Small Molecules Lead in Recent New Drug Approvals

Small molecules still lead over biologics in recent drug approvals, accounting for nearly three-fourths of drug approvals over the past several years, but will small molecules’ dominance continue? DCAT Value Chain Insights takes an inside look.

Small molecules leading in new drug approvals

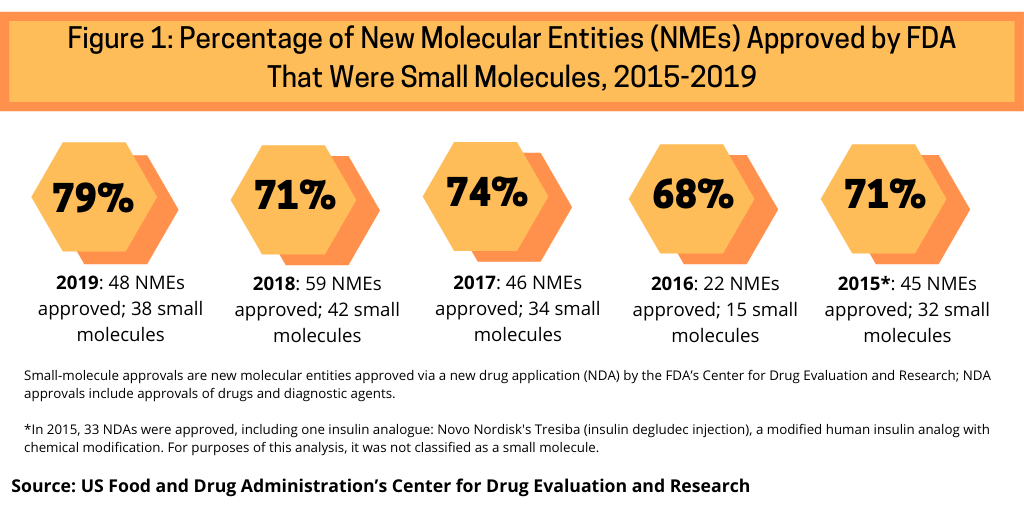

One measure to evaluate the role of small molecules versus biologics is to look how they have fared in recent approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Evaluation and Research. Between 2015 and 2019, small molecules have accounted for nearly three-fourths of NME approvals by the FDA’s CDER (see Figure 1).

Small molecules dominated new drug approvals in 2019, accounting for 79% of all NME approvals, representing 38 of the 48 NMEs approved by the FDA in 2019. Small molecules were strong also in 2018, with small molecules accounting for 71% of NME approvals, 74% in 2017, 68% in 2016, and 71% in 2015.

Big Pharma and small molecules

In looking at small-molecule NME approvals of Big Pharma companies over the last two years, Big Pharma companies have accounted for more than 40% of small-molecule approvals. In 2019, of the 38 small-molecule NME approvals, Big Pharma accounted for 16 approvals or 42%.

Novartis had three NME small-molecule approvals: Egaten (triclabendazole) for treating fascioliasis, a parasitic infestation caused by two species of flatworms or trematodes that affect the liver, sometimes referred to as “liver flukes”; Mayzent (siponimod) for treating relapsing forms of multiple sclerosis; and Piqray (alpelisib) for treating breast cancer.

Several companies had one small-molecule NME approval in 2019. AbbVie received approval of Rinvoq (upadacitinib) for treating moderately to severe active rheumatoid arthritis. Allergan gained FDA approval for Ubrelvy (ubrogepant) for treating migraines. Bristol-Myers Squibb, which gained products from its $74-billion acquisition of Celgene, received approval for Inrebic (fedratinib) for treating intermediate-2 or high-risk primary or secondary myelofibrosis. Daiichi Sankyo received approval for Turalio (pexidartinib hydrochloride) for treating symptomatic tenosynovial giant cell tumors. Roche received approval of Rozlytrek (entrectinib) for treating metastatic non-small cell lung cancer.

