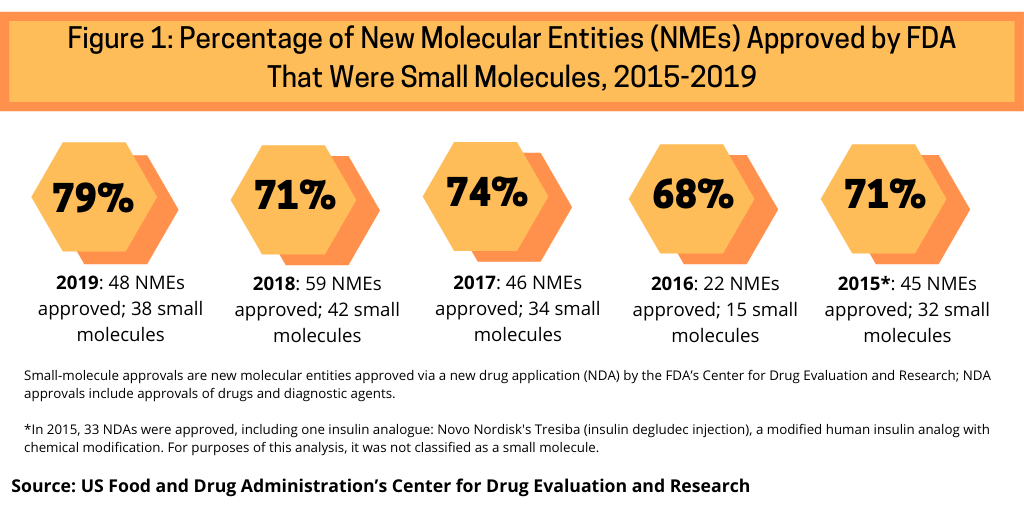

One measure to evaluate the role of small molecules versus biologics is to look at how they have fared in recent approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER). Between 2015 and 2019, small molecules have accounted for nearly three-fourths of NME approvals by the FDA’s CDER (see Figure 1).

Small molecules dominated new drug approvals in 2019, accounting for 79% of all NME approvals, representing 38 of the 48 NMEs approved by the FDA in 2019. Small molecules were strong also in 2018, with small molecules accounting for 71% of NME approvals, 74% in 2017, 68% in 2016, and 71% in 2015.

Big Pharma: recent small-molecule drug approvals

In looking at small-molecule NME approvals of Big Pharma companies over the last two years, Big Pharma companies have accounted for more than 40% of small-molecule approvals. In 2019, of the 38 small-molecule NME approvals, Big Pharma accounted for 16 approvals or 42%. Of the 42 small-molecule NME approvals in 2018, 18 or 43% were from the large pharmaceutical companies, and 57% of small-molecule approvals in 2018 were from small to mid-sized companies.

In 2019, Novartis had three NME small-molecule approvals: Egaten (triclabendazole) for treating fascioliasis, a parasitic infestation caused by two species of flatworms or trematodes that affect the liver, sometimes referred to as “liver flukes”; Mayzent (siponimod) for treating relapsing forms of multiple sclerosis; and Piqray (alpelisib) for treating breast cancer.

Several companies had one small-molecule NME approval in 2019. AbbVie received approval of Rinvoq (upadacitinib) for treating moderately to severe active rheumatoid arthritis. Allergan gained FDA approval for Ubrelvy (ubrogepant) for treating migraines. Bristol-Myers Squibb, which gained products from its $74-billion acquisition of Celgene, received approval for Inrebic (fedratinib) for treating intermediate-2 or high-risk primary or secondary myelofibrosis, a rare blood cancer. Daiichi Sankyo received approval for Turalio (pexidartinib hydrochloride) for treating symptomatic tenosynovial giant cell tumors. Roche received approval of Rozlytrek (entrectinib) for treating metastatic non-small cell lung cancer.

