Tackling the Capacity Crunch in the EU from COVID-19

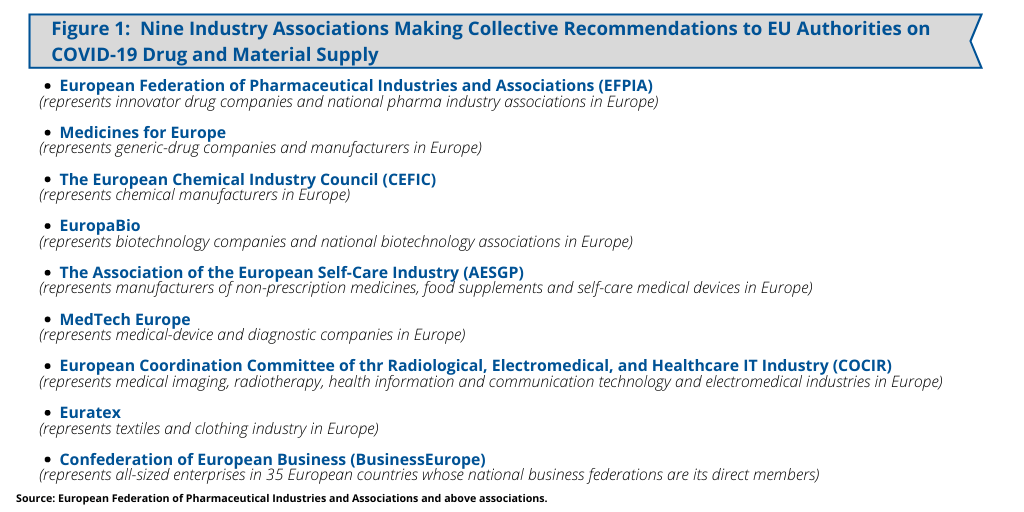

Nine associations, including those representing innovator and generic-drug companies and chemical manufacturers in Europe, have recommended measures to the European Commission and European Union (EU) member states to address supply issues of drugs and related materials relating to the novel coronavirus (COVID-19). What are they suggesting?

Capacity crunch is on

The COVID-19 outbreak is having ramifications for pharmaceutical companies and companies providing medical and protective equipment as they seek to meet increased demand and direction from European Union (EU) authorities in responding to the pandemic. To further facilitate the supply of these materials, nine industry associations (see Figure 1) in Europe directed a letter to EU trade ministers last week (April 10, 2020) to recommend lifting certain government restrictions that they say are limiting their ability to meet certain supply challenges. Signatories of the letter included the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator-drug companies in Europe, Medicines for Europe, which represents generic-drug companies and manufacturers in Europe, the European Chemical Industry Council (CEFIC), which represents chemical manufacturers in Europe, EuropaBio, which represents the biotechnology industry and national biotechnology associations in Europe, the Association of the European Self-Care Industry (AESGP), which represents over-the-counter medicines manufacturers in Europe.

”The European industry is working around the clock to increase capacity and ensure supply of critical medicines and medical and protective equipment (e.g. diagnostic tests, ventilators, protective masks, gloves and gowns, intensive-care-unit medicines and equipment, and protective clothing) to patients and healthcare workers across Europe in light of the Covid-19 pandemic,” said the associations in their letter to the EU trade ministers. “To that end, industry is pushing capacity limits to meet the exponential rise in demand and needs continued coordinated and collective action from the EU and Member States to maintain open trade and efficient supply chains, both within the EU and with the EU’s trading partners.”

The associations acknowledged the cooperation and work thus far of EU member states, the European Commission, and the European Medicines Agency to find practical measures to address supply issues related to the COVID-19 outbreak. These practical measures include setting up “green lanes” to facilitate the flow of goods, or measures to temporarily waive customs duties and value-added taxes (VAT) on imports of some medical and protective equipment from non-EU countries, which the associations said that they would also like to see extended to private entities.

Industry groups raise concerns

The industry groups, however, are also raising concerns. “We fully understand the pressure countries and their healthcare systems are under, but we are at the same time concerned by the increase in government restrictions affecting medical and protective equipment and medicines (from raw materials to finished pharmaceutical forms) both globally and in Europe,” said the industry associations in their letter to EU trade ministers. “These measures are having a serious and immediate impact on the globally integrated supply chains that ensure quality, safety, innovation and distribution across the health sector. Export bans–or other measures that restrict the manufacture or supply of medicines, clinical products and medical equipment–do more harm than good: immediately, they amplify or increase the risk of supply shortages, disrupt distribution channels, hinder the conduct of clinical trials, lead to imbalances between supply and demand, and risk retaliatory measures from trading partners that could likewise impact patients in other countries. These measures also result in significant added supply chain management delays and costs at a time when companies should be dedicating their time and resources to increasing global supply and finding durable solutions to the current crisis. In the medium-term, they inhibit innovation and endanger manufacturing of medicines, both generic and innovative, as well as innovative medical equipment and services which are crucially needed to combat this pandemic and its aftermath.”