Other small-molecule NME approvals in 2019 were from Bayer for Nubeqa (darolutamide) for treating certain types of prostate cancer; Eisai for Dayvigo (lemborexant) for treating insomnia; Eli Lilly and Company for Reyvow (lasmiditan succinate) for treating migraines; Johnson & Johnson for Balversa (erdafitinib) for treating advanced bladder cancer; Merck & Co. for Recarbrio (imipenem, cilastatin and relebactam) for treating complicated urinary tract and complicated intra-abdominal infections; Mylan for Pretomanid (pretomanid) for treating treatment-resistant forms of tuberculosis; Pfizer for Vyndaqel (tafamidis meglumine) for heart disease (cardiomyopathy) caused by transthyretin mediated amyloidosis in adults; and Shionogi for Fetroja (cefiderocol sulfate tosylate) for urinary tract infections.

Of the 42 small-molecule NME approvals in 2018, 18 or 43% were from the large pharmaceutical companies, and 57% of small-molecule approvals in 2018 were from small to mid-sized companies.

Among the large pharmaceutical companies, Pfizer led with four NME approvals in 2018, all of which were small molecules. These were: Daurismo (glasdegib) for treating newly diagnosed acute myeloid leukemia (AML) in adult patients; Lorbrena (loratinib) for treating patients with anaplastic lymphoma kinase (ALK)-positive metastatic non-small cell lung cancer; Talzenna (talazoparib) for treating locally advanced or metastatic breast cancer patients with a germline BRCA mutation; and Vizimpro (dacomitinib) for treating metastatic non-small-cell lung cancer.

Fourteen of the large pharmaceutical companies each had one small-molecule NME approval in 2018. AbbVie received approval for Orilissa (elagolix sodium) for treating moderate-to-severe pain associated with endometriosis. Allergan got the FDA nod for Seysara (sarecycline) for treating inflammatory lesions of non-nodular moderate to severe acne vulgaris in patients nine years of age and older. Astellas received approval for Xospata (gilteritinib) for treating relapsed or refractory acute myeloid leukemia, and AstraZeneca received approval for Lokelma (sodium zirconium cyclosilicate) for treating hyperkalemia (high potassium levels). Eli Lilly and Company got the FDA nod for Olumiant (baricitinib) for treating moderately to severely active rheumatoid arthritis. Also, through its $8-billion acquisition of Loxo Oncology, Lilly gained another small-molecule NME approval from 2018, Vitrakvi (larotrectinib), an anti-cancer drug.

Gilead Sciences received approval for a fixed-dose combination HIV drug, Biktarvy (bictegravir, embitcitabine, and tenofovir alafenamide), and GlaxoSmithKline received approval for Krintafel (tafenoquine), an anti-malaria drug. Johnson & Johnson’s Janssen Pharmaceutical got the FDA nod for Erleada (apalutamid) for treating non-metastatic, castration-resistant prostate cancer. Merck & Co. also gained approval of an HIV drug, Pifeltro (doravirine).

Mylan, although largely a generic-drug company, did get a NME approval in 2018, for its small-molecule, Yupelri (revefenacin) for treating chronic obstructive pulmonary disease (COPD). Novartis, through its acquisition of Advanced Accelerator Applications in 2018, received approval for the radiopharmaceutical, Lutathera (lutetium Lu 177 dotatate) for treating gastroenteropancreatic neuroendocrine tumors, a type of cancer that affects the pancreas or gastrointestinal tract.

Shire, which was acquired by Takeda in January 2019, received approval for Motegrity (prucalopride) for treating idiopathic constipation. Shionogi received approval for Mulpleta (lusutrombopag) for treating thrombocytopenia in adult patients with chronic liver disease who are scheduled to undergo a procedure, and Roche’s Genentech received approval for Xofluza (baloxavir marboxil), an antiviral medicine.