Other small-molecule NME approvals in 2019 were from Bayer for Nubeqa (darolutamide) for treating certain types of prostate cancer; Eisai for Dayvigo (lemborexant) for treating insomnia; Eli Lilly and Company for Reyvow (lasmiditan) for treating migraines; Johnson & Johnson for Balversa (erdafitinib) for treating advanced bladder cancer; Merck & Co. for Recarbrio (imipenem, cilastatin and relebactam) for treating complicated urinary tract and complicated intra-abdominal infections; Mylan for Pretomanid (pretomanid) for treating treatment-resistant forms of tuberculosis; Pfizer for Vyndaqel (tafamidis meglumine) for treating heart disease (cardiomyopathy) caused by transthyretin mediated amyloidosis in adults; and Shionogi for Fetroja (cefiderocol sulfate tosylate) for treating urinary tract infections.

Among the large pharmaceutical companies, Pfizer led with four NME approvals in 2018, all of which were small molecules. These were: Daurismo (glasdegib) for treating newly diagnosed acute myeloid leukemia in adult patients; Lorbrena (loratinib) for treating patients with anaplastic lymphoma kinase (ALK)-positive metastatic non-small cell lung cancer; Talzenna (talazoparib) for treating locally advanced or metastatic breast cancer patients with a germline BRCA mutation; and Vizimpro (dacomitinib) for treating metastatic non-small-cell lung cancer.

Fourteen of the large pharmaceutical companies each had one small-molecule NME approval in 2018. AbbVie received approval for Orilissa (elagolix sodium) for treating moderate-to-severe pain associated with endometriosis. Allergan got the FDA nod for Seysara (sarecycline) for treating inflammatory lesions of non-nodular moderate to severe acne vulgaris in patients nine years of age and older. Astellas received approval for Xospata (gilteritinib) for treating relapsed or refractory acute myeloid leukemia, and AstraZeneca received approval for Lokelma (sodium zirconium cyclosilicate) for treating hyperkalemia (high potassium levels). Eli Lilly and Company got the FDA nod for Olumiant (baricitinib) for treating moderately to severely active rheumatoid arthritis. Also, through its $8-billion acquisition of Loxo Oncology, Lilly gained another small-molecule NME approval from 2018, Vitrakvi (larotrectinib), an anti-cancer drug.

Gilead Sciences received approval for a fixed-dose combination HIV drug, Biktarvy (bictegravir, embitcitabine, and tenofovir alafenamide), and GlaxoSmithKline received approval for Krintafel (tafenoquine), an anti-malaria drug. Johnson & Johnson’s Janssen Pharmaceutical got the FDA nod for Erleada (apalutamid) for treating non-metastatic, castration-resistant prostate cancer. Merck & Co. also gained approval of an HIV drug, Pifeltro (doravirine).

Mylan, although largely a generic-drug company, did get a NME approval in 2018, for its small-molecule, Yupelri (revefenacin) for treating chronic obstructive pulmonary disease (COPD). Novartis, through its acquisition of Advanced Accelerator Applications in 2018, received approval for the radiopharmaceutical, Lutathera (lutetium Lu 177 dotatate) for treating gastroenteropancreatic neuroendocrine tumors, a type of cancer that affects the pancreas or gastrointestinal tract.

Shire, which was acquired by Takeda in January 2019, received approval for Motegrity (prucalopride) for treating idiopathic constipation. Shionogi received approval for Mulpleta (lusutrombopag) for treating thrombocytopenia in adult patients with chronic liver disease who are scheduled to undergo a procedure, and Roche’s Genentech received approval for Xofluza (baloxavir marboxil), an antiviral medicine.