Industry’s recommendations to EU authorities

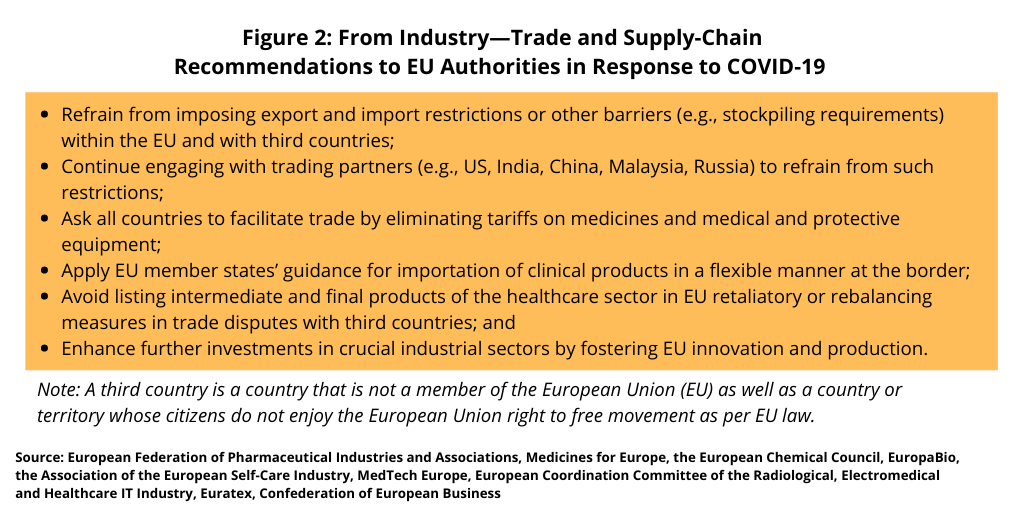

To address those concerns, the industry groups put forth a series of recommendations (see Figure 2) to EU member states and the European Commission to address those issues as outlined below.

Lift export and import restrictions. The industry groups are calling on EU authorities to refrain from imposing export and import restrictions or other barriers (e.g., stockpiling requirements) that will disrupt global supply chains, both within the EU and with third countries. A third country is a country outside the EU or to a country or territory outside the jurisdictional authority where its people do not have the EU right to movement as specified by EU law.

Engagement with trading partners. The industry groups are also calling on the EU and its member states to continue to engage with trading partners (e.g., US, India, China, Malaysia, Russia) to ensure all relevant parties refrain from such restrictions.

Eliminate tariffs. The industry groups are recommending to EU authorities that they ask all countries to facilitate trade by eliminating tariffs on medicines and medical and protective equipment, to provide enhanced flexibility through customs authorities accepting electronic documents, and to encourage countries to work together to update the World Trade Organization’s pharmaceutical zero-for-zero initiative and extend it to all pharmaceutical and medical goods.

Guidance for importation of clinical products. The industry associations are also recommending to EU authorities that they apply EU member states’ guidance for importation of clinical products in relation to the required documentation in a flexible manner at the border. In particular, they are requesting that critical batches of essential supplies pass while carrying out any needed regulatory documentation checks in parallel.

Listing of intermediates and final products. The industry groups are also requesting that EU authorities avoid listing intermediate and final products of the healthcare sector and related supplying industries (e.g. medicines, textiles, intermediate chemicals, medical and protective equipment) in the retaliatory or rebalancing measures the EU wishes to engage in response to trade disputes with third countries.

Investment in crucial industrial sectors. The industry associations are also recommending further investments in crucial industrial sectors in Europe, linking to the framework of the new EU Industrial Strategy, by fostering EU innovation and production and ensuring a holistic approach with more sector-specific policies to be announced later this year.

”In order to beat the pandemic, we need global cooperation, shared resources, and significant investments,” said the industry groups in their concluding comments to EU authorities. “The current increases in zero-sum unilateral trade policies could lead to tit-for-tat policies that hamper the global response to contain COVID-19.”