Potential small-molecule blockbusters

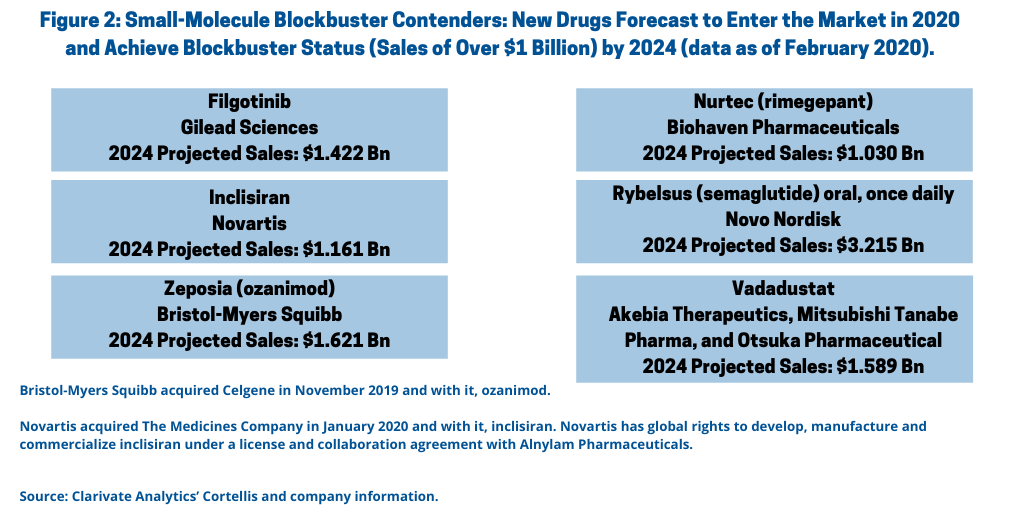

How do small molecules fare in future market strength? A recent analysis (data as of February 2020) from Clarivate Analytics’ Cortellis identifies 11 drugs that are expected to enter the market in 2020 and achieve blockbuster status by 2024; of these 11 drugs, six are small molecules (see Figure 2).

Novo Nordisk’s Rybelsus (semaglutide) oral, once daily. Novo Nordisk’s Rybelsus (semaglutide) an oral, once-daily medicine for treating Type II diabetes, is a strong contender for blockbuster status with 2024 projected sales of $3.215 billion, according to the Clarivate Analytics’ Cortellis analysis. Rybelsus (semaglutide) oral tablets were approved by the FDA in September 2019 to improve control of blood sugar in adult patients with Type 2 diabetes, along with diet and exercise. Rybelsus was the first glucagon-like peptide (GLP-1) receptor protein treatment approved for use in the US that does not need to be injected, according to the FDA. Novo Nordisk has an injectable version of semaglutide in Ozempic, which was first approved by the FDA in 2017 and which posted 2019 sales of DKK 11.237 billion ($1.6 billion).

The oral administration of Rybelsus is one of the competitive advantages it will have over injectable GLP-1 agonists, according to an analysis by BioWorld, which provided further examination of the disease landscape of the blockbuster list. Cardiovascular (CV) safety data were also added to the drug’s label in January 2020. Additional filings for adults with Type 2 diabetes have also been submitted in the European Union and Canada. Rybelsus combines the convenience of a once-daily pill with the glucose-lowering activity and the CV benefits of injectable GLP-1 agonists, which is seen as the main reason it could have a major impact on the diabetes market, according to the BioWorld analysis.

Bristol-Myers Squibb’s Zeposia (ozanimod). Bristol-Myers Squibb’s (BMS) Zeposia (ozanimod) for treating relapsing forms of multiple sclerosis is a potential blockbuster for the company with projected 2024 sales of $1.621 billion, according to the Clarivate Analytics’ Cortellis analysis, and which was acquired by BMS in its $74-billion acquisition of Celgene in 2019.

The drug was approved by the FDA earlier this year (March 2020), and the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency adopted a positive opinion, recommending the granting of a marketing authorization for the drug.

Ozanimod is an oral agonist of the sphingosine 1-phosphatase (S1P) 1 and 5 receptors. It will compete against other oral drugs to treat relapsing forms of MS with similar mechanisms of action: Novartis’ Gilenya (fingolimod), which was approved in 2010, Novartis’ Mayzent (siponimod), which was approved in 2019, and Merck KGaA’s Mavenclad (cladribine), which was also approved in 2019. On a competitive basis, both Mayzent and Gilenya require additional testing before a patient can take either drug, which may offer further potential for ozanimod, according to the BioWorld analysis. Competition from other oral MS drugs with similar mechanisms of action, include: Biogen’s Tecfidera (dimethyl fumarate), Sanofi’s Aubagio (teriflunomide), and Johnson & Johnson’s investigational drug ponesimod. Other oral competitors with different mechanisms are Biogen’s and Alkermes’ Vumerity (diroximel fumarate), which was approved by the FDA in October 2019.

Novartis’ inclisiran. Novartis’ inclisiran for treating familial hypercholesterolaemia, an inherited disorder that results in high levels of low-density lipoprotein cholesterol (LDL-C), is another potential blockbuster that is a small molecule. Novartis acquired the drug in its $9.7-billion acquisition of The Medicines Company, in January 2020. Projected 2024 sales are $1.161 billion, according to the Clarivate Analytics’ Cortellis analysis.

In December 2019, The Medicines Company submitted a new drug application for inclisiran to the FDA for use in secondary prevention patients with atherosclerotic cardiovascular disease and familial hypercholesterolaemia. Inclisiran is a small interfering RNA (siRNA) drug and PCSK9 (proprotein convertase subtilisin/kexin type 9) inhibitor. It would compete against PCSK9-targeting antibodies, such as Sanofi’s and Regeneron Pharmaceuticals’ Praluent (alirocumab) and Amgen’s Repatha (evolocumab) as well as other cholesterol-lowering drugs such as statins.

Gilead Sciences’ filgotinib. Gilead Sciences’ filgotinib for treating rheumatoid arthritis, one of several targeted indications, has projected 2024 sales of $1.422 billion, according to the Clarivate Analytics’ Cortellis analysis. The drug is an oral inhibitor of Janus kinase (JAK) 1; overactivation/dysregulation of JAK1 can lead to autoimmune responses, according to the BioWorld analysis. Filgotinib is currently up for approval as a treatment for rheumatoid arthritis, with marketing applications for the initial indication filed in the European Union in August 2019, in Japan in October 2019, and in the US in December 2019. Gilead Sciences is using a priority review voucher with the FDA to shorten the review time by four months. Gilead is partnered with Galapagos and Eisai, which will market filgotinib in various regions.

The drug will compete against other drugs to treat rheumatoid arthritis with different mechanisms of action, such as AbbVie’s Humira (adalimumab), BMS’ Orencia (abatacept), Sobi’s Kineret (anakinra), Sanofi’s and Regeneron’s Kevzara (sarilumab), Roche’s Actemra (tocilizumab), and Roche’s/Biogen’s Rituxan (rituximab) as well as multiple other JAK inhibitors, including Pfizer’s Xeljanz (tofacitinib), Eli Lilly and Company’s Olumiant (baricitinib) and AbbVie’s Rinvoq (upadacitinib).

Gilead and Galapagos are also testing filgotinib as a treatment for ulcerative colitis, Crohn’s disease, psoriatic arthritis and ankylosing spondylitis, potentially resulting in five approvals over the next four years, according to the BioWorld analysis.

Akebia Therapeutics’, Mitsubishi Tanabe Pharma’s, and Otsuka Pharmaceutical’s vadadustat. Akebia Therapeutics’, Mitsubishi Tanabe Pharma’s, and Otsuka Pharmaceutical’s vadadustat for treating anemia related to chronic kidney disease is another potential blockbuster expected to be launched in 2020 with 2024 projected sales of nearly $1.6 billion, according to the Clarivate Analytics’ Cortellis’ analysis.

Akebia is developing the drug in partnership with Otsuka Pharmaceutical and Mitsubishi Tanabe Pharma. In 2016, Akebia entered into a collaboration and license agreement with Otsuka for the development and commercialization of vadadustat in the US and in 2017, Akebia expanded its relationship with Otsuka to develop and commercialize vadadustat in Europe, China, Russia, Canada, Australia, the Middle East, and certain other territories. In 2015, Akebia entered into a collaboration agreement with Mitsubishi Tanabe Pharma with exclusive development and commercialization rights to vadadustat in Japan and certain other Asian countries. Mitsubishi Tanabe Pharma submitted a Japanese new drug application for vadadustat to Japan’s Ministry of Health, Labor and Welfare in July 2019, representing the first regulatory submission for vadadustat. If approved, the company expects commercial launch during mid-2020, and filings in the US and the European Union are planned.

Biohaven Pharmaceuticals’ Nurtec (rimegepant). Biohaven Pharmaceuticals’ Nurtec (Rimegepant) for treating migraines is another drug with expected launch in 2020 with blockbuster potential. Clarivate Analytics’ Cortellis projects 2024 sales of $1.03 billion. The drug was approved by the FDA earlier this year (February 2020). It is a new oral option for patients with acute, or episodic, attacks of migraines and is the second oral small-molecule calcitonin gene-related peptide (CGRP) antagonist approved; the other was Allergan’s Ubrelvy (ubrogepant), which was approved by the FDA in December 2019. These two oral medicines follow three injectables in the CGRP class that entered the market in 2018, according to the BioWorld analysis.